Beware Of Currency ETFs

Post on: 20 Июнь, 2015 No Comment

The currency market (called the foreign exchange, forex, or the FX market) is the largest and most liquid market in the world. The volume of FX trading is over 3 trillion dollars per day, which is an order of magnitude greater than the trading volume on all the world’s stock exchanges combined. In the past, it was difficult for retail investors to gain access to this market since you had to open an account with a forex broker. All this changed in 2005 when Rydex Investments launched the first currency Exchange Traded Fund (( ETF )) based on the value of the Euro. Now there are over 29 currency ETFs and one currency Closed End Fund (( CEF )).

Let me be clear, I am not an expert on the FX market and do not have an account with a forex broker. However, as an investor, I am interested in any asset class that might enhance my retirement portfolio. One of the characteristics of currency funds is that they are not correlated with the stock market so they offer the potential for diversification. To determine if these funds are suitable for my portfolio, I analyzed the risk versus reward of these assets over the past 5 years.

Retail investors may not be familiar with the characteristics of currency funds so I will provide a quick tutorial before presenting the results of my analysis. The primary reason for the FX market is to facilitate the exchange of one currency into another by multi-national corporations. On a much smaller scale, everyone who has traveled abroad is familiar with foreign exchange rates. If you travel to Europe, you will need to convert your dollars to euros at the current rate of 0.72 euros per dollars. So if you buy a product for 72 euros it will cost you $100 in terms of dollars. This rate is not fixed. For example, in 2010 the dollars was worth .80 Euros so the same 72 Euro product would have cost only $90 dollars. This was because the dollar was stronger in 2010 than it is today.

The above illustrates that currencies are traded as pairs based on the price of one currency in terms of another. The seven most liquid pairs are (where dollar without a qualifier refers to the U.S. dollar):

- Euro/Dollar

- Dollar/Japanese Yen

- British Pound/Dollar

- Dollar/Swiss Franc

- Australian Dollar/Dollar

- Dollar/Canadian Dollar

- New Zealand Dollar/Dollar

Some other aspects of the currency market are:

- Trading currencies is a zero-sum game, as opposed to trading stocks which have a long-term positive expectation. If one currency appreciates, another currency must depreciate.

- The forex market is open 24 hours a day from the start of the business day on Monday in the Asia-Pacific time zone to the Friday close of business in New York.

- Currencies are not traded on an exchange and trading is not controlled by a clearing house or a central governing body.

- There are no commissions. Brokers make money on the spread between the buying and selling price.

- There are no limits on the amount of currency you can buy. If you wanted to buy $1 billion U.S. dollars, the transaction could be easily accommodated.

- The value of a currency is established by supply and demand. Some factors influencing the demand include interest rates, inflation and stability of the economy. The supply can be affected if governments intervene in the market to buy or sell huge quantities of currency. For example, if Japan wants to increase the popularity of their exports, the government may want to weaken the yen, which will make Japanese goods more attractive to foreign buyers. This could lead to currency wars where governments jockey for position in the international trade markets. These political interventions may result in unnatural fluctuations in the market.

- The currency carry trade is a strategy where the investor sells a currency with a low interest rate and buys a currency with a higher interest rate. The investor tries to profit from the difference between the two rates.

To limit the number of funds I included in my analysis, I did not include any inverse or bear funds and required the funds to meet the following criteria:

- Have at least a 5 year history

- Trade at least an average of 50,000 shares per day

- Have a market cap of at least $150 million.

The ETFs and CEFs described below passed my screen.

PowerShares DB US Dollar Index Bullish ( UUP ). This ETF tracks the U.S. dollar against a basket of currencies consisting of the euro, Japanese yen, British pound, Canadian dollar, Swedishkrona and the Swiss franc. The euro is weighted at 58%, the Japanese yen at 14% and the British pound at 12%. The other currencies make up the remaining 16%. The fund uses future contracts to maintain the currency exposure. UUP is structured as a limited partnership, so investors will receive a K-1 form at the end of the year rather than a 1099 form. The fund does not pay any dividends and the expense ratio of 0.75%.

PowerShares DB G10 Currency Harvest ( DBV ). This EFT implements a carry trade strategy, using a quantitative strategy for buying and selling future contracts. This makes a sophisticated hedge-fund strategy available to individual investors with a tiny fraction of the fees charged by hedge funds. The fund can select from any currency used by the following countries: United States, Canada, Japan, Australia, New Zealand, Great Britain, Switzerland, Euro Zone, Norway or Sweden. The fund utilizes 2 times leverage and buys higher yielding currencies while shorting the lower yielding currencies. Because this fund uses future contracts and is structured as a limited partnership, it has some unique tax consequences that should be discussed with your tax advisor. The fund does not pay any dividends and has an expense ratio of 0.81%.

CurrencyShares Australian Dollar Trust ( FXA ). The Currency Shares funds are managed by Guggenheim Investments who purchased Rydex in 2010. FXA is an ETF designed to track the price of the Australian dollar. It is organized as an exchange traded grantor trust, which means that the fund invests in a static basket of Australian dollars. Each share of the fund represents a fractional interest in this portfolio of Australian dollars. The fund yields 2% and has an expense ratio of 0.40%.

CurrencyShares Canadian Dollar Trust (FXC). This ETF is designed to track the price of the Canadian dollar. Similar to FXA, this fund is also organized as a grantor trust that invests in Canadian dollars. The fund yields 0.2% and has an expense ratio of 0.40%.

CurrencyShares Euro Trust (FXE). This ETF is designed to track the price of the Euro. It is a grantor trust that invests in the Euro. It does not generate any yield and has an expense ratio of 0.40%.

CurrencyShares Japanese Yen Trust (FXY). This ETF is designed to track the price of the Japanese Yen. It is a grantor trust that invests in the Yen. It does not generate any yield and has an expense ratio of 0.40%.

WisdomTree Chinese Yuan Strategy (CYB). This ETF seeks to achieve a total return associated with the interest rate in China and changes in value of the Chinese Yuan. Since the money market Chinese securities are not very liquid, the fund employs a sophisticated strategy based on forward contracts and currency swaps to achieve its objectives. The fund is short-term oriented, generally having a portfolio maturity of 90 days or less for money market instruments and a maturity of 6 months or less for forward contracts. The fund yields 0.8% and has an expense ratio of 0.45%.

Nuveen Diversified Currency Opportunity (JGT). The CEF sells at a discount of 16.2% which is slightly below its average discount of 14.5%. The fund’s objective is to seek current income and total return by investing in short duration global bonds, forward currency contracts and other derivatives. The portfolio consists of about 60% foreign Government bonds denominated in local currency, 11% invested in foreign Government bonds denominated in U.S. dollars, 9% in investment grade corporate bonds, 7% in U.S. treasuries and 6% in high yield bonds. In terms of geographic distribution, 20% of the assets are from the U.S. 15% from Brazil, 13% from Canada, 12% from Mexico and the rest from other countries. The fund does not use leverage and has an expense ratio of 1%. The distribution is a high 8.4% but over 50% comes from return of capital.

To compare the performance of currency funds with U.S. Treasury Bonds, I used the iShares 7-10 Year Treasury Bond (IEF) ETF as a reference. This ETF tracks the Barclay U.S. 7-10 Year Treasury Bond index, yields 1.75% and has an expense ratio of 0.15%.

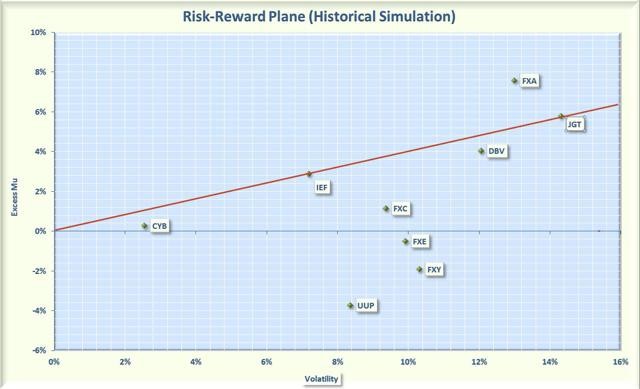

To begin the analysis, I utilized the Smartfolio 3 program to plot the rate of return in excess of the risk free rate (called Excess Mu on the charts) versus the volatility of each stock. The results are shown in Figure 1 for a 5 year look-back period.

Figure 1: Reward and Risk over 5 years

The figure indicates that there has been a wide range of returns and volatilities associated with currency funds. For example, FXA had the highest return but also had a high volatility. Was the increased return worth the increased risk? To answer this question, I calculated the Sharpe Ratio for each fund.

The Sharpe Ratio is a metric, developed by Nobel laureate William Sharpe that measures risk-adjusted performance. It is calculated as the ratio of the excess return over the volatility. This reward-to-risk ratio (assuming that risk is measured by volatility) is a good way to compare peers to assess if higher returns are due to superior investment performance or from taking additional risk. On the figure, I also plotted a red line that represents the Sharpe Ratio of IEF. If an asset is above the line, it has a higher Sharpe Ratio than IEF, which means it has a higher risk-adjusted return. Conversely, if an asset is below the line, the reward-to-risk is worse than IEF.

Some interesting observations are apparent from the plot. With the exception of CYB, all the currency ETFs were more volatile than intermediate U.S. Treasury bonds. The Chinese yuan had exceptionally low volatility, likely because it has been manipulated by the Chinese government. However, the yuan may be more volatile in the future since the People’s Bank of China has announced that it will widen the trading bands around the yuan.

In general, intermediate Treasury bonds, as exemplified by IEF, had a significantly better risk-adjusted performance than the vast majority of currency funds. Only the Australian dollar had a higher Sharpe Ratio than IEF. The risk-adjusted performance of the closed end fund JGT equaled that of IEF and DBV was not far behind. The other ETFs booked significantly poorer performance with FXE, FXY, and UUP actually featuring negative returns over the period.

On the plus side, the currency ETFs and CEF did live up to their reputation of providing diversification. To be diversified, you would choose assets such that when some assets are down, others are up. In mathematical terms, you want to select assets that are uncorrelated (or at least not highly correlated) with each other. To assess diversification, I calculated the pair-wise correlations associated with the currency funds and IEF. For comparison with the overall stock market, I also included the SPDR S&P 500 (SPY) ETF. The results are shown in Figure 2.

Figure 2. Correlation matrix over past 5 years

The Chinese yuan is only slightly correlated with the other assets, which was expected because of the non-free-market nature of yuan fluctuations. With the exception of the yen and dollar, the currency funds were negatively correlated with U.S. treasuries. The dollar was only slightly correlated with IEF and the yen was moderately correlated. In addition, the yen and dollar were negatively correlated with the S&P 500 while the other currency funds were moderately correlated. Since currencies are a zero sum game, it is not surprising that, with the exception of the yen, the other currencies were negatively correlated with the dollar. Overall, the currencies provided moderate-to-excellent diversification with respect to one another.

As we have seen, over the 5 year look-back period, only a few of the currency funds (FXA, DBV, and JGT) performed well when compared to IEF. Did this performance continue for the more recent past? To answer this question, I re-ran the analysis for the past 3 years. The results are shown in Figure 3.

Figure 3. Risk versus Reward over past 3 years

Unfortunately, all the currency funds had poor performance over this time period. With the exception of CYB, all the funds significantly lagged IEF on both an absolute and risk-adjusted basis. In fact, only CYB and DBV were able to book a positive return.

No one knows what the future will hold, but for me, the diversification I might receive from investing in currency funds does not compensate for the potential dismal performance. Based on this data, I would be wary of adding currency funds to my portfolio.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.