Advanced system #1 (Midnight setup)

Post on: 17 Июль, 2015 No Comment

Submitted by Edward Revy on April 29, 2007 — 08:11.

Ready to dedicate your midnight hour to Forex trading? This strategy can be your winner.

Trading strategy setup:

Currency pair: GBP/USD or any other.

Time frame: 1 day.

Indicators: None.

Trading Rules:

This system is based on the fact that most of the time you won’t find same size candles for 2 consecutive days on a daily chart. What does this mean for us – only one thing: the price is moving steady either up or down with almost no price noise which is always present on smaller time frames.

Entry:

At 00:00 (your local time) or rather: according to the time set on your trading platform, with newly formed daily candle find highest and lowest price of the day for the previous daily bar.

If the price bar (including shadows) is less than 90 pips long we will not open new trades the next day. (This is our requirement for GBP/USD pair, it can be changed/adjusted for other currency pairs).

If the previous day bar turns out to be an Inside bar,

be cautious about entries the following day. While an Inside bar candle implies a good breakout opportunity the following day, it can also be a dual whipsaw breakout — a break in both directions — the most unwanted scenario for our trading system.

If we’ve chosen to trade the next day, set a Buy Stop order at the top of the previous day candle the highest price +5 pips, and Sell stop order at the bottom -5 pips.

Put your stop loss order for a Long entry at the lowest price of the previous day -3 pips.

Put your stop for the Short order at the top of the highest price of the previous day +3 pips.

These additional pips for entries and stops can also be adjusted once you learn the behavior of a chosen currency pair over the time.

Exit:

Now, when one of the orders is filled – stay in the trade for the whole day. At midnight with the new daily candle open, adjust your orders and stops according with the previous daily candle following the same routine; keep trading position open until you get +100 pips, then you may close current position to reward yourself. Rewarding is a very powerful tool, use it.

An alternative money management approach would suggest to enter with two trading positions, where the first one will be closed once we are +100 pips in profit, while the second one will be left to run till we get stopped out, thus allowing us to collect everything the market is willing to offer.

Close you current open positions (with either profit or loss) if a daily candle becomes a Doji candle or is almost a Doji. What we mean by almost is that for the true Doji you need open price = close price, while almost Doji can have some distance between open and close (but no more than 10 pips).

Also close your open trades if you’ve met a Shooting Star candlestick in an uptrend or a Hammer candlestick in a downtrend.

Below is an example (no screen shot) to illustrate how we navigate in time:

On May 1st at 00:05am, we opened a daily chart and it was a downtrend.

We set our orders (both Buy and Sell) according to the previous candle (April 30th). The same day our Sell order gets filled. The day has passed and the price made some further progress down. At 00:05am, May 2nd with a new daily candle appearing we change our stop loss for a current Short position according to the high of the previous bar (from May 1st), from that point we can either continue to stay in the trade or lock in profits. Also we reset our Buy order which is now going to be just above the highest high of the May 2nd candle.

This system also gives an opportunity to be constantly in a trade and at the same time it requires very little observation and takes only 5 minutes a day to set all positions and forget about Forex till the next midnight. You will see losing trades with this system from time to time – it is a part of any trading, but the overall result will be very positive.

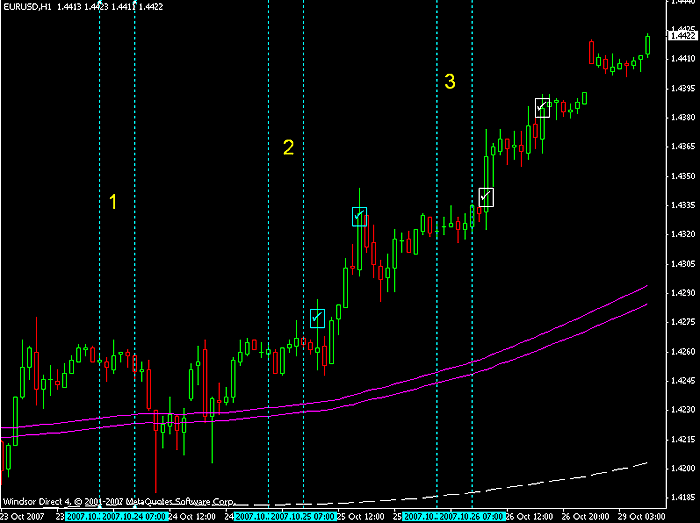

Let’s look at the screen shot now and examine our trading in greater details:

Next is a detailed candle-by-candle explanation of the trading on the chart above.

We will number candles starting form 1, so number 1 is a circled candle.

1st candle (high – low = over 90 pips) which allows entries the next day. We set entry orders.

2nd candle – the price didn’t get above or below the 1st candle, no orders filled. Midnight: the 2nd candle is over 90 pips long, we’re going to reset orders according to the 2nd candle’s high and low. The second candle is also an Inside bar, so if we decide to trade, we should keep in mind that our risks at this stage will be higher.

3rd – our buy order is filled. Midnight: day ended negatively, but didn’t trigger the stop loss, we keep our position open and adjust stop loss below the low of the 3rd candle and minus additional 3 pips. The 3rd candle is also less that 90 pips long and we wouldn’t trade the next day except that for now we have already one position running.

4th – went in profit and we rewarded ourselves closing position at the end of the day with just over 100 pips (you can actually set your target lower than that, or use 2 entry orders as suggested above).

Choosing a profit target for the day becomes easier when you know a daily range average for a particular currency pair.

For example,

GBP/USD daily range average is 180-200 pips

EUR/USD daily range average is 110-120 pips

USD/JPY daily range average is 80-90 pips

USD/CHF daily range average is 120-130 pips

Taking about a half of it can determine your daily profit targets.

Update: from now on to get data about Daily range average over the past month (20 days, excluding Saturdays and Sundays, you can use the following custom indicator for MT4: Daily_Range_Calculator.mq4 ) Attention: with 5 decimal platforms you have to disregard the 5th digit. On 4 decimal platform no adjustments needed.

5th – no trading as the price didn’t exceed previous candle boundaries. Midnight: candle #5 is less than 90 pips + it is an Inside bar, thus we are not setting any orders for the next day.

6th – we didn’t trade it and for a good reason – price managed to get below and above the previous candle’s high and low, which would have hit our stops, in worst case — twice. By the end of the day we reevaluate the charts and it is a good time to set new trades.

7th — entered Long, our stop loss was below the low of candle #6, this trade is a reward again – more than 150 pips, so we lock it in. At midnight we set new orders again.

We will have systems that will be able to easily allow trades running their positions further relatively safe, but for this one it is important to lock your profits at least partially – the reason is that we move our stop order every day.

8th – no trading opportunities. Midnight: candle #8 is less than 90 pips + an Inside bar (IB) again, means we are not going to trade the next day.

9th — no trading and we were very right about it. Midnight: #9 candle is long enough for us to set targets for the next day.

10th – no orders triggered. Midnight: #10 candle is long enough, but is again an Inside bar, it is risky to trade, looking at previous days traders are now obviously indecisive about the trend. Decide per your own risk appetite.

11th – no trading, but if we did, the day would have ended with a small profit.

12th – no orders triggered. An IB again.

13th – no trading. At midnight set new pending orders.

14th — Bought, but closed negative for the day, although the candle was bullish. We stay in a trade.

15th – we are almost at break even, but nothing to earn, we stay in a trade, stop loss below the latest daily candle.

16th – we got stopped out (not a problem, you shouldn’t be worried about such negative days), a short position is filled soon after on the same day. One day later it’ll become profitable and so on.

Happy trading!

Edward Revy,

forex-strategies-revealed.com/