Candlesticks (Stock market) Definition Online Encyclopedia

Post on: 9 Апрель, 2015 No Comment

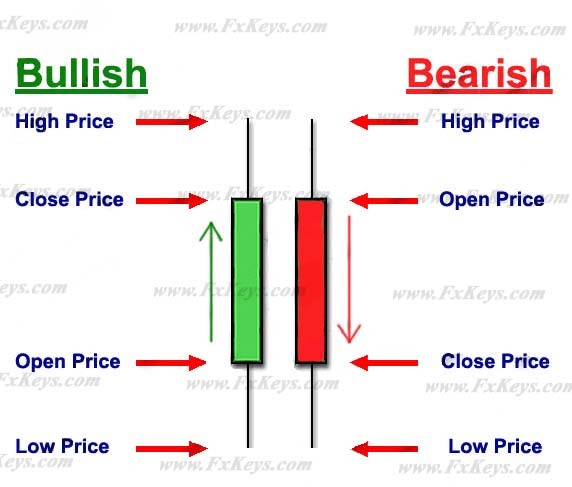

A single candlestick shows how a stock traded within a certain time frame (minutes, days, weeks or even months). The candle stick can tell you where the stock opened and close d as well as its high and low.

A Candlesticks Trading Strategy With Mountains, Rivers, Crows and Soldiers

By Galen Woods in Trading Setups on 20 November 2013

This haiku encapsulates the trading strategies in this review.

Forex Candlesticks

Candlesticks provide an excellent visual perspective on the price movement of a stock. Easy to interpret and use, memorable descriptions, and excellence in highlighting swing points make them an essential tool in swing trading.

Candlesticks Evaluation

Candlesticks should not be used in isolation to generate trading signal s. There are too many other factors that impact on price.

Doji Candlesticks

Doji is formed when the open and the close price are virtually equal. Despite that the upper and lower shadow s may vary, the actual Doji candle looks like a cross or a plus sign.

Doji candlesticks have the same open and close price or at least their bodies are extreme ly short. A doji should have a very small body that appears as a thin line.

CANDLESTICKS — JAPANESE

Overview

In the 1600s, the Japanese developed a method of technical analysis to analyze the price of rice contract s. This technique is called candlestick charting.

Candlesticks have grown in popularity since they were introduced to the western hemisphere by Steve Nison, author of numerous books on candlestick patterns including Japanese Candlestick Charting Techniques.

Candlesticks Basics

Japanese candlesticks originate from the Japanese rice trading market s in the 1700’s. They were used to track rice futures on the world’s first futures exchange.

Candlesticks provide an excellent means to identify short-term reversal s, but should not be used alone. A candlestick reversal pattern indicates that buyer s overcame prior selling pressure, but it remains unclear whether new buyer s will bid price s higher.

Candlesticks. however, are able to accurately pick up on the changes in trend that occur at the end of each market swing. If you pay meticulous attention to them, then they often warn you of impending changes.

Related links:

Candlesticks Patterns have been developed over the centuries by rice farmers in Japan and are well respected because of their ability to stand the test of time and help you see real time sentiment towards price.

Candlesticks which have long wicks and short bodies indicate period s where there was a lot of action pushing the market either higher or lower but where it ended up closing right near the open.

These candlesticks HAVE to be a better way to prevent getting whipsaw ed out of a potential profit. Easy to understand, and very clear entry /exit patterns. Brilliant, thank you.

it is fantastic.

Single candlesticks help you predict when prices may be about to reverse or continue, depending on what the pattern is.

Yo Sen and In Sen patterns

The Yo Sen and the In Sen candlestick patterns consist of a full body and short or non-existent wicks.

Because Candlesticks display the relationship between the open. high, low. and closing price s, they cannot be displayed on securities that only have closing price s, nor were they intended to be displayed on securities that lack opening price s.