BoE Minutes Rattle British Pound Putting Price in Perspective

Post on: 6 Июль, 2015 No Comment

Talking Points:

- Bank of England unanimous in policy hold; 7.0% Unemployment Rate doesnt guarantee interest rate hike.

-0.35 %

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR ): + 0.08 % ( -0.20 % prior 5-days)

ASIA/EUROPE FOREX NEWS WRAP

Weakness in the commodity currencies coupled with strength in the safe havens sees markets around the globe favoring lower yielding, safer assets on Wednesday. The G10 currencies are little changed around the US Dollar overall, with the British Pound the notable outperformer after this mornings release of the Bank of Englands November meeting Minutes.

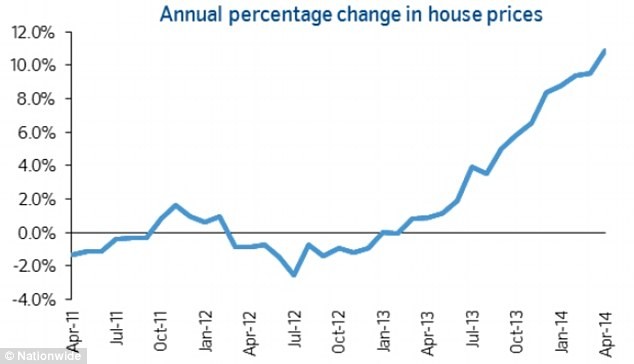

British Pound strength wasnt directly apparent after the BoE Minutes were released, as language within differentiated itself moderately from rhetoric employed just last week. Whereas in the Quarterly Inflation Report the BoE moved up its projection for the Unemployment Rate to hit 7.0% in the 3Q15 rather than the 3Q16 (a hawkish policy implication policy will tighten sooner than anticipated).

Todays Minutes show that a rate hike isnt guaranteed once the labor market threshold is hit (a dovish implication rates will remain lower for longer). Expectedly, the British Pound was unnerved by the more dovish tone employed, and saw brief downside in the wake of the release.

Yet with price recovering soon after across the GBP-crosses spectrum, its evident that underlying British Pound strength remains. If further strength for the Sterling is to materialize, it may occur against the Euro and the Japanese Yen in the near-term:

EURGBP Daily Chart: July 3, 2012 to Present

Want to automate your trading or trade baskets of currencies? Try Mirror Trader.

- The EURGBP has set a lower high after breaking the uptrend from July 2012 (ascending black TL), and price has pierced sideways channel support (grey channel, dating back to January 2013).

- A new descending channel may be emerging (red channel); confirmation below 0.8300.

- Weekly close <0.8300 suggests move into 0.8175/0.8225 by year end.

GBPJPY H4 Chart: September 11, 2013 to Present

Want to automate your trading or trade baskets of currencies? Try Mirror Trader.

- The GBPJPY remains supported by an uptrend dating back to November 2012, and a more concerted uptrend since April 2013.

- Price has broken out in an ascending triangle since September above 159.75/160.00.

- After breakout last week, on H4 price has consolidated into a potential Bull Flag (context of the bullish breakout).

- H4 close >162.00 gives confidence for continuation into 162.75 and 164.20 over the coming weeks.

ECONOMIC CALENDAR UPCOMING NORTH AMERICAN SESSION

See the DailyFX Econo m ic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators. Want the forecasts to appear right on your charts? Download the DailyFX News App.

— Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christophers e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.