Commodity Portfolio Manager resume in London United Kingdom February 2015

Post on: 16 Март, 2015 No Comment

Commodity Portfolio Manager

James E Brueton

Successfully managed diverse commodities portfolio at Top Tier Hedge Fund, having produced a high RoE at co-

partnered hedge fund, launched in 2012

• Extensive engagement in portfolio, risk and fund management, driving successful, high growth fund in

challenging investment environment

• Solid professional foundation and high level of business efficacy gained at Top 4 consulting firm, with

experience in financial modelling and technology strategy consulting

Professional Experience

Portfolio Manager – Millennium Capital

Jan 2014 — Dec 2014

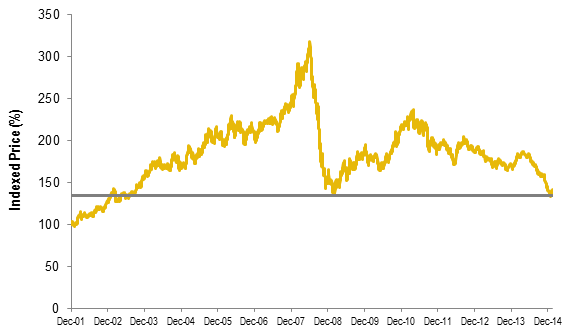

Managed $100m systematic commodities strategy with discretionary overlay, as run at previous

co-partnered hedge fund and subsequently absorbed by Millennium

• Produced superior risk weighted returns in a liquid environment, using in depth

fundamental and seasonal analysis of commodity markets

• Minimized portfolio risk, maintaining low volatility in challenging market conditions

through continual risk analysis, scenario testing and FX hedging

• Identified key market themes to aid product price forecasting, through development of

commodity specific S&D models across all sectors

Partner – IKEN Capital LLP

Feb 2012 — Dec 2013

Launched relative value commodities hedge fund, with managed investments across Energy, Metal, Agricultural

and Soft sectors

• Achieved returns of +18% in 2012 and +9% in 2013 with ann. volatility of 10%*

• Drove significant growth of assets under management from instructional level Fund of

Funds, Asset Manager and Family Office investors

• Effectively controlled risk by designing and building real-time portfolio management tools

managing position, portfolio and FX exposures

Commodities Trader – Marex Spectron

Nov 2008 — Jan 2012

Developed and managed multi asset commodity portfolio, employing a mixture of model driven fundamental and

technical strategies

• Generated consistent high RoE, with Sharpe Ratio of 4 and ann. volatility of 10%*

• Effectively controlled risk through VAR modelling and dynamic hedging of c.50 strategies within energy

future markets

Strategy and Technology Consultant – Deloitte & Touche

Feb 15

James E Brueton

Aug 2007 — Nov 2008

Key focus on personal development, including CIMA, financial modelling, due diligence, advanced MS Office,

presentation and interviewing skills

Feb 15

James E Brueton

Financial Modelling

Helped financially model 250m payments system implementation and created financial reporting tools

• Aided more effective decision making by investment board through creation of comprehensive project

finance presentations

• Pioneered project expense versus budget reporting process and model, used by the PMO team to control

costs

M&A Technology Due Diligence

Within technology strategy team, worked on c.20 pre-M&A transaction projects, spanning various industries

• Identified key risks and opportunities for future client cost savings, through creation of technology due

diligence reports

• Optimized due diligence process by developing comprehensive and time saving fact finding tools, used by

team to liaise with target company Industry Chiefs

Pricing Analyst Internship – GE Money

Jul 2005 — Sep 2006

High profile commercial role for analysis, development and execution of motor loan pricing policy

• Increased contract sales through development of bespoke price packages and establishment of dealer

profitability reviews

• Helped pioneer market leading campaigns by liaising with sales force (100FTE), marketing and risk

departments, ensuring effective growth targets

• Improved finance deal pricing process for auto finance department, through development and

implementation of new pricing models (Award for services)

• Enhanced business RoE by maintaining auto specific pricing models, utilising MIS to ensure robustness of

motor loan deal pricing

Skills

• Extensive knowledge of MS Office (esp. Excel, PowerPoint, Word), VBA, Bloomberg, Reuters and

industry standard trading systems

• Fluent English, intermediate French, basic Italian

Awards and Other Interests

• Achieved a top assessment grade and sponsorship on year’s internship in GE Money

• Procter and Gamble Marketing Strategy prize for Marketing Strategy module

• Sailing, skiing, squash, kitesurfing and travelling