A Forex Strategy Using Elliott Wave Indicators

Post on: 12 Май, 2015 No Comment

Learn this powerful Fibonacci Retracement method FREE that pulls 500+ pips per trade. Download this 1 Minute Forex Trading System FREE. Get one week FREE Forex Training from Bob Iaccino who was a Chicago Truck Driver and now he is one of the famous forex traders in the world who regularly appears on CNBC, FOX Business, Bloomberg, CNN Money etc. He is the master of manual trading. Elliott Waves were first discovered by R.N Elliott in the 1930s. What he found was the markets follow a certain wave pattern over the long term as well as on the short term that is repeated over and over again. This wave pattern is now considered to be a universal law of the markets and is named as Elliott Waves.

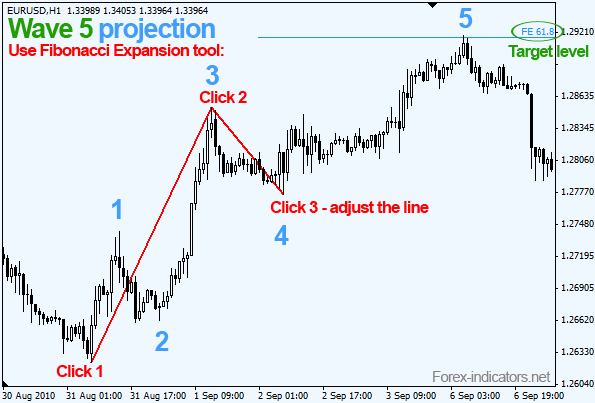

Price action can be divided into tends and corrections or sideways movements. Elliott Waves Theory stipulates that markets move in repetitive patterns. There is always a five wave advance ( impulse waves) and a three wave decline (corrective waves). Waves 1, 3 and 5 are the impulse waves, wave 3 being the longest. Waves 2 and 4 are the corrective waves. These impulse waves are the trends in the market and the corrective waves are the sideway movements in the market.

This Elliott Wave pattern can be seen on all timeframes from intraday to longer term like monthly to what R.N Elliott called the Grand Supercycle of 200 years. Each wave in a cycle can be further divided into smaller cycles.

Now in this simple forex trading strategy we will combine the above basic knowledge about Elliott Waves with three Elliott Wave Indicators. Combining these principles with Elliott Wave Indicators gives you a powerful and a unique trading method that can be highly profitable yet easy to master.

On most of the charting software, you will find these three Elliott Wave Indicators as part of the advanced package. These three Elliott Wave indicators are:

1. Elliott Wave Trend (ET)

2. Elliott Wave Number (EN)

3. Elliott Wave Oscillator (EWO)

These are the rules for going long with these three indicators: EN should be 3 or 5. ET should be 0 or 1 and EWO should be a positive number. These three things must happen simultaneously. When you find the three indicators lined up together, you should look for an opportunity to go long immediately. When EWO becomes negative immediately close your position. EWO below zero means price action is about to retrace itself.

And these are the rules for going short: EN should be 4. ET should be 0 or -1 and EWO should be a negative number. These three things must happen at the same time. Exit your position when EWO becomes positive.

You can practice this Elliott Wave Indicator Strategy on any timeframe from 5 minutes and higher. Always have a stop loss in place and confirm the trend with at least three candlesticks making consecutive higher lows. Once, your position become profitable, you can use a trailing stop or keep on moving your stop higher whatever suits you. You can also use this strategy with stocks.

%img src=http://media.avapartner.com/banners/p369485172.gif?tag=33247&tag2=

banner_6673 /%

Popular post queries: elliott wave indicator, ewo indicator, Elliott Waves Pro, Elliott Waves Pro MetaTrader 4 Indicator, elliott waves pro indicator,