Are your variable annuities safe

Post on: 16 Март, 2015 No Comment

Highlights

- Annuities pay an income stream during retirement in exchange for funds.

- Some annuities guarantee a minimum benefit even if the market tanks.

- Though insurers are suffering losses, annuities offer some protections.

Annuities have long been favored by investors looking to lock in a steady income stream during retirement, once their paychecks come to a halt.

Designed to ensure you don’t outlive your money, annuities are a contract between you and your life insurance company that guarantees lifelong income in exchange for a lump sum or regular contributions over a fixed time period.

Yet as a growing number of insurers falter, the peace of mind annuities provide has rapidly been replaced by anxiety-inducing questions: What happens if the life insurance company that sold me my annuity goes under? How do I check the financial strength of my insurer? Is my guaranteed income really guaranteed?

Annuity basics

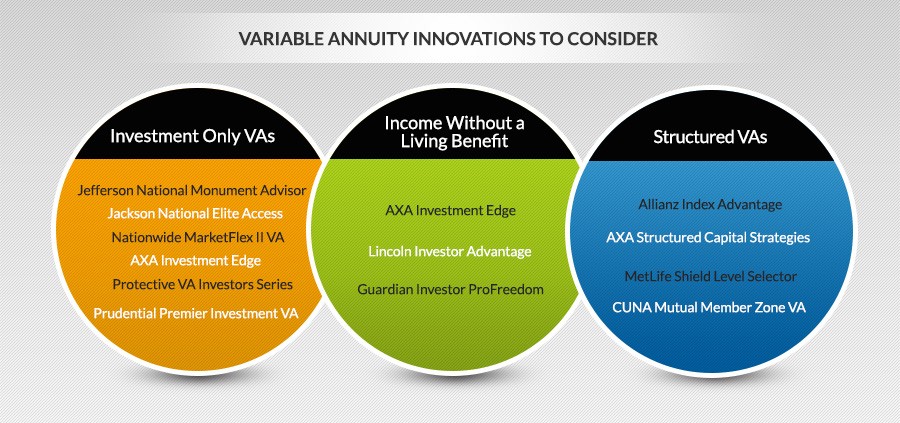

First, a quick lesson. There are two main categories of annuities: fixed and variable.

Under a fixed annuity, insurance companies guarantee the principal and, in some cases, a minimum rate of interest during the savings phase.

In a variable annuity. your contributions are invested in mutual fund-like investments called subaccounts, and the payout stream is determined by the investments’ performance.

To mitigate downside risk, however, and in exchange for higher fees, many retirement savers in recent years bought a variable annuity with a guaranteed minimum withdrawal benefit, which promises a minimum payout during retirement, plus any extra earnings if the value of the subaccounts rise.

That’s where the insurance industry got itself into trouble, since it has not been immune to the market malaise.

When their investments don’t produce enough to cover those returns, they have to use their reserves to make good on their guarantee, explains Terence Martin, vice president of insurance research for Conning Research & Consulting in Hartford, Conn.

To offset their risk, in recent weeks variable annuity providers have been raising fees and decreasing benefits. Some firms have even suspended offering the guaranteed income and withdrawal features of these policies altogether.

Nonprofits big investors

It’s not just retirees who own annuities.

Most 403(b) retirement plans offered by nonprofit organizations, such as public schools, religious institutions and hospitals, include tax-sheltered variable annuities as the biggest component of their investment offerings, says Rita Cheng, a Certified Financial Planner for Ameriprise Financial Services in Bethesda, Md.

Employees of those organizations invest in variable annuities, sold by insurance companies, through payroll deductions.

Schoolteachers, for example, have 403(b)s, and those are the kinds of clients who are more focused on the value of their annuities right now, says Cheng.

advertisement

Some of the largest providers, such as TIAA-CREF, don’t offer performance guarantees on their variable annuities. But consumers and plan sponsors can review the financial strength of their life insurers by visiting the Web sites of Moody’s and A.M. Best and typing in the name of their provider. (Moody’s is free but requires you to register.)

Despite the challenging environment for life insurance companies, Andrew Edelsberg, an insurance analyst with A.M. Best, says those that sell variable annuities have been largely successful so far at mitigating market risk through sophisticated investment strategies.