A complete guide to simplifying your Forex trading by Nial Fuller » Learn To Trade

Post on: 13 Апрель, 2015 No Comment

A Complete Guide to Simplifying Your Forex Trading by Nial Fuller

My students’ number one issue is that they over-analyze and think too deeply about the markets. As a result of this over-analysis they are on the wrong track; many are still trying to trade with messy lagging indicator based trading systems or inflexible Forex trading “robot” systems. It is very common for beginning or even seasoned traders to be emotional wrecks; stressed and panicky like an out-of-control gambler with no plan. Today’s lesson will guide you in shifting your trading strategy and your trading psychology from complicated to simple.

Note From Nial Do me a favor, and please click on the social icons below to share this on twitter & like it on facebook. When your done reading, please leave a comment below.

Changing your beliefs about Forex trading

Step 1 – Understanding why you’re losing money

The first thing you need to do in order to change the way you trade is to change your beliefs about trading. If you are losing money consistently, it’s probably safe to say that you are thinking about the market all wrong and that you need to totally change your beliefs about what Forex trading success is all about and how to achieve it.

There really are only two reasons why people lose money in the markets: over-trading and over-leveraging (risking too much). The reason you are losing money in the markets is because your beliefs are not in-line with reality. Trader’s who over-trade and over-leverage their trading accounts, are simply trying to control the markets, whether they are aware of it or not. Unfortunately for these traders, the reality of Forex trading is that YOU SIMPLY CANNOT CONTROL THE MARKET, the only variable you can control is yourself, that’s it. So, it goes to reason that if you want to make money in Forex you have to learn how to control yourself, because I promise you that no one else is going to be able to control your actions in the market; not me or any other Forex educator, you are the only one in charge.

Right now I want you to stop reading this lesson for a minute, go take a look at your trading account history for the last month or two, take a good long look at it, and decide for yourself whether it reflects the habits of a successful price action Forex trader. Did you do it? If not, you need to before reading on.

I’m willing to bet that if you are one of the masses of losing traders, you saw a lot of trades in your trading account history and you probably also saw inconsistent risk amounts between trades. These are the hallmarks of inconsistent traders who over-trade and over-leverage. Your trading account history should reflect a calm and confident trading mindset rather than that of an erratic gambler; you need to make sure that every trade you take is one you would feel confident explaining to me based off the concepts in my trading course.

You should be proud of your trading track record, and meticulously maintaining your Forex trading journal should be something you are passionate about. If you get a good enough track record over a period of three months or more you can find people to fund you, so don’t worry about not having a lot of money right now. I promise you that if you focus on mastering your trading strategy, and not on making tons of money right away, the money will eventually follow.

Step 2 – Accepting your new beliefs and moving forward

Next, you need to accept that you are trading too much and risking too much. You really need to put your ego aside for a minute and accept the reality of the situation if you want to grow and progress as a trader. If you do not accept your trading flaws you will certainly continue to repeat them until you do. Once you accept that you need to stop over-analyzing the markets, trading so much, and risking too much, you can make a plan of action to help get yourself on track. Now that you’ve accepted the reality of why you are losing money in the markets (you have accepted it right?), you need to take some time off from real-money trading and go back to the drawing board.

Changing the way you trade

Step 3 – Less is more

The first thing you need to do if you want to align your new simplified trading mindset with the reality of the markets is throw out all the junk Forex indicators or software trading robots that you are using and go back to the basics; plain vanilla price chart trading. You can click the previous link to learn why indicators are a waste of time; I’ve discussed this a lot so I won’t get into it much here except to say that if you want to truly simplify your trading you need to learn how to trade off of pure price action. At the very least you need to know how to read price dynamics and trade based off of them, even if you don’t make price action your primary trading strategy. All successful Forex traders have a solid understanding of price action and how to trade it, it’s a very effective stand-alone trading strategy and will only make any other strategy or system you may use in the future that much more effective.

Step 4 – Mastering simple trading strategies

After accepting that you need to learn how to trade based off simple price action strategies. you need to take the time and make the commitment to truly master them. I find that some of my students take my course and join my community and then don’t really follow-through with the education they have purchased. No one is going to learn how to trade for you. You have to put in time and make a solid effort if you really want to be a Forex trader; there is just no way around it. So, forget about getting rich quick by some “magic bullet” trading system you stumbled across on your Google search for automatic forex trading robots; I promise you that trading takes time and energy and you have to actually learn how to read the charts, there is no such thing as just downloading some software and pressing buttons to make tons of money.

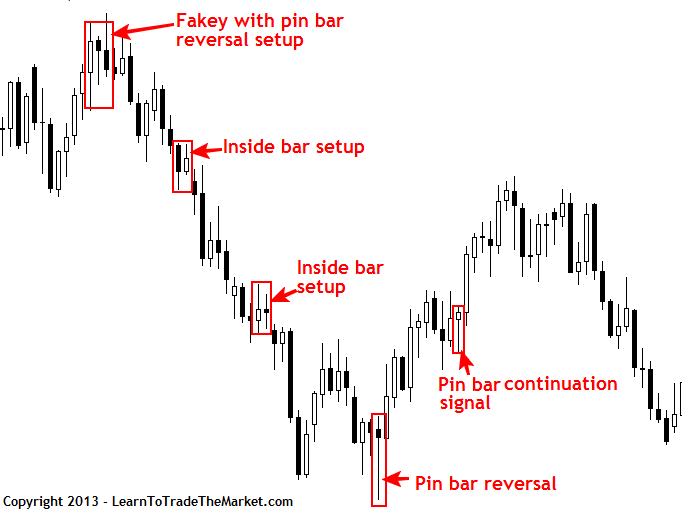

While it is very true that successful Forex trading takes time and effort to achieve, the actual process of trading is really not that hard. Actually understanding and learning simple trading strategies like price action is really not a technically difficult thing to do and you don’t need to be smart to be a trader. What you do need is a trading strategy that is simple and effective and that actually teaches you something. For me, this strategy is and has always been price action. I too was a struggling trader early on in my career, but once I discovered the power and simplicity of trading off simple price action based setups, I never looked at any other indicator or trading software again. I cannot understand why anyone who has been exposed to price action trading would ever trade any other way, it simply doesn’t make any sense, it’s like trying to drive a car blindfolded; basically making something that’s relatively simple in nature much more complicated than it ever needs to be.

The best way to change your trading strategy from complicated to simple is to master one trading strategy at a time. I teach a number of simple price action trading strategies that you can focus in on and learn one at a time. You should really dedicate yourself to learning all the nuances of one price action setup at a time on the daily charts, once you do this and are making money consistently on a demo account you can then move on to the next price action setup. You need to be structured and methodical in all aspects of your Forex trading, otherwise you will end up over-complicating everything again. To learn more about simple price action trading setups and becoming a simple but effective Forex trader, check out my price action Forex trading course .