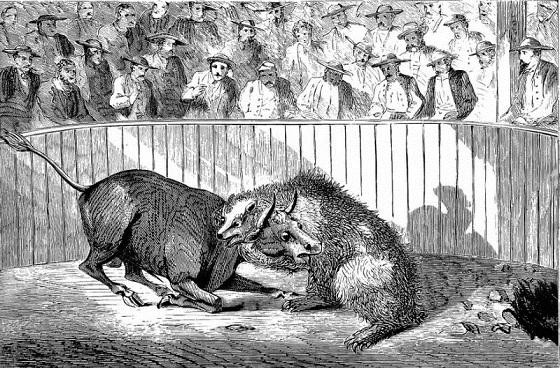

A Brief History of Bear Markets (^DJI ^GSPC)

Post on: 16 Март, 2015 No Comment

Sources: Yahoo! Finance, author’s calculations, and numerous history-laden websites.

*Assumes multiple bear rallies but no official recovery until post-1942.

**By percentage drop. Assumes three separate recessions in late 1930’s.

Be smarter than the average bear

We’re now in the fifth month of our current bear market, and there’s no telling where it will go from here. With the European default crisis unresolved, a shaky American economy. and political gridlock at home and abroad, our current problems bear similarities to several different declines. History might not repeat itself, but it often rhymes, and our present Ode to Bears looks like a mishmash of 1938 (the short one), 1966, and 1990, with a few words clipped from 2007.

My colleague Morgan Housel looked at the cyclically adjusted P/E ratio in August and found it trending very close to its postwar average. Prices are more reasonable by this measure than they’ve been at any point in the last decade, except during the last downturn — which should signal opportunity for savvy investors.

Swipe that pic-a-nic basket

You can find those opportunities even deep in a bear cave. I looked back at 2008 to find a handful of high-flyers that avoided the subprime freefall. You shouldn’t be surprised by what made it:

- Family Dollar ( NYSE: FDO ) was up 23% in 2008. The discount retailer offers budget-conscious consumers a safe haven, and that’s bound to be important if belt-tightening continues.

- Amgen ( Nasdaq: AMGN ) rode the 2008 bear to a healthy 25% gain. It’s flat this year, but that beats a 20% loss, and the company’s still very healthy, sporting a P/E of 11.3 and a recently instituted 2% dividend.

- Walmart ( NYSE: WMT ) joined its bargain brethren (that’s Family Dollar) on the 2008 outperformance list with a 16% gain. Little has changed since then, and the company isn’t going to roll back into unprofitability in the foreseeable future.

- One of the best 2008 performances came from UST. which was acquired by Altria ( NYSE: MO ) that year. UST’s new parent may be 2011’s top stock, as it’s up 8% this year and has beaten the Dow by 57% over the last five years — and that’s before dividends!

They’re more afraid of you than you are of them

If you’re still nervous about the coming storm, there’s a video you really need to watch before the real crash comes. It’s got the information you need to protect your investments, and it’s absolutely free .

Fool contributor Alex Planes holds no financial stake in any company mentioned here. Follow him on Google+ — he promises not to link to any LOLcats. The Motley Fool owns shares of Wal-Mart Stores, International Business Machines, and Altria Group. Motley Fool newsletter services have recommended buying shares of and creating a diagonal call position in Wal-Mart Stores. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .