Commodity Prices and Currency Movements

Post on: 10 Апрель, 2015 No Comment

Commodity Prices and Currency Movements 5.00 / 5 (100.00%) 1 vote

Commodity prices and currency movements have a direct correlation with each other. The currency rate in the market is influenced by various factors, including commodity prices, capital flows, inflation, economics and interest rates. If you want to be a successful trader, it is advisable to understand some of these factors. The currencies of most large commodity exporters (Australia, Canada & South Africa) move together with commodity prices.

Correlation between Commodities and Currencies

When a country is more dependent on a specific commodity then the correlation between the commodity and currency becomes stronger. This can result in the currency of the country fluctuating more when there is substantial movement in the commodity. The currency may also fluctuate depending on whether the country is a net importer or exporter of the commodity.

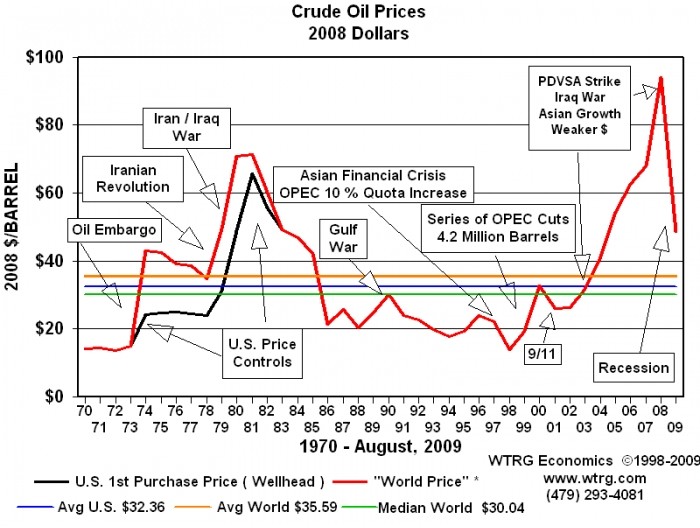

Similarly, countries that rely on imports of a specific commodity may also experience currency fluctuation when the price of the commodity moves substantially. For example, Japan is heavily dependent on import of energy products (coal, crude oil & uranium). This makes the Japanese currency (Yen) vulnerable when these energy products experience substantial fluctuations.

A vast majority of global commodities (oil, grains and precious metals) are traded in U.S dollar and when the value of these commodities so does the dollar. If the price of the commodity is to remain the same in terms of another currency then it has to rise in relation to the dollar.

Commodity Prices and Currency Movements

Commodities and Market Speculation

The forex market is affected by traders speculating on a combination of commodities and currencies. If you want to invest successfully in this market, therefore, you need to predict with great accuracy the currency rates that are based on the shift in commodity prices.

As a trader, you also need to understand which currency is vulnerable to which commodity price movement. This can help you trade successfully in this volatile market. In certain instances, the correlation may not be direct but it is advisable to keep track of it since even a small movement in the market may affect prices significantly.

Traders have started understanding the unique role that commodity prices play in determining the exchange rates of currencies. Any fluctuation that occurs in the price of the commodity has a direct or indirect bearing on the rate of the currencies traded in the forex market.

When there is an increased demand for a particular commodity, the currency related to it also increases and similarly when there is a decline in demand, the currency price may come down. Keeping track of the commodity prices and currency movements can help you time your trade effectively which translates to more profits. Avoid placing a random trade without understanding the relationship between currencies and commodities as it can result in losing your investments.

3A%2F%2F1.gravatar.com%2Favatar%2Fad516503a11cd5ca435acc9bb6523536%3Fs%3D52&r=G /%