Adding Fibonacci Retracements into Your Forex Trading Strategy Forex Success Traders

Post on: 27 Июнь, 2015 No Comment

You began trading the forex market because you wanted to make money in one of the most lucrative markets in the world. However, to make a consistent profit trading currencies, a successful trader relies on different strategies and software to navigate the ebbs and flows of the foreign currency exchange. Here, we’ll focus on Fibonacci trading strategies, named after Italian mathematician Leonardo Fibonacci. Fibonacci retracements help traders identify how far the foreign currency rate will go before it begins stalling or falling.

Before I continue, lets go over the very basics that’ll help you incorporate the Fibonacci strategy into your own forex strategies. Fibonacci numbers are easy to identify because they’re a series of numbers when you add the first and second number, the answer will be the third number. So on. For example, you add 1 and 2 to get 3. 2 and 3 to get a total of 5. See if you can continue the sequence a few more digits.

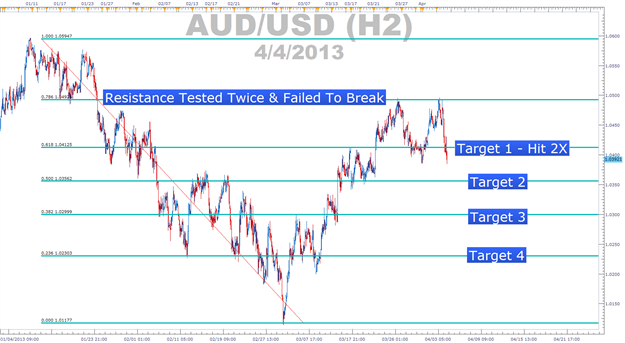

You should’ve gotten. 1, 2, 3, 5, 8, 13, 21, 34, 55. Great. What does this have to do with forex strategies and trading foreign currency? Well, these numbers will help you develop forex techniques that anticipate and take advantage when a particular currency changes trends. Common knowledge among currency traders is that stocks and currencies often retrace a certain percentage of the previous move, usually 38.2%, 50%. 61.8%, before it reverses. Your job as a trader is to watch these retracements and pull backs before determining if you want to open a long or short position.

Regardless of what trading strategy you utilise, Fibonacci retracements can help you identify trends. Act accordingly on them. When the foreign exchange rate begins to fall. Decrease in value, you can plot the levels on a chart (most automated forex software has a Fibonacci setting) and search for any signs that your stock is about to reverse.

As useful as Fibonacci retracements are, you shouldnt rely on them as your only source for technical analysis. Dont buy simply because the stock is at one of the common retracement levels. Wait for another indicator to confirm what the Fibonacci patterns are telling you. Keep in mind that the task of plotting the Fibonacci patterns will be left up to each trader. That most automated forex software does provide you assistance.

Incorporating a Fibonacci retracement pattern into any of your existing currency trading strategy is simple, just make sure you plot the lines and follow the information they’re providing you. By adding Fibonacci patterns to your existing trading techniques, you can increase your accuracy for a near perfect graphical representation of how a particular currency is doing on the foreign exchange market.

The easiest way to get acquainted with Fibonacci retracements is to sign into your favourite forex trading website. Practice plotting retracement points. At first this pattern seems difficult. After just a few moments most forex traders find themselves comfortably trading foreign currency using Fibonacci numbers.