Accounting change won t save banking

Post on: 16 Март, 2015 No Comment

Accounting change wont save banking

By all means reform accounting, but for pitys sake take your time and keep your expectations low.

Suspending mark-to-market accounting immediately as a means of levitating banks out of peril simply wont work. While transparency may or may not be the foundation of banking, trust undoubtedly is.

Adjusting or suspending fair value accounting, even if you swear up and down that this time its even more fair will erode rather than build trust and repel rather than attract capital.

The House Financial Services Subcommittee on Capital Markets, Insurance, and Government Sponsored Enterprises, led by Congressman Paul Kanjorski of Pennsylvania today is holding a hearing on mark-to-market and already the industry knives are out.

A group of 31 industry groups and financial institutions, including the American Bankers Association, Mortgage Bankers Association and U.S. Chamber of Commerce, have petitioned the committee to take immediate action to stop the spiral of accounting-driven financial losses, according to the Los Angeles Times .

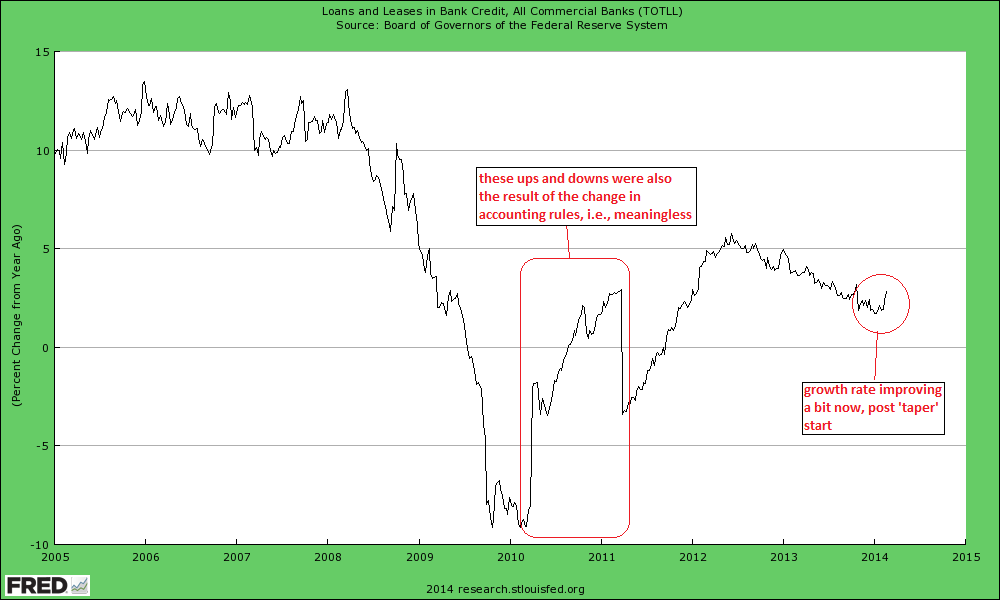

They argue that current rules, which force banks to carry some securities on their books at levels that reflect current market prices, mean they have to recognize losses that do not have a basis in economic reality.

Thats as may be, but so far market prices have arguably been a better directional indicator of the future performance of collateral than some hopeful internally generated marks. Is mark-to-market perfect? No. Might reform, in the fullness of time, adjust some of its pro-cyclical effects? Yes. Will doing that in the midst of a crisis have the desired effect? No.

This whole effort fundamentally misunderstands the situation facing banking.

The problem facing the banking industry is not just solvency on some accounting or regulatory basis, it is solvency on, for want of a better phrase, a solvency basis. Thus banks are unwilling to do business with one another and investors unwilling to lend banks money or invest in them. They do not reliably know who is bust and who is not.

Some may possibly be tarred unfairly by mark-to-market, but allowing everyone to step back from market discipline will make investors less willing to commit capital to banks and banks less willing to do business with one another.

Regulators and accountants may turn a blind eye, but given the current set of economic circumstances people with money on the line wont find internally generated prices for assets more inspiring of confidence than market derived ones. Quite the opposite.

– At the time of publication James Saft did not own any direct investments in securities mentioned in this article. He may be an owner indirectly as an investor in a fund –