Bollinger Bands As A Great Currency Volatility Indicator

Post on: 4 Июль, 2015 No Comment

Understanding Volatility In Currency Trade

Apart from Volumes, Volatility is the other key ‘V’ word to track in the world of currency trade. Currency volatility is essentially the risk or the extent of uncertainty associated with the amount of change in a specific currency pair. The higher this volatility level is, more the chances of the currency pair seeing dramatic changes over a very short period of time. Not just that higher volatility also involves a relatively wider of values or price movement. Lower volatility generally signifies a stable exchange rate with low level of fluctuation and higher chances of a consistent price move.

Tackling Volatility

Currency volatility is not a static factor. Every currency pair under consideration might go through phases of volatility and stable price movement alternatively. There are periods when they see high volatility or prices move up and down in quick succession. The popular notion is volatility is a negative element in currency trade give the risk and uncertainty associated with it. However, the profitability potential of a volatile currency trade is huge, and it is something that traders are currently waking up to. Indeed higher the market volatility, more the chance of profiting from it.

Technically speaking, ‘Volatility’ refers to the standard deviation of the change over a period of time. By change, it signals a change in value of a specific financial instrument under consideration. Volatility normally is expressed either in absolute numbers or percentage terms. Either way it is a measure of the risk involved in trading a specific currency pair at a given point in time. It points out the extent of risk that a specific investor is exposing himself/herself to while executing a specific trade. It can, therefore, be used effectively to not just quantify the uncertainty factor but also an extent of profit one might target.

Bollinger Bands®

One of the easiest and convenient measures of volatility used in currency trade is called the Bollinger Bands. It was created by John Bollinger in the early 80s. A CFA & CMT by profession, John Bollinger is a much-respected face in the world of forex trade for his analysis and market commentary.

Bollinger Bands provide a definition of the higher and lower band of the market in relation to the prices. This is particularly useful in interpreting the price action and taking an uniform trading decision. Some of the key parameters that can be understood in a more constructive fashion using these bands include:

- The extent of consolidation in the forex market

- Deciding on price targets for a specific trade

- Getting the ‘Buy’ & ‘Sell’ signals for a currency pair

- Period of trend continuations and points of a trend reversal

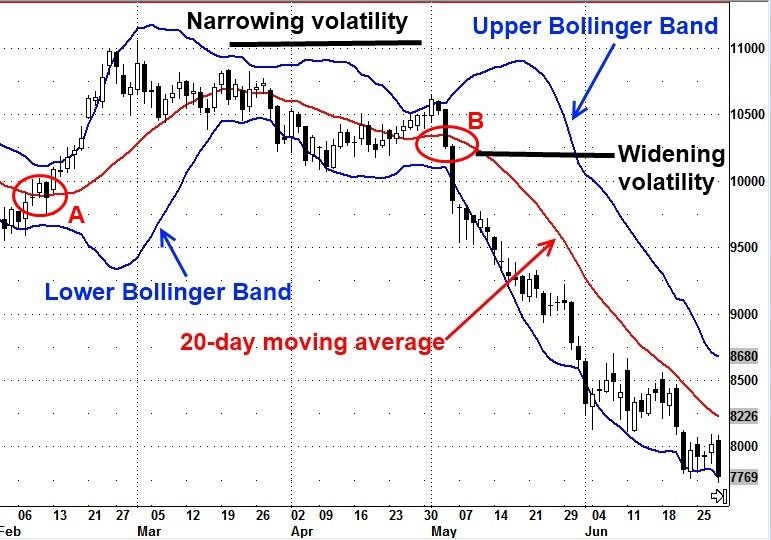

Its functioning is quite similar to that of the Moving Averages used in technical analysis of equity trade. The addition is Bollinger Bands also take the standard deviation and statistics in consideration. There are essentially three lines to help interpret market moves. These are the higher band, the lower band and the middle ‘moving average ’ line. This middle line serves as a base for both the higher and the lower band. The difference between the upper/lower bands with the middle line is what determines the extent of volatility. Overlaid on top of price action, these bands use the simple concept to the standard deviation to achieve the desired results. Essentially the volatility of the current price compared to moving average price is what increases/decreases the deviation.

Interpreting Bollinger Bands

Now that we get a basic peek into the construction of these Bollinger Bands, the next consideration is how best we can use it to get the desired result and boost the returns from a trade. The most basic reading that you can easily get from these charts are:

- The band widens when volatility increases

- The band shrinks in case of lower volatility

Regular tracking of these charts would indicate the heightened currency volatility during reversal of a market top or bottom. Traders are usually on a high or in fear of shorts collapsing, and that leads to a spike in the volatility. The start of a potential upside is more measured and better spread out through the session in comparison. Also, as currency is traded in a pair, investors must always remember that the market top for one currency also signifies the bottom for the other one in the pair.

Squeeze and bulges are the other key trend signals while reading the Bollinger Bands. A narrow standard deviation normally signals the consolidation, and it could also prepare traders for a potential breakout. The chance of a breakout increases if this consolidation phase stays for longer duration. In contrast to this unusually apart charts indicate the trend reversal. The point of reversal is generally the point where the price reaches the maximum possible level. These levels are generally based on statistics and distribution theory.

Patterns & Signals Based On Bollinger Bands Charts

One of the biggest advantages of the Bollinger Charts is that they provide effective visual signals predicting a trend, reversal or market peak.

- In the case there is an upswing in the market, the price stays within the upper band & the middle line.

- The reverse happens during a downturn in the market. The price move is between the moving average line and the lower band of the chart

- Prices above the upper or lower band do not signal a potential reversal

- Consecutive close above a particular band signals the trend beginning and indicate traders about the preferred strategy

- Reversals can be identified by price turns after hitting a specific band.

- Reversals are confirmed when the price levels in the chart cross over to the opposite side of the moving average after hitting a particular band.

Bollinger Bands as you can understand from the above explanations is an extremely effective tool for the technical analysis of the market. However, traders must understand that like most other tools used in the market place, they can’t be interpreted in isolation. As the Bollinger Bands give you a measure of the currency volatility, price action, trends. reversals and price targets for the currency pair in consideration, traders should employ means of correctly assessing the volume. momentum and open interest in the market along with these for a more specific results and accurate prediction of future move.

If you like to use Bollinger Bands and candlestick patterns to make money consistently, it is strongly recommended to start from here: Become A Profitable Forex Trader In 5 Easy Steps

It is the easiest and best way to trade forex and become a professional full time trader .

Note: This article is written by my trading buddy Peter M. He has already published some great articles on FxKeys. “A Simple Swing Trading Strategy for Forex Traders ” is one of them. Thank you Peter!

Don’t Miss Our New Articles!

Be the first who receives our most recent articles:

Learn more: