5 Steps to Become a Successful Forex Trader

Post on: 18 Май, 2015 No Comment

By John | Published: June 18, 2012

As with all forms of financial trading, forex trading—the buying and selling of currency pairs based on the exploitation of changes in price, or of the spreads between currencies—is associated with the assumption of certain risks. The distinction between a successful trader and one who only experiences marginal success, if any, lies in how the trader prepares for the risks associated with forex trading, and how they manage their risk as they engage in their trades. While much of risk mitigation lies in the fundamental methodology used by individual retail traders, regardless of the methodology utilized, taking the following steps is de rigueur for establishing a pattern of success in trading forex:

1. Prepare: do not attempt to “get your feet wet” in forex trading by simply “jumping in”, even if you have substantial experience in other kinds of trading; the analytical skills and technical tools needed to trade successfully are simply too different. Instead, research the specific nuances of the forex markets to become familiar with their patterns. Decide which currency pairs you are the most comfortable with, or whose movements you find the most understandable. Decide when you are most likely to be trading, since by definition the forex markets never close. Sign up for a free online demo account with one of the many forex brokers so that you can begin developing your skills, familiarizing yourself with the markets and learning which trading patterns best suit your personality as you play with the different parameters. Do not stake any real money until you have the confidence that comes from knowing that you are fully prepared.

2. Pick Your Strategy. are you more comfortable trading in the short-term, “scalping” smaller profits and losses from quick flips, or do you prefer to take a medium or long-term position, riding out trends? Are you financially capable of handling the increased capital requirements associated with the execution of leveraged short-term trades? If so, do you have the time to devote to managing an on-going series of short-term buys and sells in order to turn a profit? Are you risk-averse, or risk-friendly? How much profit per “pip” (the smallest price increment in forex trading) would you hope to achieve? Make clear microeconomic decisions which, when combined, will comprise the macroeconomic outline of how you will trade forex.

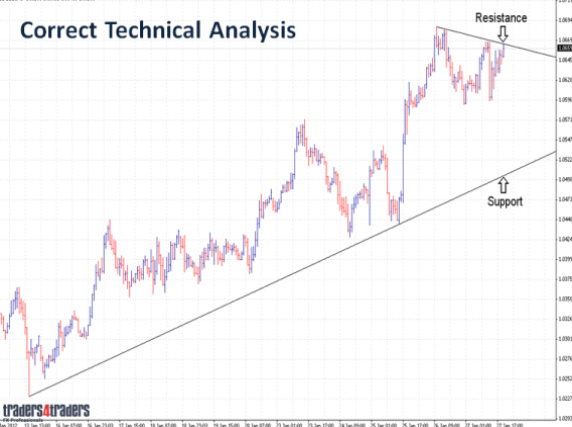

3. Pick Your Methodology: by picking your methodology, you are defining how you will implement your strategy. Which of the various tools and indicators generally available to you will you rely on the most? Which are the easiest for you to understand, or have the most direct relevance to your chosen currency pair(s) and your chosen time frame? At what price level or pip spread will you identify your stop loss and take profit points? Your strategy is meaningless if you have not decided upon the methodology through which it will be implemented.

4. Enforce Self- Discipline: do not underestimate the value of detachment in implementing your strategy and applying your methodology. Remain unemotional at all times, taking your losses—and your gains—in stride. Neither celebrate each upturn nor sweat each downturn, rather, judge your success based on performance over time. Have patience, and resist the urge to “correct” before giving the market the chance to correct itself for you. Stick with your stop losses, and fight the temptation to increase your take profits.

5. Manage Your Campaign: remain ready, willing and able to get out of an unexpected losing position. Understand that only 51% of your trades need to be profitable in order for you to experience trading success. thus, even if 49% of your trades go badly, you are still in a positive aspect. Be realistic about your goals. Stay abreast of the market and of news that can influence its movements, and be prepared within reason to change your trading parameters if market movements so dictate. Understand forex leveraging requirements to ensure that you remain able to cover your positions. Have confidence in your picks.

Forex trading distinguishes itself from stock or commodity trading in many ways, but one aspect is particularly unique to forex: because currencies are traded in pairs, and because, by definition, when one currency in the pair rises, the other must fall, success in forex trading is easily accomplished so long as the retail trader has thoroughly prepared himself, can recognize how the two currencies are most likely to move against each other, and remains resolute in his picks.