ActTrader enterpriseFX platforms Trade Forex Future CFDs Equity CFDs Currency Options ETFs and

Post on: 13 Апрель, 2015 No Comment

ActForex is now providing its clients with an integrated Mirror Trader tab within the ActTrader platform, making registering for, and using of, a Mirror Trader account easy and convenient.

June 20, 2014 Tradency, a global technology company and the originator of the Mirror Trader trading concept & services and ActForex, a leading independent provider of cutting-edge trading technology solutions, are strengthening their cooperation by adding an integrated Mirror Trader option within the ActTrader platform. The cooperation between these companies results in a more convenient solution for ActTrader and Mirror Trader users alike.

The new functionality includes an integrated front end, seamless account creation and login. Mirror Trader is now available via a tab in ActTrader that allows users to trade and monitor their accounts from within either front end. Any trades placed through Mirror Trader are immediately reflected in ActTrader. In addition, ActTrader users can sign up for a Mirror Trader account directly within the ActTrader platform. The Mirror Trader account is created with a single click without having to re-enter any information that the trader had already submitted during registration for the ActTrader account. The trader is automatically logged into Mirror Trader when logging into ActTrader, eliminating the need to re-enter the login and password.

Mirror Trader has been popular with ActTrader users for several years. Ilya Sorokin, CEO of ActForex: We are committed to providing the best trading tools to our clients and their traders, this functionality provides a lot of real-world value since traders benefit by having the markets best integrated features and trading technology available, while brokers enjoy the obvious benefit of having improved account trading activity.

About Tradency

Tradency Inc. is the developer and originator of Mirror Trading technology, which enables FOREX traders to use the knowledge of experienced traders in real time for their own trading techniques. Tradencys Mirror Trading Platform offers traders a flexible choice of combining its groundbreaking approach with traditional online trading methods. Since its inception in 2005, Tradency has pioneered this new method, creating a new category of platform trading. Tradency continues to innovate its services, reinforcing its reputation as the creator of cutting-edge industry practice. www.tradency.com

About ActTrader

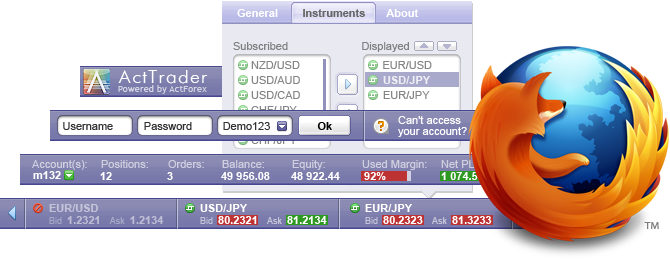

ActTrader is a widely used independent multi-instrument trading platform. ActTrader is equally well suited for novices, professional traders, and money managers. Traders can create their own strategies without writing a single line of code, or use over 200 popular strategies which come with the platform. With applications for desktop, web, iPhone, iPad, Android and mobile phones, it is possible to trade anywhere, any time. ActTrader is employed by a multitude of Forex Market Makers, Introducing Brokers, Money Managers and other financial institutions worldwide since 2000. For more information, please visit www.acttrader.com

New York USA, October 1, 2013 – ActForex, Inc. the leading provider of independent retail trading platforms is pleased to announce a partnership with LMAX Exchange, the first FCA regulated MTF for FX trading.

Access to LMAX Exchange is now integrated into ActForex’s advanced retail trading platform, ActTrader. Through the ActTrader platform, LMAX Exchange delivers exchange quality execution in over 60 FX pairs with an average matching speed of 4ms and no ‘last look’ as standard – ensuring FX execution with optimal precision.

ActTrader, with integrated LMAX Exchange access, is a complete scalable and fully hosted trading solution for FX Brokers delivering:

- User Friendly customizable multilingual interface

- Traditional Algorithmic trading with MT4 Converter

- Visual Algorithmic Trading (VAT), requiring no programming skills

- Extensive API for third party integration

- Complete back office with over 50 real time and historical reports

- Fully integrated Risk Management system

- Native iPhone, iPad, and Android applications

- Built-in FXApps store with over 220 ready-to-use strategies, indicators & apps

Jeremy Barnes, Head of Institutional Relationships at LMAX Exchange commented, “The ActTrader cutting-edge trading platform powered by LMAX Exchange liquidity and trade execution capabilities, will prove a formidable combination for brokers seeking a premium trading experience for their clients.”

“By completing integration with LMAX Exchange, ActForex is able to offer its customers access to open order-book with firm liquidity and exchange-quality low latency execution, meeting the most demanding execution requirements of modern high performance trading” stated ActForex CEO, Ilya Sorokin.

The platform technology of ActTrader with access to the award winning LMAX Exchange will significantly enhance the user experience of FX Brokers and their clients.

- ENDS -

Notes to Editors

About ActForex Inc:

ActForex, Inc. is a leading independent provider of cutting-edge trading technology solutions for a multitude of FCMs, Forex Brokers, Broker/Dealers, Introducing Brokers, Money Managers and financial institutions worldwide since 2000. To find out more about ActTrader please visit www.actforex.com

About LMAX Exchange:

The award-winning LMAX Exchange is the first FCA authorised and regulated MTF for FX. Servicing brokers, funds, corporates, asset managers and banks, LMAX Exchange delivers a unique vision for global FX trading — a transparent, neutral, level playing field for all market participants, regardless of status, size or activity levels.

The LMAX Exchange OPEN order book is driven by streaming, non ‘last look’ limit orders supplied by General Member liquidity providers. LMAX Exchange offers markets in 62 FX pairs, spot Gold and Silver, with complete pre and post-trade transparency and order execution where no ‘last look’ is standard. Orders are executed in strict price/time priority at an average speed of 4ms.

FX Industry awards:

2013 Ranked #15 Fastest Growing Tech Company in the UK — Sunday Times Tech Track

2013 Best Margin Sector Platform — Profit & Loss Readers’ Choice Awards

2013 Best FX Trading Platform — ECN/MTF — WSL Institutional Trading Awards

LMAX Limited operates a multilateral trading facility (MTF). Authorised and regulated by the Financial Conduct Authority, FCA Registered no. 509778.