Cost of Equity – Capital Asset Pricing Model (CAPM)

Post on: 16 Март, 2015 No Comment

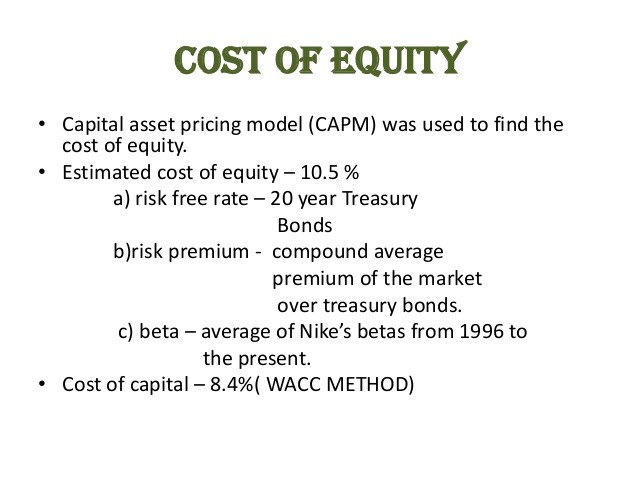

Cost of equity is estimated using the Sharpe’s Model of Capital Asset Pricing Model. The model finds the cost of capital by establishing a relationship between risk and return. As per this model, at least risk free return is expected out of every investment and the expectation greater than that is dependent on the amount of risk associated with the respective investment. As per this model, the required rate of return is equal to the sum of risk free rate and a premium based on the systematic risk associated with the security.

Cost of Equity – Capital Asset Pricing Model (CAPM)

Systematic Risk and Unsystematic Risk:

Systematic Risk is that risk which is unavoidable by diversifying the investments. This risk includes the factors which affects the overall market and not a particular stock in the market viz. changes in economic conditions, inflationary situations all over the world, etc. This risk is measured by Beta (β).

Unsystematic Risk is the stock specific risk which affects only a particular stock price and not the whole market. Such a risk can be diversified and reduced to a great extent by diversifying a portfolio.

The result of the model is a simple formula based on the explanation just given above.

Rj = Required rate of return or cost of equity

Rf = Risk free rate of return, normally the treasury interest rate offered by the government.

Rm = It is the expected return from the Market Portfolio .

β = Beta is a measure of risk in the equation.

Market Portfolio conceptually means the portfolio of shares containing all the shares trading in the market with their weights as their market capitalization. Practically, we can take a portfolio which has all the industries and has sufficient number of stock of each industry to diversify the stock specific risks. The objective of taking the market portfolio is that we want a portfolio which has diversified all the avoidable risk and such a portfolio cannot be more than market portfolio.

Beta is the measure of responsiveness of an individual stock’s return due to a change in market return. Higher the beta of a security, higher would be the required rate of return by the investor. It impacts the required return because it has a direct multiplication impact on the premium. If the beta is 1, the stock return would be equal to the market return. If less than 1, stock return would be less than the market return and if it is greater than 1, the required return of the stock is greater than market return.

Example of Cost of Equity with CAPM

Suppose Rm is 20%, Rf is 8%, β is 1.2, the Rj would be

⇒ Rj = 8% + (20% – 8%)1.2

⇒ Rj = 8% + 14.4%

⇒ Rj = 22.4%

In the above example, the risk free rate of return is 8% and the risk premium of the stock is higher than 20% i.e. more than market return. It is because the stock beta is greater than 1 i.e. 1.2.

Advantage and Disadvantages

Finding cost of equity with CAPM model is widely used. the primary advantage of this model is that it relates return to the risk which is a general behavior of all the rational investors. The disadvantage is that it is difficult to estimate the market return and the beta.