COT Report For Forex Traders

Post on: 21 Апрель, 2015 No Comment

How To Keep Track Of Where The Smart Money Is Going In Forex Markets

COT FX Dashboard Introduction

The COT FX Dashboard provides weekly analysis of the Commitment of Traders (COT) Report for 7 Major currency pairs (14 if you include the reverse positions).

The Dashboard includes positional bias (net long or short) of the world’s biggest Forex Future traders, and 52 week trend of net positions to help identify significant points or extremes that may indicate a reversal is about to happen.

What is the COT FX Dashboard?

If you are a spot FX trader, you will be aware that there is no centralised data available for the currency markets. This can be a disadvantage compared to other speculative vehicles which are more transparent in terms of volume and market data available to independent traders.

However, for those in the know, there is a way of getting a similar insight by analysing data released by the Commodity Futures Trading Commission (CFTC).

The CFTC requires that the largest traders in the world FX Futures markets report their commercial and non-commercial positions. This information is compiled into the Commitment of Traders (COT) Report.

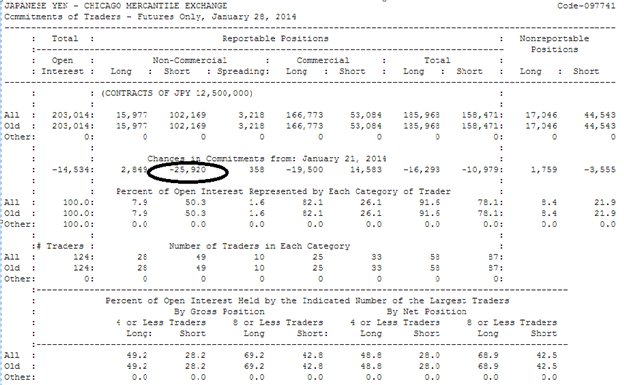

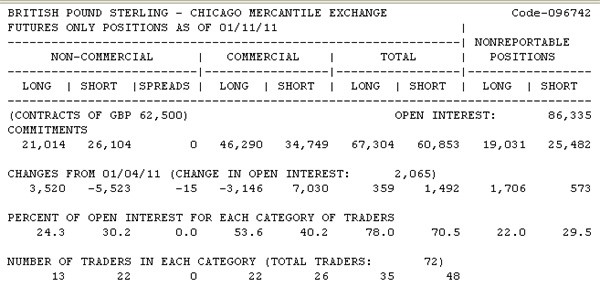

The COT report provides an incredible insight into market behaviour. However, the data in the COT report is not user friendly (see below).

Example of the COT Report

This complex-looking format can discourage many people from taking advantage of the powerful insight provided by the report. This is a pity because the COT report can be an incredibly useful tool to assist with spot Forex trading decisions.

In order to assist traders who would like to take advantage of the information in the COT report, but are intimidated by it, or don’t have the time to trawl through the data to work out the key points, I have created the COT FX Dashboard.

The COT FX Dashboard aims to make key COT data as simple and accessible as possible to independent traders.

Quickly zone-in on the information you need.

It focuses on 7 major FX pairs: AUDUSD, GBPUSD, CADUSD, EURUSD, JPYUSD, NZDUSD, CHFUSD

As well as the 7 reverse pairs: USDAUD, USDGBP, USDCAD, USDEUR, USDJPY, NZDUSD, USDCHF

It provides an overview of the most important pairs

You will be able to see at a glance the positional bias of the FX Futures Market, giving you an insight into how the largest traders in the world are positioned in the currency pairs you are trading.

Extreme Position Alerts

You will see alerts for extreme positioning. When the net position gets towards historic highs or lows, it can often precede a significant reversal.

Drill into the information you need

See the bigger picture

You will be able to see a 52 week trend of net positions across the 7 pairs and reverses.

Now you can analyse sentiment and manage your trades more effectively based on reactions at historical net levels.

The COT FX Dashboard is updated weekly in line with the CFTC release of the data.

If you agree that knowing the positions of the largest FX Futures traders in the world would provide a useful edge to your trading activity, then you are faced with the challenge of reading and interpreting a very challenging data format.

Alternatively, for a small monthly subscription charge, you could have access to the COT FX Dashboard, which does all the heavy lifting for you and gives you only what you need to know in a clean, understandable format.

If this Dashboard saves an hour of your time every month, it has to be worth it, right? Sign-up now..