Advanced MACD Strategies

Post on: 7 Август, 2015 No Comment

Build your own trading strategies by learning directly from the DailyForex team with free lessons at FX Academy.

By: Richard Cox

Once we become familiar with the trading tools that are most common in the financial markets, it is important to start thinking about the ways these tools can be used. It is not enough to simply base trading decisions off of the base indicator readings themselves, and more advanced traders have devised ways to look differently at the behavior in the MACD in constructing trade ideas. Here we will look at two of the best examples: Crossovers and Divergences.

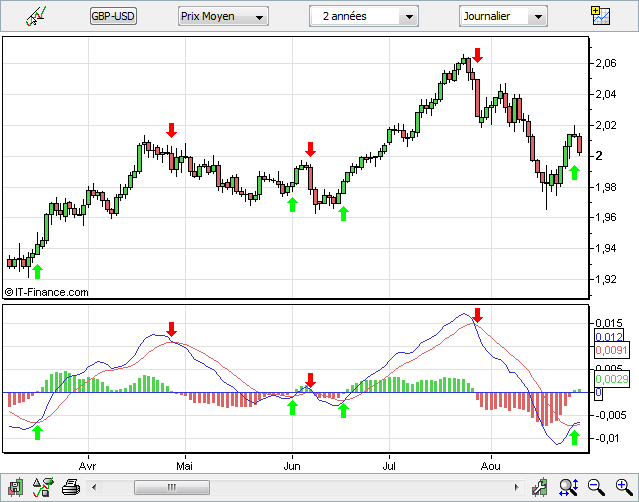

MACD Crossovers

When using the MACD, one of the first methods that traders are exposed to is seen in employing crossovers as the main generator of trading signals. In a bullish scenario, a trading signal is generated when the MACD rises above the Signal Line. This signal is telling traders that momentum is shifting in the underlying price activity and that there is an increased likelihood that the chosen currency will rise in value in the future. In the opposing scenario, when traders are looking to sell into bearish situations, those traders should be looking for the MACD to fall below the Signal Line. This tells traders that the underlying momentum in your forex pair is changing direction and is much more likely to continue in the downward direction in the future.

Traders relying on this Crossover method, said Haris Constantinou, markets analyst at TeleTrade, often prefer to wait for confirmation of the crossover below the signal line before any positions are undertaken. Confirmation can be seen when prices push above price resistance (for bullish positions) or fall below support (for bearish positions). Failing to follow these rules can result in fake outs and this can lead to traders having to absorb unnecessary stop losses.

Since traders will need to avoid fake outs of this type, (or, conversely, entering into positions too early), the MACD indicator can prove to be highly valuable for traders looking to find ways of viewing price activity in an objective way.

Trading MACD Divergences

While crossovers are perhaps the most common method for utilizing the strengths of the MACD, there are other methods as well. The next common use of the MACD indicator is to use it as a means for identifying divergences. For those unfamiliar with the term, divergences essentially refer to situations where price activity differs, or deviates from what is seen in an indicator reading. For example, if prices are making a new high while, at the same time, the indicator is failing to make a new high, a divergence is present.

When divergences are seen, the current price activity should be viewed with some skepticism because there is no confirmation, or agreement, between the price and the indicator reading. These types of situations often lead to reversals. Once we understand what is meant by the term divergence, we can take a look at bullish and bearish scenarios so that trades can be placed when signals are generated. Divergences and Crossovers offer some new ways for traders to view the traditional MACD indicator.