Continuation Chart Patterns Ascending and Descending Triangle

Post on: 11 Апрель, 2015 No Comment

When these continuation chart patterns are formed they confirm that the current Forex trend is going to continue moving in the same direction.

Continuation patterns are used by Currency traders to identify halfway points of the Forex trend, this is because continuation chart patterns form at the halfway point of a Forex trend.

There are four types of continuation chart patterns:

- Ascending Triangle

- Descending Triangle

- Bull flag/pennant

- Bear flag/pennant

Ascending Triangle Chart Pattern

The ascending triangle chart pattern is formed in an uptrend and it shows that the upward direction of the Forex trend is going to continue.

The ascending triangle chart pattern shows that there is a resistance level that the buyers keep pushing each time moving it higher, and once it breaks price will continue moving upward.

The overhead resistance temporarily prevents the Currency market from advancing higher, while the rising trend line beneath the pattern signals that buyers are still present. An upside penetration of the upper line is a technical buy signal for a market breaking out from an ascending triangle.

Found within a Forex uptrend, the ascending triangle chart pattern forms as a consolidation period within the uptrend and indicates upside continuation will follow.

Ascending Triangle

The market formed an ascending triangle pattern during its uptrend which led to upside continuation. The buy point is when price clears the upper Forex trend line and the market continues moving upwards.

Descending Triangle Chart Pattern

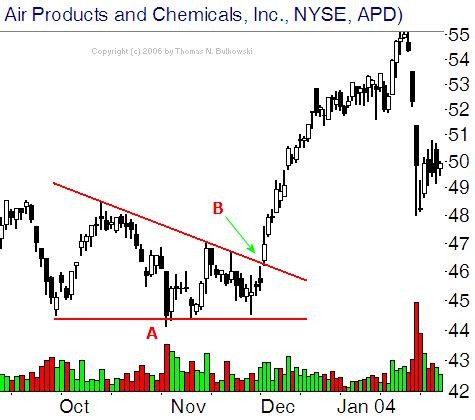

The descending triangle chart pattern is formed in a Forex downtrend and it shows that the downward direction of price movement is going to continue.

The descending triangle shows that there is a support level that the sellers keep pushing each time moving it lower, and once it breaks price will continue moving downwards.

The support temporarily prevents the market from declining, while the descending trend line above the pattern signals that sellers are still present. A downside penetration of the lower line is a technical sell signal for a market breaking down from a descending triangle, and indicates selling will follow.

Found within a Forex downtrend, the descending triangle chart pattern forms as a consolidation period within the downtrend and indicates downside continuation will follow.

Descending Triangle

The market formed a descending triangle chart pattern during its downtrend which led to further selling and continuation of the downtrend. The technical sell signal is when price breaks the lower horizontal trend line as selling resumes to push the market lower.