COT Report Forex Trading Using the Commitment of Traders Report in the Forex Market

Post on: 21 Апрель, 2015 No Comment

While the COT Report is not an exact timing indicator, it can aid in forex trading and provide a context for the current, and future, market environment. There are potentially many ways to use the COT Report for analyzing a forex pair; here are three COT Report forex strategies.

The Basics of COT Report Forex Trading

Before going into COT Report forex strategies I want to briefly outline a few of the key elements. The COT Report has quite a bit of data, yet there is really only two pieces of information I care about: the net position of Commercials and the net positions of Large Speculators.

Commercials are hedgers who have large positions which are offsetting another position or transaction. Commercials include importers or exporters who are hedging foreign currency exposure to control costs or normalize income. As a group these are counter trend traders. They can afford to hold positions against large trends because their transaction are a hedge, thus do not expose the holder to a direct loss.

Large Speculators on the other hand are mostly hedge funds. Despite the name hedge fund these large speculators are rarely hedged, and therefore cannot sustain large losses or afford to trade against the trend. As a group Large Speculators are trend followers.

Since Large Speculators are trend followers and much more sensitive to price movements than the Commercials, Large Speculators are the group of prime interest and the group on which our COT Report forex strategies are based.

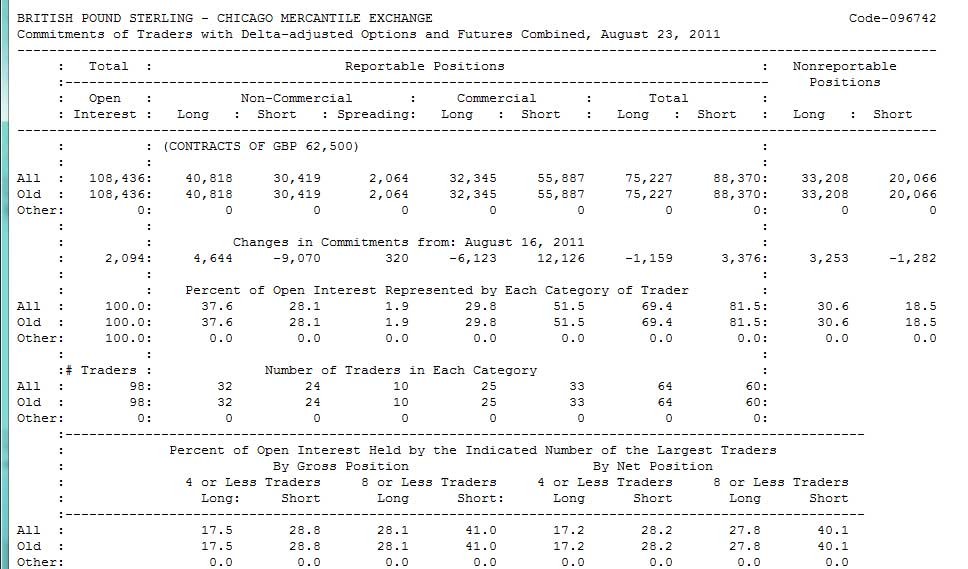

Calculating the net position by hand is possible as the reports are released weekly by the CFTC. or Commodity Futures Trading Commission, but that is ultimately unnecessary. Using a COT Report chart is one of the easiest ways to track the data for trading purposes.

COT Report charts can be seen on barcharts.com. Select the future you wish to view a chart of along the left hand side and then change the chart settings as you see fit. Near the bottom under parameters you choose to add the indicator: Commitment of Traders Line Chart. This will add the COT data to the currency futures chart.

The following is an example of a Euro (FX) futures chart showing the COT Report data along the bottom. The frequency of the chart is weekly continuation and the period is 5 years.

In the chart above we can see the net positions of the Commercials (red) and Large Speculators (green). The chart shows that the speculators usually move with the price, and commercials against the price. When a line is below the 0 market it means the net position is short, while above the 0 line means the net position is long.

One other thing to note is that a currency future is relative to the US dollar. Therefore, the Euro future will move with the EUR/USD. The Canadian dollar future will move with the CAD/USD, which is inverse to the USD/CAD. When the USD is the second currency in the pair the future and the currency pair will move in unison. In currency pairs where the USD is first, the futures will move opposite the pair, such as the case with the CAD futures. Remember this when analyzing COT data and acting on it in the forex market.

By visually seeing the COT data in this way we can extract useful information, which then provides the basis for our COT Report forex strategies.

COT Report Forex Trading Speculators are Trend Followers

Speculators drive trends. Contrary to popular the convention Dont follow the crowd, we actually want to follow the crowdat least for a time. If others are buying, we want to be buying too. This is how trends occur, and how traders make money. The trick is to get out before everyone starts heading for the exit.

Therefore, use the interest of speculators as a confirmation tool for trends. If the Euro is moving higher and speculators are increasing their long position this means big traders are pushing the market in your favor if you are long the EURUSD. Trade with the big boys, and follow the trend. Dont get too greedy though, because if all the speculators are long, then there is no one left to keep pushing the trend. This brings us to the next way to use the COT data.

COT Report Forex Trading Extreme Levels Can Indicate a Reversal

When speculators are accumulating a position it can be a confirmation that there is interest in the trend if shorts are being accumulated as the price drops or if long positions are being accumulated as the price rises this can be a good sign the trend will continue. But speculators have a limitthey cant purchase or sell indefinitely. They may run out of money, or simply wish to take profit (or losses). When speculators are tapped out, want out or dont want to invest anymore there is nowhere left for the price to go, but to reverse.

Therefore, the COT data can be used as a type of overbought/oversold indicator. Not in terms of price and arbitrary levels like most overbought and oversold indicators, but in terms of the health of traders within the market. Each futures market will be a bit different but critical levels will often repeat and indicate when speculators are overextended.

The Euro futures chart above shows that when speculators were 100,000 contracts long or short this generally resulted in a quick reversal, except in 2007 where the price continued to trend for a time. 2012 shows a very large short position and is an indication that the Euro could go higher as it is unlikely speculators can continue to add to the short position and continue pushing the Euro down.

This method is not recommended for a top or bottom picking strategy; it can be used to provide a context for other analysis and be used to confirm reversals in price though. Extreme levels can look easy to isolate in hindsight, but are not ideal timing indicators. That said, it is very useful for alerting traders when a reversal could be nearby. The COT data should not be acted on alone though; wait for price to confirm a potential reversal signal in the COT data.

COT Report Forex Trading Watch For Speculators to Flip Their Position

With the third approach we are looking to capture the meat of the trend. If speculators are net short and that short position continually decreases until eventually it crosses above zero, a new trend is quite possibly underway.

The movement from net short to net long or vice versa signals a change in sentiment and that a new trend is emerging or has already begun. Using the logic of our first method of following the speculator trend (when it aligns with price) this shift represents a potential trading opportunity. Exiting positions can be done when the price breaks the trends, when speculation reaches extreme levels or when speculative demand begins to wane. Again, the COT data should always be combined with price analysis, and not acted on in isolation.

COT Report Forex Trading Conclusion

The COT report is useful in at least three ways for forex trading. None are precise entry and exit signals but rather provide a context for other analysis and can be used as a confirmation tool for reversals or trends. The first uses COT data as a confirmation tool for forex trends. The second method alerts us when speculators are over-extended, which could in turn lead to a reversal. The third method can be used to see shifts in sentiment and potentially catch a chunk of the trend (but remember to watch for over-extension). When using any indicator, wait for price to confirm the indicator signal.

For other forex trading strategies, check out the Forex Trading Strategies Guide for Day and Swing Traders eBook, by Cory Mitchell. At over 300 pages, and including more than 20 strategies, it is more than an eBookits a complete course on forex trading.

Some other articles you may enjoy:

High Probability Forex Engulfing Candle Trading Strategy A trading strategy using engulfing candles as an entry point into a defined trend. Useful for noting the transition from pullback to trend. Provides an alternate entry method compared to the “traditional” approach.

ABC Forex Trading Strategy – (Video ) A simple but powerful price pattern seen in all markets; it gets you in in the direction of strong momentum.

How to Identify a Trend Change in Real-Time (video) A look at how to monitor real-time changes in direction.