A Forex System For H4 Timeframe!

Post on: 7 Август, 2015 No Comment

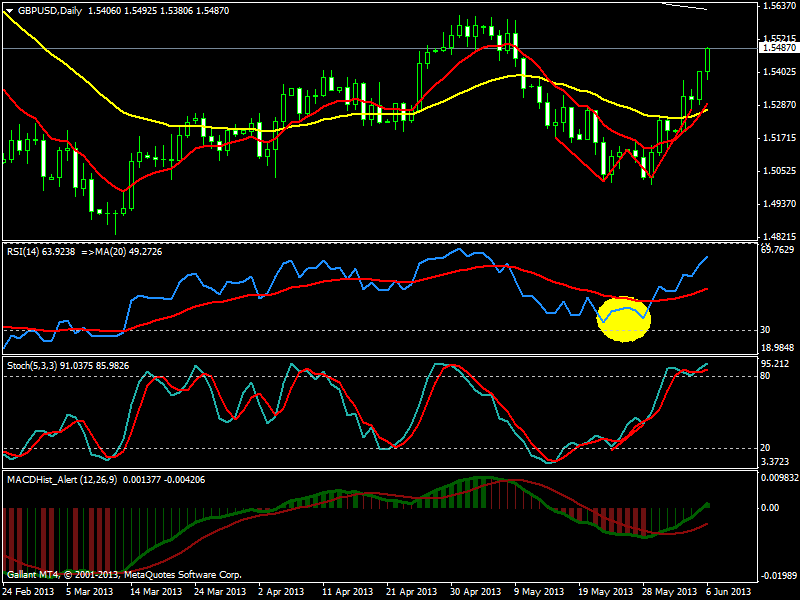

April 1 2013

In this post, I will discuss my personal trading system that I use to trade on the H4 timeframe. I am a scalper plus a swing trader. I use divergence extensively both for scalping as well as swing trading. When I am scalping, I trade on M15 timeframe and when I am swing trading I trade on the H4 timeframe. So I basically trade divergences. My system is the same for scalping as well as swing trading. In a future post, I will discuss my scalping system in detail as well. Divergence develops when the price action and the indicator move in the opposite direction. The best indicators for finding divergences are MACD, Stochastic and RSI. I use all 3 of them. Lets take a look at the following screenshot!

As you can see a nice bearish divergence pattern is developing on the MACD, Stochastic and the RSI. The date is 31st December 2012. Bearish divergence pattern means the price is about to fall. After spotting the divergence pattern, I need to confirm that this is a valid signal. I draw a minor trendline and wait for its break whenever I want to confirm a divergence pattern. The screenshot below shows how I draw the minor trendline.

The minor trendline was broken on M30 much earlier as compared to H4. If I had used the H4 timeframe, the entry price would have been at 1.6305 while the stop loss would have been at 1.6385. So my risk would have been 80 pips if I had entered using the H4 timeframe. Once I spot the divergence pattern on the higher timeframe, I move to a lower timeframe so that I can find a better entry with a lower stop loss. After spotting the divergence pattern on the H4 timeframe, I moved to the M30 timeframe and drew the trendline as shown in the following screenshot.

Only the Stochastic is showing a bearish divergence on M30 but since H4 is showing bearish divergence on MACD, Stochastic and the RSI, it is a much stronger signal for us. The minor trendline was broken on the M30 much earlier as compared to on the H4 timeframe. I got into a short trade at 1.6335 using the M30 chart. My stop loss was at 1.6385. So my risk is 50 pips instead of 80 pips. I have been able to reduce the risk by 30 pips. This illustrates the importance of using a multi timeframe approach. A move on the H4 timeframe easily makes 100-300 pips. So my reward to risk ratio is 2:1. I am expecting to make at least 100 pips. I will continue in the trade as long as there is no bullish divergence on H4. I will check the chart 2-3 times daily and see whether any bullish divergence is forming or not. On 9th Bullish Divergence appears on H4 timeframe.

Now keep this in mind that the market doesnt change direction all of a sudden. Take a look at the following screenshot that shows the bullish diverence on H4 and the minor trendline that I have drawn. Price has made a low at 1.5997. When I spotted the bullish divergence, I opened the M30 chart and drew a minor trendline as shown below. I closed the short trade at 1.6010 and made a total of 325 pips in 10 days.

Once I spotted divergence on H4 timeframe, I moved to the M30 timeframe to find a better entry.MACD and RSI are showing bullish divergence while Stochastic is not showing it. But since on H4 timeframe, all three are showing bullish divergence we have a much stronger signal. After closing the short trade, I immediately opened a long trade at 1.6010. As you can see from the above screenshot market moved up to 1.6179 in 1 day. So I made another 160 pips with this long trade. I made a total of 485 pips in 12 days.

In the beginning, I had a problem in finding the proper entry when I spotted a divergence pattern. But as I have explained above, drawing a minor trendline solved this problem for me nicely. The advantage of trading on the H4 timeframe is that you dont need to monitor the charts much as compared to scalping. If you are scalping, you have to constantly monitor the charts. So I would advice that you should start by trading on the H4 timeframe. It is much much easier as compared to scalping. As you have seen, I only use standard oscillators MACD, Stochastic and RSI and use trendlines a lot. Thats all I do! I dont need any fancy software to tell me where the market wants to go. You must have also seen moving averages in the screenshots above. Once a trend develops, moving averages tell you a lot about the strength of the trend. When the moving averages are fanning apart, it means the trend is going strong and when they try to come closer, it means the trend is getting weak.

Now, it is always a good idea to learn from others. The best traders are those who have taken part in a trading competition and won that. You must have heard about the Surefire Trading Challenge. If not then you must read the story of how a 20 year old college student from Vermont USA was able to beat thousands of traders in one of the biggest live online trading competition in the world . Taking a look at his system and the systems of other winners of this big online forex competition will teach you a lot. You will be surprised to find the most of them are ordinary part time traders who were able to develop their system by reading the free material on the internet.

Another good service that can help you a lot in case you want to master how to trade on the H4 timeframe is the Forex Mentor PRO Service run by two professional forex traders Dean Saunders and Marc Walton .

Incase you are not clear about divergence, then you should read these 2 PDFs that explain in depth candlesticks, moving averages and divergences .

Ultimate Swing Trading

Download Insider Secrets of Successful Traders Report FREE That Has Been Downloaded 37,000+ Times!