CFD TRADING Contracts for Dummies

Post on: 12 Апрель, 2015 No Comment

CFD TRADING — Contracts for Dummies?

Contracts for Difference (CFDs) are an important financial innovation, and their use by hedge funds and individual traders has grown exponentially over the past few years, especially in the UK, Continental Europe and in Australia. CFDs are mostly traded OTC and only the ASX (Australian Stock Exchange) has been providing some standardized regulated CFDs since 2007. But what are these CFDs exactly? Why do our forex brokers seem to be continuously enhancing their product offering with more CFDs? Why should a trader prefer a CFD over a stock or future trade? Let’s try to answer these questions in this article.

1. What is a Contract For Difference?

CFDs are future-style derivatives designed such that their theoretical price (without transaction costs) should be equal to the price of the underlying security. They provide traders with the opportunity to take highly leveraged (margined) effective positions in stocks or other traded financial instruments without actually owning them.

CFDs have become popular because they enable much more flexibility and lower capital required to trade than outright futures or equities. They were originally introduced into the London OTC market in the early 1990s, only for institutional investors (due to the degree of counterparty risk, complexity and leverage involved). The invention of the CFD is widely credited to Brian Keelan and Jon Wood, both of UBS Warburg, on their Trafalgar House deal in the early 90s. In November 2007 the Australian Securities Exchange (ASX) became the first exchange to design and list exchange-traded CFDs. In London, the CFD market has grown exponentially and already in 2007 was at 35% of the value of the LSE equity transactions. The first company to provide CFD trading to retail investors was GNI (originally known as Gerrard & National Intercommodities). GNI and its CFD trading service GNI touch was later acquired by MF Global. They were soon followed byIG Markets and CMC Markets who started to popularize the service in 2000. In October 2013, LCH.Clearnet in partnership with Cantor Fitzgerald, ING Bank and Commerzbank launched centrally cleared CFDs in line with the EU financial regulators stated aim of increasing the proportion of cleared OTC contracts.

So what are the main issues that regulatory bodies are facing when addressing CFDs?

- Untargeted marketing presence (by brokers) that creates and overall impressions for retail investors that CFDs are easy to use; Information provided by CFD issuers in disclosure documents, advertising and seminars is generally not sufficient for retail investors to make informed decisions; OTC issuers may be offering CFDs to individuals that are not eligible for such a product; Many retail investors do not understand how CFDs are created and/or the risks involved in trading them; There is a lack of clear, independent information on CFD features, operation, and risk; Retail investors do not seek out professional advice before trading CFDs; Retail investors generally overestimate their ability to trade and understand CFDs successfully.

Bottom Line: CFDs are a high leverage investment vehicle that must be understood thoroughly before attempting to incorporate them into your portfolio. Use your common sense: if brokers are so happy to push CFDs onto their clients, there must be a good (and lucrative) reason for it.

2. Contract For Difference: Structure and Pricing Mechanism

To understand a CFD’s pricing structure, we first need to remind ourselves of the logic behind a future’s pricing structure. What follows is NOT an extensive description of pricing mechanisms. It is just enough to get the point across.

Future Price = Ft = St * e rt where S = spot price and e rt is the discount factor. r is the risk-free rate available at the time.

The Future price must equate to 2 strategies:

- Buy Spot right now and hold until time T. Buy Future right now and invest the current value of F in a Bond at the risk-free rate r.

Now let’s see what the CFD pricing conditions are. CFD Price = PT and Underlying Price = UT so the 2 parties get into a CFD trade at time t

1. For each moment in time t

2. At time T (the close of the position) there is a cash flow of PT — Pt = UT — P t

So the CFD pricing mecchanism that would keep the CFD price locked to the Underlying price at all times, and that would satisfy the Futures pricing mecchanism, would be:

This is the financing cost (contract interest) justified by the fact that the CFD issuer should have a physical position in the underlying, for which it has set aside margin, and they are not doing this pro-bono.

Where:

amt = Trade Size

close = daily closing price of the CFD contract

rate = relevant 3Month LIBOR rate (usually). to which the CFD issuers usually add (for long positions) or deduct (for short positions) a certain amount. For example, if your broker adds 3% to longs and deducts 3% for shorts, so effectively their haircut is 6% (because they make you pay 3% more on the longs and they give you 3% less on the shorts)

And now let’s try to understand a little more what the pricing formula means:

Long 1 CFD = PT-1 = FT-1 (UT-1 *(e r -1)) + DT so the client benefits from (positive) Future price variation and the dividends, and pays Libor 3M+3% (in our example)

Short 1 CFD = — PT-1 = — FT-1 + (UT-1 *(e r -1)) DT so the client benefits from (negative) Future price variation and Libor 3M-3% (in our example), and pays the dividends.

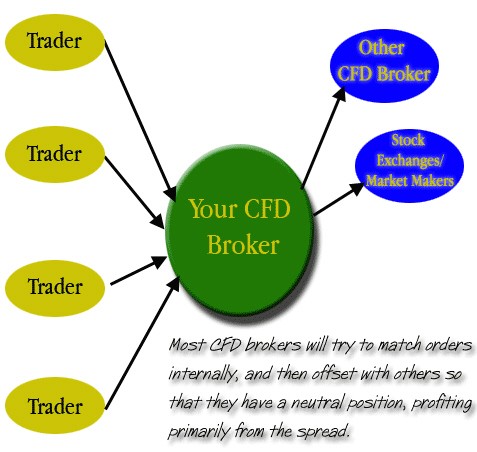

And finally, let’s take a look at why it’s beneficial for the CFD issuer to offer as many CFDs as possible: