BBC Stephanomics Inflation Consumers fight back

Post on: 16 Март, 2015 No Comment

Stephanie Flanders | 11:05 UK time, Tuesday, 12 April 2011

For once, a surprise in the opposite direction. City forecasters were expecting inflation to be broadly unchanged in March. Instead, the annual rate of inflation has fallen from 4.4% to 4% — thanks, in large part, to a 1.4% monthly fall in the price of food. There’s also welcome news on the trade front: exports were 15% higher in the last three months than the same period last year.

With households so squeezed, it’s been a puzzle how firms could pass on all these input price increases month after month. Taken alongside the bad news coming from retailers, today’s figures might, just might, suggest that consumers are starting to say no.

However, the trend in inflation is still up: on the CPI measure, inflation averaged 3.4% in the last three months of 2010. The average for the first three months of 2011 has been 4.1%.

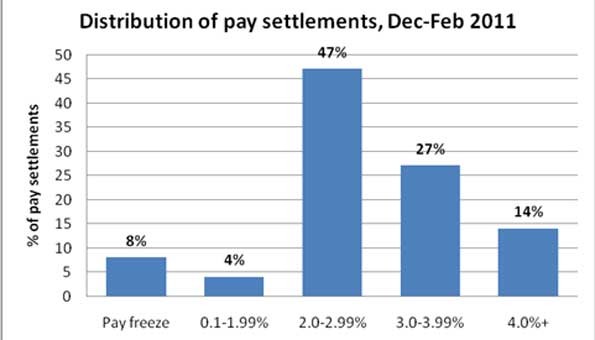

It’s not just the Bank of England that’s been taken by surprise by the level and persistence of inflation in the past few years — most City forecasters (and, as some of you delight in pointing out, Stephanomics) have been surprised as well. After all, inputs such as oil and other raw materials only represent a proportion of producers’ costs. The cost of labour is usually much more important, and, until recently at least, wage costs were barely rising at all.

To Danny Gabay, of Fathom Consulting, the forecasting errors suggest that companies have been doing more than pass on increases in costs — they have also been using the opportunity to increase their margins — especially food retailers.

Two charts make the point. The first shows international retail food prices and UK prices.

The gap between the UK and the rest of the world in 2008 and 2009 is easily explained by the fall in the exchange rate. But you can’t pin the more recent price rise on the currency — sterling has been stable or rising in most of this period.

The second chart shows recent trends in food retail and wholesale prices, and wages.

Some of you will remember I debated UK food prices in a post last month. This time I’ll let Danny Gabay make the point:

For the retail sector as a whole, labour costs account for around 50% of the total cost base.

Consequently, for a period where margins are stable, one would normally expect the green line showing increases in the retail price of food, to lie somewhere between the blue line, showing increases in the wholesale price of food, and the pink line, showing wage inflation in the retail sector as a whole.

The fact that the retail price of food has, since the middle of last year, risen almost as much as the wholesale price of food at a time when wage inflation in the retail sector has been subdued, suggests to us that food retailers have been widening their margins.

These charts were created before today’s figures came out. The fall in food prices in March may have changed the picture a little. But Bank of England economists have also puzzled over companies’ ability to pass on price rises in such a subdued consumer environment. And the forecast for the next few months is still that the headline rate of inflation will go up.

Some point to the incentives facing managers in big corporations these days, which might encourage them to protect argins more zealously than the volume of sales. If so, it could be bad news for the economy, because it would suggest that it will take longer for inflation to work its way back to target than it might have done in the past, even when there is a considerable amount of slack in the economy. The fear would then be that we would only be able to get inflation back to 2% target with a prolonged period of sub-trend growth, which would itself be bad news for our long-term potential because some of our idle capacity would be lost forever.

We shall see. For the moment, consumers can take some good cheer from the reminder that inflation, like share prices, can go down as well as up.