An Overview of the Interbank Market

Post on: 11 Июль, 2015 No Comment

The interbank market is a section of the foreign currency exchange (Forex) market that involves trade between banks. Banks make agreements to exchange specified amounts of currency at agreed rates on fixed dates. The banks may trade either via electronic brokering platforms or deal directly with each other.

This is a top-level market where large sums of money are traded with minimum trade sizes being a million of base currency. It is not unusual for banks to trade more than $10 million within seconds.

Overnight Rates

Most interbank transactions have a maximum maturity of one month but many of them are conducted overnight. Banks use the interest rates that their respective national central banks declare. In the United States, the rate is known as the federal funds rate.

Banks generally opt for overnight borrowing when they cannot readily get the required funding. It gives them the safest option since they do not need any collateral.

Who Regulates the Interbank Market?

The interbank market determines the prices traded on individual Forex platforms online. Interestingly, the market is mostly unregulated, having developed without much governmental oversight. In many cases, either national or local banking regulations are all that control the market.

There is no central exchange where prices are quoted and statistics collected. However, some international institutions and national central banks collect data to evaluate economic developments. Players in the market provide the data on a voluntary basis.

In addition, the United States regulates foreign currency options from the Philadelphia Stock Exchange.

Participants in the Market

Although there are relatively few major players in the interbank market, hundreds of international financial institutions take part in the market and their efforts contribute towards market interest and liquidity. Investment banks and hedge funds take a comparatively small percentage of the market but they still play a larger part than commercial banks on several occasions because they can use higher leverage levels.

The banks trade in the interbank market to provide their customers with currency trading services or participate in proprietary trading where they facilitate speculation for their respective accounts, which forms the largest chunk of trade operations. The customers receiving such services are relatively large, such as government agencies, hedge funds and corporations. A few wealthy private individuals may also take part.

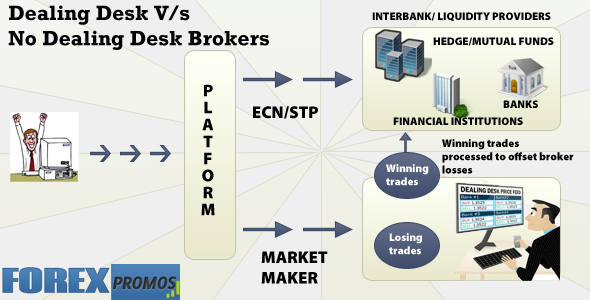

Statistics show that Forex brokers account for two percent of all activities in the market. These are the intermediaries who represent clients in the interbank market. They pool together orders from their customers that they sell and buy amongst themselves before passing the balance to the market to meet the orders. This means that the brokers communicate fewer orders to the banks compared to the total volume they receive from their clients.

In addition to matching orders internally, the Forex brokers add smaller fees to the prices that banks trading in the interbank market charge. The fees are their major sources of income. These charges are known as spread.

Impact of the Interbank Market

The interbank market serves both large amounts of short-term, speculative currency trading and commercial turnover of various currency investments. The market accounts for about half of all foreign exchange transactions.

One of the major things that set the interbank market apart from the retail one is the rate of interest charged on borrowed money. The interest rates in the retail market are relatively higher than the interbank market where the financial institutions have access to their countries central banks. Indeed, it is this difference that helps the banks to serve their customers and make profit.

The interbank market influences other financial markets in a country in various ways. For example, tension in the market may lead to increased volatility, lack of liquidity, shortage of currency and widening spreads. If the banks cannot get the funds they need to operate, then they will not be in a position to finance their own borrowers. The state of the interbank market will therefore shape market trends and determine economic stability.

Problems in the market are usually experienced first in the overnight rates because of their high sensitivity to illiquid conditions. However, overnight markets hardly shut down completely because of interventions by the central banks.