Capital Gains Let s Rumble

Post on: 16 Март, 2015 No Comment

January 18th, 2012 at 10:18 pm

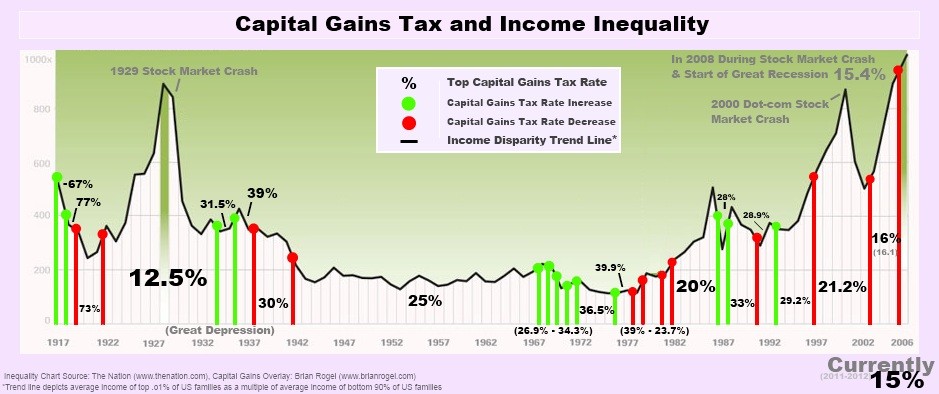

Like it or not America—and I rather like it—we are going to have a long national argument about the right tax rate for realized capital gains (the increase in the value of your financial assets when you sell them). Candidate Romney is taxed at 15%not presumably in violation of tax law, but in violation of the Buffett rule (millionaires shouldn’t pay lower rates than the middle class)—because his income is from assets, not earnings, and assets are afforded very favorable treatment in our tax code.

Paul K has nice post up on the history of capital gains tax rates, pushing back on a David Frum argument that there’s an historical precedent for keeping them very low. Allow me to add this figure from an old post of mine, which adds real business investment to the picture.

Sources: NIPA, CTJ

As I described the figure back then:

Plotting the top cap gains rate against real business investment doesn’t show much (biz investment is in natural logs to show proportional growth over this long time series). The cap gains rate bounces around based more on politics than policy, while investment pretty much grows with the cycle. Hard to see anything in the picture supporting the view that either the level or changes in cap gains taxes play a determinant role in investment decisions.

Remember, the ostensible reason for the favoritism in tax treatment here is to incentivize more investment and faster productivity growth. But that’s not in the data and the reason it’s not in the data is because investors aren’t nearly as elastic to cap gains rates as their lobbyists say they are (more precisely, theyll carefully time their realizations to maximize their gains around rate changes, but thats not real economic activitythats tax planning).

Warren Buffett:

“I have worked with investors for 60 years and I have yet to see anyone — not even when capital gains rates were 39.9 percent in 1976-77 — shy away from a sensible investment because of the tax rate on the potential gain. People invest to make money, and potential taxes have never scared them off.”

One other point. I took Frum’s point to be not just that cap gains tax rates have been low, but that they’ve been lower than the rates on ordinary income. And here, as this CBO figure shows, he’s right (btw, Frum is always worth reading, IMHO).

But again, what’s the evidence for his claim that this differential facilitates better investment outcomes? Show me the research! Eyeballing these two graphs, which is not research (it’s eyeballing), you don’t see accelerated investment when the difference between the two rates was largest. If anything, the one investment boom that’s pretty clear in the top graph—the 1990s—occurred when ordinary and capital income were taxed at very similar rates.

What the tax literature does suggest is that the revenue maximizing tax rate for wage income is a lot higher than that for capital income, because investors can time income realizations in ways that wage earners can’t. But all that tells you is that you could set your highest tax rate on earnings at some (politically) implausibly high level, like 80% (check this out) and your cap gains rate somewhere below that. It doesn’t preclude the possibility that they both could profitably—in terms of maximum investment and revenue—be set at the same rate in plausible ranges (say, in the 30-40% range) given the current code.

And the problem is not just that the rate on cap gains and dividends is so much lower than the rate on earnings; that problem is much amplified by the carried interest loophole that encourages tapping that difference (this is the one where PE and hedge fund managerslike Gov. Romney used to beget to apply the cap gains rate to their earnings).

I’m more convinced than ever that all this favorable treatment just needlessly loses scads of revenue and redistributes income upwards. I’m wide open to evidence to the contrary, and let’s have the debate. But you’re going to need to bring a lot moreA LOT MORE!to the table than complaints about the “bitter politics of envy .”

Share the post Capital Gains: Lets Rumble