Accumulative Swing Index (ASI)_1

Post on: 1 Апрель, 2015 No Comment

Quick Summary

Trading with ASI indicator involves the following details:

ASI has positive value — uptrend.

ASI has negative value — downtrend.

ASI trend line breakout — validates a breakout on the price chart.

Details

What is Accumulative Swing Index

Welles Wilder, the creator of ASI indicator said, Somewhere amidst the maze of Open, High, Low and Close prices is a phantom line that is the real market. The Accumulation Swing Index shows this phantom line the line of the real market.

The Accumulative Swing Index uses a scale from 0 to 100 for an up trend and 0 to -100 for a down trend.

How to interpret ASI indicator

If a long-term trend is up, the ASI has a positive value; and if long-term trend is down indicator appears in a negative value. During sideways moving market, the ASI moves between + and values.

Accumulative Swing Index is widely used to confirm or deny trend lines breakouts on Forex charts.

Trend lines are drawn on both: a chart and indicator’s graph and then compared against each other to confirm/dismiss trend line breakout signals.

How to trade with Accumulative Swing Index

Welles Wilder, developer of Accumulative Swing Index indicator, describes in his book New Concepts in Technical Trading Systems why ASI can be used for trend line breakout confirmations. He said, that ASI is able to show the real strength and direction of the market and since Accumulative Swing Index is heavily weighted in favor of the close price, daily upward and downward spikes do not adversely affect ASI.

Here is a quote from his book:

When the Index is plotted on the same chart as the daily bar chart, trend lines drawn on the ASI can be compared to trend lines drawn on the bar chart. For those who know how to draw meaningful trend lines, the ASI can be a good tool to confirm trend-line breakouts. Often erroneous breaking of trend lines drawn on bar charts will not be confirmed by the trend lines drawn on the ASI. Since the ASI is heavily weighted in favor of the close price, a quick run up or down during a days trading does not adversely affect the index.

Signal Buy with ASI occurs when indicator exceeds its previous Swing High.

Signal Sell occurs when ASI dips below its previous Swing Low.

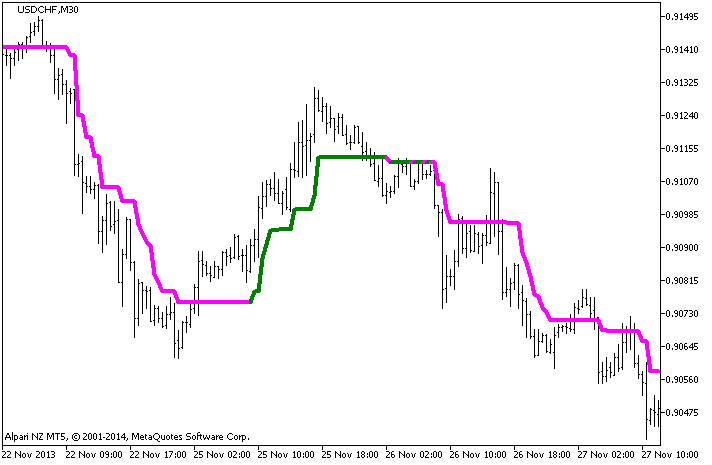

Accumulative Swing Index chart example

Since ASI line represents real market price, Forex traders may effectively use classic technical analysis methods on the indicator itself:

identify support/resistance levels,