Bitcoin Price Arbitrage Explored

Post on: 19 Июль, 2015 No Comment

Bitcoin price is in a slow controlled descent with frequent spikes to the upside developing. Market orders are streaming through the exchanges like a ticker tape and buy limit orders fill the orderbooks down to $290. We look at arbitrage trading in the Bitcoin exchanges and consider options for trend in the coming days.

Bitcoin Price Arbitrage

Many thanks to all the readers, supporters and cynics alike, who had responded to Sundays article about manipulation in the exchanges. Its only by kicking the hornets nest that discussion about the many uncomfortable truths about centralization and opaque trusted third parties can begin.

Some readers agreed, and substantiated claims of manipulation and collusion. Others accused the writer of being a disgruntled trader, a conspiracy theorist, or for lacking basic comprehension of financial markets. Allow the writer, contrary to his modest nature, to state for the record that hes a trader with over five years experience in forex, commodity and equity markets. His trading experience extends to futures markets, options trading as well as options writing. Hes one of the 5% most-subscribed members at Forex Factory that has in excess of 300k members. So, objectively, the writer cannot be called a spring chicken when it comes to markets and trading.

Recap

Sundays article has become unwieldy to read since the number of comments, and back-and-forth discussion is voluminous. For the sake of clarity the articles position is reiterated:

Objection is made to the fact that the Bitcoin Foundation has the self-proclaimed brief of looking after the health of the Bitcoin ecosystem, while most of the centralized exchanges, seeking legitimacy, are Bitcoin Foundation members. Conflicts of interest arise. Some of the exchange bosses even sit on the Bitcoin Foundation board. More conflicts of interest.

Currently, we have a situation whereby the active collusion (not arbitrage well get to this in a minute) between exchanges has pulled the Bitcoin price down to levels where many smaller miners are throwing in the towel due to unprofitability. This is bad for diversity and decentralization of the Bitcoin network of which the Bitcoin Foundation calls itself custodian.

That there is collusion and manipulation in the exchanges and by the exchanges themselves is not something the writer doubts. It remains to be proven and the burden of proof falls to the exchanges. Of course, they dont have to prove anything granted but many community members are challenging them to come clear. Regardless of their response, the fact remains that their lack of transparency and centralization renders them untrustworthy. Traders have the option to vote with their feet. The blockchain allows for decentralized exchanges. The centralized exchange market is by no means the only option, or even a necessary compromise as is the case with, say, the Gold and forex markets.

Bitcoin Price Arbitrage Myth

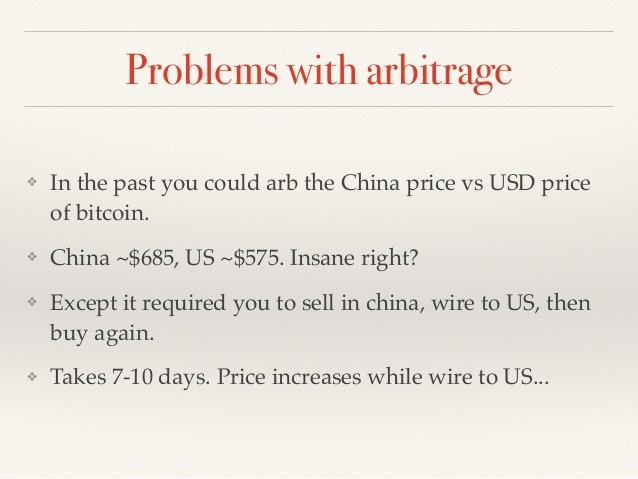

In an attempt to explain the uncanny coordination of exchange price movements many readers ascribed the phenomenon to natural market arbitrage. Some even felt it necessary to explain what arbitrage is. They did so in exasperated tones as if explaining the principle of cause-and-effect to a child. After some time in the market any trader eventually understands the difference between pure and risk arbitrage it is an apparent opportunity for profit and can be lucrative when taken advantage of timeously. However the example provided by many as an explanation of why the exchanges prices move up and down in tandem is not, by any realistic measure, an example of pure arbitrage but of pure horse manure.

Pure arbitrage in the Bitcoin exchange market is not viable because of the slow transaction mechanism imposed by the blockchain. No, no you dont understand Khaosan separate wallets held at separate exchanges, savvy? As a potential strategy for profiting from differences between exchange quotes it sounds very clever, yet, any trader trying to apply arbitrage strategy in the manner suggested will soon, with a steady stream of losses, abandon it as unprofitable. Here is a simple illustration of why the exchange arbitrage example provided by readers is not viable:

Lets assume an arbitrageur has $100,000 and 100 BTC at Bitstamp and $100,000 and 100 BTC at BitFinex. Lets assume a starting price of $310 BTC/USD at both exchanges

Bitstamp

100 BTC

100,000 USD

total holdings (in USD @ $310): $131,000

BitFinex

100 BTC

100,000 USD

total holdings (in USD @ $310): $131,000

1) A big seller executes a large order on Bitstamp. Bitstamps price goes to $300 while BitFinex remains at $310.

2) The arbitrageur, spotting his opportunity, buys 100 bitcoins at Bitstamp for $30,000 and sells 100 bitcoins at BitFinex for $31,000 (lets assume spread equals zero). He now has $1,000 profit: