Asset management Hedge funds

Post on: 16 Март, 2015 No Comment

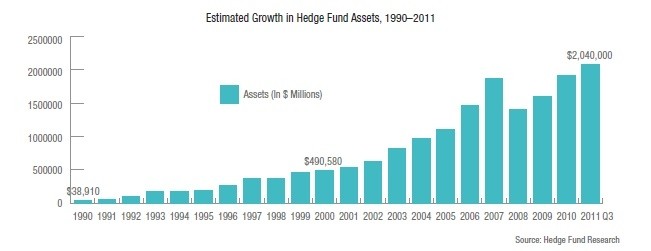

Most hedge funds which have survived the crisis have returned to growth. Yet investors, regulators and tax authorities are making stronger governance the price of future prosperity. Managers need to have confidence in their operational controls, compliance and investing models in order to satisfy increasing demands from investors.

Regulation

Hedge fund managers face increased regulation. The Private Fund Investment Advisers Registration Act in the United States and the Alternative Investment Fund Managers Directive in Europe are both having considerable impacts on the industry already, if only for the uncertainty that they have created until they are in effect. Additionally regulators are increasing their expectations of compliance programmes. Managers need to spend time planning and preparing.

Operations

Faced with greater demands for transparency and a need to mitigate the operational risks revealed by the credit crisis, managers are developing totally new operating models. These involve the entire infrastructure, including people, processes, technology, data and organisational design. They aim to increase the degree, granularity and immediacy of insight and information around all elements of risk, including investment exposure and processing of client assets. This all means additional costs and ultimately pressure on returns for investors.

Tax

Tax authorities across the globe are seeking investors’ identities (e.g. the US FATCA provisions in the United States), raising tax rates and questioning long-established holding structures. They are reinforcing all of this with increased audit activity. Managers must respond by improving their tax functions.

Restructuring

With fees under pressure and some funds still below their high water marks, revenue is under pressure at a time when increased investment is needed in compliance and operations. Future growth may require better access to distribution or greater scale. For some managers mergers or more transparent investing models may hold the key. Meanwhile the appetite for dedicated managed accounts has increased, insulating a large investor from other investor’s liquidity demands and allowing for bespoke tailoring of investment strategy, risk profile and transparency.

Risk

Hedge fund governance and operational risk management has been called into question by market events. Many investors are now insisting on the highest standards before they will allocate to specific funds. Are you aware of what constitutes best practice? Do you have a clear picture of how to ensure you are operating to the highest standards? We’re also seeing a marked increase in interest in third party assurance reporting by prime brokers and hedge fund managers.

People

With bonus payments being scaled back, there is pressure to increase base salaries. HR professionals have to decide how to redefine the overall compensation offering, taking into account upwards pay pressure from employees and criticism from shareholders, regulators and the public over ‘excessive’ incentive outcomes. Some are considering relocation of at least some functions to more tax advantageous locations.