Adaptive Forex Trend Trading Strategy Using Pivot PointsForex Strategy Tester

Post on: 23 Октябрь, 2015 No Comment

In any market, including Forex, trend trading is potentially the most profitable. However, to get decent profits, you need to catch a trend early enough. Which is not easy, but doable, because Forex trends usually last quite long.

What is considerably more difficult is to have enough self-control and not to leave the markets too early. Market doesnt move in a straight line and its impossible to predict where the market tops or bottoms.

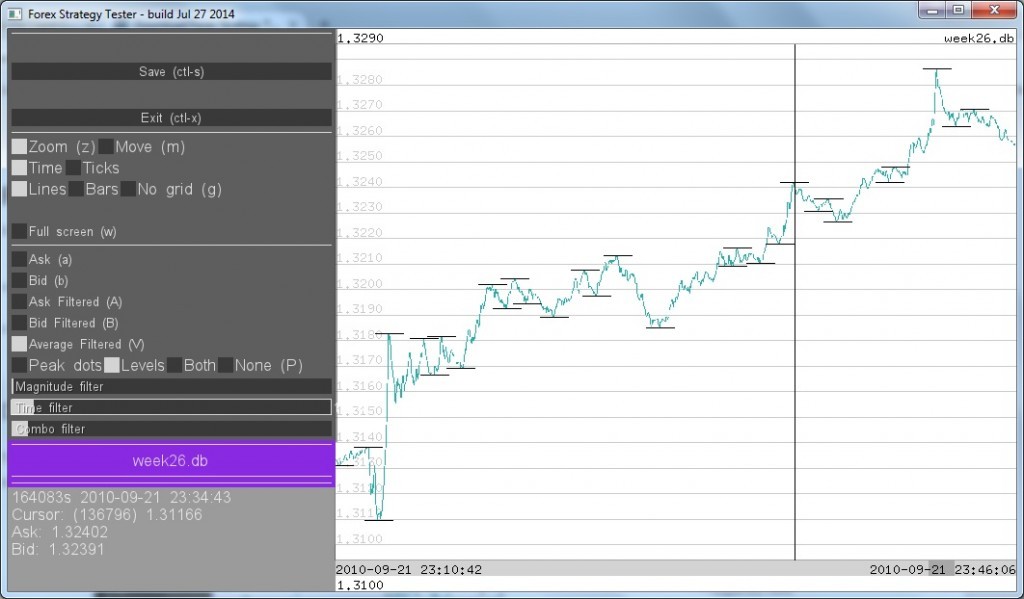

In hindsight, spotting a trend is an easiest task. This one a clear trend, right? From the bottom A to the top C market advanced almost 200 pips! And along the way, the rise from A to B looks even more obvious. It appears easy to get in somewhere in between and still have enough profit potential.

On Forex Trend Trading Strategy Development Big Picture

But lets take a closer look. The next picture shows the closeup between A and B that covers about 2 hours of trading .

On Forex Trend Trading Strategy Development closeup

You can see that A-B that seemed an obvious trend on an averaged graph, now looks completely differently. And when you follow the market in real-time, the picture will be much more uncertain. And this is exactly the timeframe where decisions have to be made.

You got the idea. Suppose, you are extremely lucky and entered a trade at the bottom A. Will you still dare to stay in the market at C? or D? And in the big picture, A-C or A-D are only a small fractions of the whole trend.

So what trend trading strategy should we use? Which works better: wait for the ultimate top or bottom and lose profit or fix profit on reaching a certain level only to watch how market continues to advance in the same direction? How to address this dilemma?

Forex Trend Trading Strategies Need Adaptive Algorithms

In our opinion, a good Forex trend strategy must be adaptive. And it needs reliable and fast signals about local tops and bottoms. We are developing our trend following strategy based on signals from our pivot point detection algorithm and our real-time trend indicator .

The main idea is to try to enter market on very early signs of emerging trend not to be late. This is impossible to predict, as any trend indicator wont give any signal so early. So we need to do it by trial and error. And tune itself on the market as trend develops.

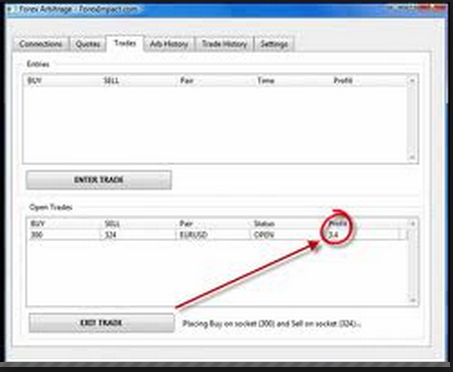

Here is where our pivot point analyzer comes very handy. It can nail a top or bottom very accurately and in real time. This is important as it gives us a chance to win some pips on the counter-trend movenens even if we didnt guess the bigger trend direction.

And this buffer allows us to take more risk. Suppose we decided to call a market top at the peak to the left of D. And opened a short position to trade a possible market reversal. We have in this case enough potential not to lose when the market eventually ends its correction in the point D. And we can use the same approach and enter the market at D againg, but now in the opposite direction.

Another level of adaptation is the pivot point detection algorithm itself. We can use the market direction information for more reliable pivot points detection. The idea is to introduce asymmetry in the peak analysis process.

So, e.g. for an ascending trend, we need to raise the detection threshlold before picking a possible top candidate, because the chances are higher that the market will continue higher. At the same time, we need to lower the threshold for bottom candidates.

Adaptation is also needed to adjust the thresholds depending on the nature of the trend: the steeper it is the bigger changes are needed in the threshold values compared to the default values that work in flat market conditions.

Stay tuned on the implementation of this trend trading strategy. We advise you to subscribe and not to miss important updates of the software and strategies.