Advanced Trading Strategy

Post on: 28 Май, 2015 No Comment

Advanced Trading Strategy

Actually, there is no single trading technique which may be called the Advanced Strategy. It consists of many rules and principles, which should be flexibly adapted to the present market situation, and combined in a way which would constitute a coherent whole. Trading systems are a particular example of the Advanced Strategy. Basic techniques used to create the Advanced Strategy can be based on:

● confirming the importance of signals with the help of other analytical tools

● adopting proper trading techniques depending on the trend direction of particular degrees

● defining the probability of trend reversal (with the help of market cycles)

● specifying the scope of movement and the strength of a trend with the use of channels

● using other analytical techniques, e.g. Elliot Waves Theory

Signal confirmation

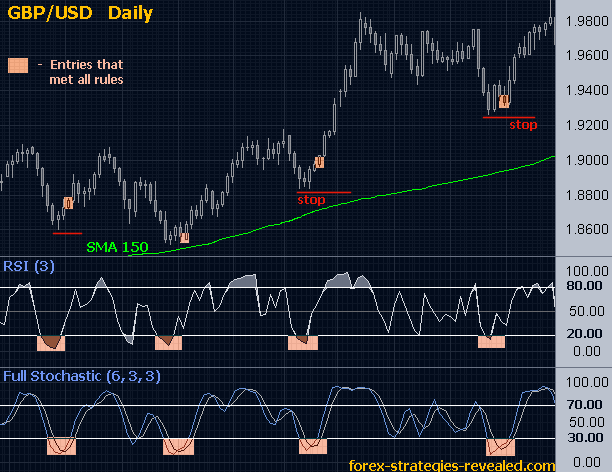

In the majority of cases, the situation on the market is not that clear as the handbooks describe it. Examples described in them show ideal situations which occur rarely in real trading. Thus, its worth obtaining additional confirmation about a signal like the price changes during a couple of sessions, favorable indicators and oscillators configuration or using other analytical techniques, e.g. candlestick charts. Although one may miss a few favorable signals or enter the market too late, in the long term, a signal confirmation decreases the number of failed transactions.

Trendfollowing countertrend Trading

The majority of analytical tools serve to trendfollowing trading. There are, however, a few techniques to trade against the trend. They are applied in specific situations, like during horizontal movements, at the end of corrections or on a strongly overbought or oversold market to take profits. Irrespective of the fact, whether we prefer trendfollowing techniques or countertrend techniques, it is crucial to adopt appropriate tools adapted to a present market situation. Unfortunately, many traders dont pay enough attention to the fact whether a given technique is adapted to a strong trend or rather horizontal movement and uses his/her favorite indicators or oscillators all the time, irrespective of the present situation on the market.

Market cycles

Cycles analysis is often associated with calculating the number of days between particular highs and lows and moving appointed distance forward. Although, thanks to this method, it is sometimes possible to foresee a future extremum, due to many cycles appearing at the same time, their different stages, width, and movement, this method is not useful in the majority of cases. If you would like to find cycles, we advice you to use oscillators. Nearly all oscillators showing an overbought and oversold, rectify the price from trend and other disturbances to facilitate finding trend reversal days. During their use, one should bear in mind that a given oscillator shows only a cycle in a given trading horizon and to asses the market more comprehensively, medium-term and long-term cycles should also be proved.

It is also worth pointing out that indicators like moving averages or MACD have a totally different task than oscillators. They rectify the price from cycles and other accidental price movements to show the present trend. Of course, in this case, it is also not enough to have a look at indicators only for a short period of time, but one should check their configuration in a medium-term and a long-term trading horizon.

Formations

Although formations are one of the most popular and most described tools of technical analysis, we would like to point out that they are in reality a set of trend lines, support and resistance. Thus, the signals they produce should be interpreted in particular as the trend line break, rising above the maximum or breaking the support. Formations shouldnt be treated as a completely separate trading technique, but only as a specific approach towards trend analysis.

It is worth stressing its prognostic element that pure trend line analysis doesnt have. Formations often help to foresee the scope of price movement or suggest a trend line change before it actually happens. Although a defined level is only a minimal price range, which can be easily broken during the next sessions, it often indicates the first correction or return movement, which, in turn, helps to adopt a proper strategy to open a position or make profits.

A specific type of formations, which may be often found on charts are called channels. At the same time, it is a formation which gives very important tips concerning both price movement scope and trend change possibilities.

Other techniques

Technical analysis is developing all the time. New promising analyzing techniques of stock exchange prices appear nearly every day. Some of them are really useful tools, which help to increase the probability of success, and some are only a marketing catch. It is important, however, to understand well every technique we use and to apply it in accordance with logic.

As a supplement to the Advanced Strategy may certainly serve the Elliott Wave Theory. intermarket analysis or combination of different time frames, i.e. multiple time frame trading. These are certainly valuable tools, however, not everybody may find all of them useful. A lot depends on the psyche of a trader. Some of them prefer a little more subjective methods, the others more automated, very simple or complicated methods. Irrespective of the fact, which methods we use, it is important not to forget our common sense and logic and not only act to make money and hope to make huge profits with the help of a magic indicator or a mysterious theory.

Summing up

It is worth mentioning at the end that the Advanced Strategy is not only based on the use of complicated, not fully understood analytical tools, but on the skilful and logical coherent connection of the basic techniques into a whole, which together comprehensively assesses the market. While using the Advanced Strategy as well as any other strategy, both right and misleading signals appear. It is important to be able to assess precisely in the majority of cases whether the loss resulted from our mistake or whether it was a result of the risk calculated within the trading on the capital market.

Trading systems are a particular example of the Advanced Strategy. Although not all of them use advanced techniques to confirm signals or indicate favorable conditions to make a transaction, a subjective factor is completely eliminated in this case. This way, only logical principles remain and if they are properly adapted, they may significantly increase the probability of success in a long- term trading horizon.

Please note: Alot of fraudulent providers will offer you advanced analysis and techniques for signing up with them. If your not familiar with how a certain technique/analysis works in the forex market then you should not use it until you are certain it is accurate.