Bollinger Band trading like you have never seen!

Post on: 20 Июнь, 2015 No Comment

Bollinger Band trading like you have never seen! On the 1 st of September 2010 I started trading forex using the GBPUSD currency pair. I started with £1,800 and at the end of month 1 had made £6,000. I took my £1,800 out and continued trading. By the end of December 2010 I had made over £70,000 and had a run of well over 1,000 winning trades. By the end of March 2011 my profit was over £156,000. So, how did I do it?

Note that I only trade the GBPUSD also known as “Cable”. These techniques may work with other currency pairs but I have not tested them so can’t comment.

Only one indicator – Bollinger Bands

I knew a lot about stock and options trading and nothing at all about forex trading. From my stock trading I knew about John Bollinger’s Bollinger Bands and decided to use this as my ONLY indicator. However, since then, I have found that I actually knew very little about Bollinger Bands and did not know how to use them “properly” as John Bollinger intended.

Thank goodness I did not! I used my instincts to work out my own Bollinger Band trading system and it continues to work for me today. Since then I have added in my own trading indicators in the form of Jeff’s lines and Jeff’s rule of thirds – both of which also feature in tis blog. These two allowed me to reduce the number and frequency of trades but my Bollinger Band trading system works as well as ever.

What are Bollinger Bands?

en.wikipedia.org/wiki/John_Bollinger For my part I have read these but just don’t consider the knowledge necessary for making money. All you actually need to know is how to make money from them and this is what you will learn here.

Here is a candlestick chart showing Bollinger Bands in place.

Bollinger Bands in place on a forex chart

The Bollinger Bands are the “wiggerly” lines tracking above, below and through the middle of the candlesticks. The centre line is actually a simple moving average, in this case and in all cases for my trading, the 20 period simple moving average. The outer lines are a statistical measure away from the centre line called standard deviations (default = 2 standard deviations).

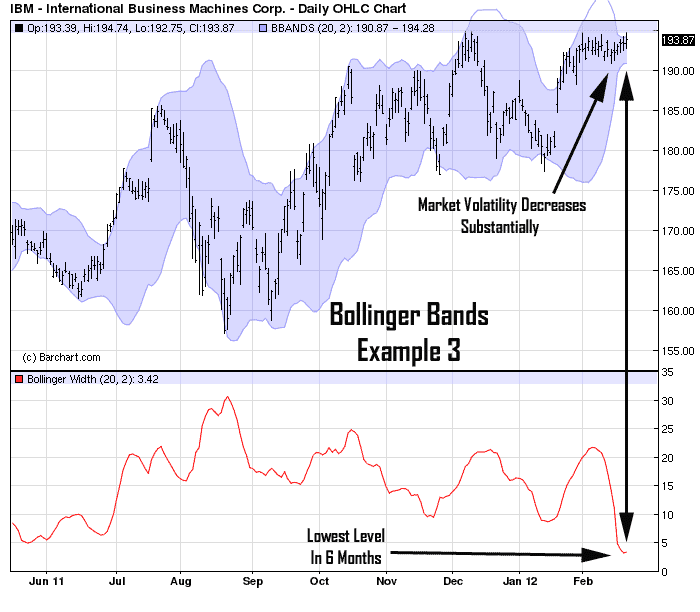

Looking at the Bollinger Bands you will notice that they move closer and further apart. You will also see that the candlesticks seem to either “bounce” off the upper, lower and middle lines, go through them or sometimes track along them. You will also see that there are occasions where the lines run closely together and that such periods end with a significant move up or down in the price. This effect is called a squeeze.

I use these effects to try to predict price direction changes and therefore to make money.

So, let’s make some money

GBPUSD 1 Minute Chart

Here is a one minute chart GBPUSD chart showing the Bollinger Bands.

Notice that the candlesticks, representing the price movement, have “walked” down the lower Bollinger Band (predominantly red candlesticks) and has then “stepped away” from it with the last 5 (predominantly green) candlesticks shown. I took that as an initial signal to buy. I did in fact buy but only after getting confirmation of the signal.

The more of these stepping away candlesticks that appear the stronger the entry signal is. However, these candlesticks are also eating into the potential profit of the trade. My rule of thumb is to look for at least 3 such candlesticks unless the first and second are very strong.

I get the confirmation by looking at the Bollinger Bands as they appear on the 5 minute chart and the 15 minute chart.

GBPUSD 5 Minute Chart

Here is the 5 minute chart and the screen shot was taken at the same time as the 1 minute illustration above.

Notice that the pattern is similar to that of the 1 minute chart in that it ends with one or more candlesticks that have stepped away from the lower Bollinger Band.

This is usually confirmation enough for me to go ahead with buying the pair.

GBPUSD 15 Minute Chart

However, I will also look at the 15 minute chart which could give even stronger confirmation to base my decision on.

Here is the 15 minute chart.

Notice that while there is not a clear candlestick “stepped” away from the Bollinger Band there has been a rise in the price. This is indicated by the bottom of the final candlestick being above the bottom of the “wick” of the previous candlestick.

A sell entry signal is just the inverse of the buy entry signal. Therefore, we are looking for the candlesticks to step away from the upper or middle Bollinger Bands after having been moving in an upward direction. We would also seek confirmation by looking at the 5 and preferably the 15 minute candlestick charts to show opposite and equal effects to those above.

Getting out or exiting the trade

Choosing an exit point is basically about seeing the price bounce off one of the Bollinger Bands on the 1 minute chart. If the trade started after the price bounced off the bottom Bollinger Band exit would be at either the middle or upper Bollinger Band. If it started at the top as a sell trade then entry would be either at the middle or lower Bollinger Band.

If the trade started at the middle Bollinger Band it could be a buy or a sell trade and the exit would be at the top or bottom Bollinger Band respectively.

Where the trade starts at one of the outer Bollinger Bands it is mainly a matter of judgement to decide whether to exit at the middle or opposite Bollinger Band.

Sometimes the price may continue through the target Bollinger Band and continue to walk along the target. In this circumstance some of the potential of the trade can be lost but it is better to exit safely rather sorrowfully.

The exit point can also be confirmed by looking at the 5 minute and 15 minute charts. Such confirmation can greatly enhance the profit from a trade.

It can and will sometimes not go to plan

coursesonforex.co.uk/shop/ In addition; most of the other posts in this blog are directly relevant. You can also see the Bollinger Bands being used live in my live trading blog under the tab on the website of that name or at www.the1stmillion.com

The Squeeze

The first image on this post shows a clear squeeze. These are periods when the Bollinger Bands run closely together for a period before the price “squeezes” out sharply in one or other direction. Unfortunately, no-one has yet devised a way of determining which way the price will move at the end of a squeeze. We only know that it will move significantly.

A future article will be dedicated to taking advantage of Bollinger Band squeezes.