An Introduction to Currency Pairs Financial Web

Post on: 3 Апрель, 2015 No Comment

If you plan on getting involved in the Forex market, you will need to understand what currency pairs are and how they work. Here are the basics of currency pairs and how to use them in Forex trading.

Currency Pairs

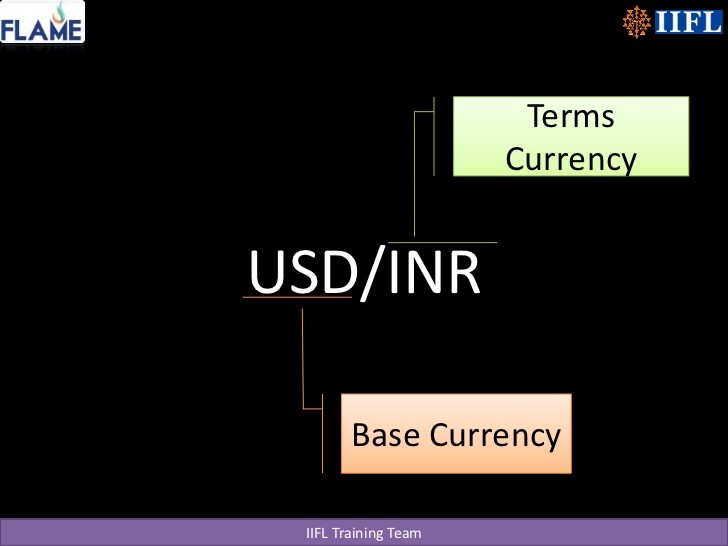

When trading Forex, you will immediately notice that currencies are grouped into pairs. Each pair is made up of a base currency and a counter currency. The first currency that is listed in the currency pair is always the base currency. The second currency listed is always the counter currency.

Buying and Selling

When you work with currency pairs, you will always be simultaneously selling one and buying the other. However, you will deal with these pairs as an individual unit. For example, you will say that you are buying the EUR/USD pair. What this really means is that you are purchasing euros and selling dollars. By contrast, if you said that you were selling the EUR/USD pair, you would be selling euros and buying dollars.

Profiting from Trades

When trading currency pairs, you will be able to profit by taking advantage of changes in the exchange rate between the two currencies. Money is made in these transactions when the value of one currency goes up against the other. For example, if you are purchasing the EUR/USD pair, you are hoping that the value of the euro goes up and the value of the dollar goes down.

The Majors

When talking about currency pairs, there are certain groups of pairs that are called the majors. This group of currency pairs makes up the vast majority of what is traded in the Forex market. This group consists of EUR/USD, GBP/USD, USD/JPY, USD/CHF, AUD/USD and USD/CAD. In some cases, the NZD/USD pair is also considered one of the majors.

Lots

When trading currency pairs, you will be working with standard lots of the currencies. A standard lot is represented by 100,000 units of the base currency. Therefore, when you buy one lot of EUR/USD, you are essentially buying 100,000 euros and selling 100,000 Dollars. You can do this by using large amounts of leverage in your Forex trading account. For example, most brokers will allow at least 100:1 leverage when trading currency pairs. In some cases, you can get leverage as high as 500:1.

Working With Brokers

In order to be able to trade currency pairs, you will need to open an account with a Forex broker. There are many different Forex brokers for you to choose from in the marketplace. Different brokers will offer different currency pairs for you to trade. Nearly every broker should provide you with access to the major currency pairs. However, if you want to trade some of the less popular currency pairs, you will have to shop around between the brokers. Most of the larger brokers will have a wide array of currency pairs for you to choose from for your trading.

$7 Online Trading. Fast executions. Only at Scottrade