4 Important Forex Indicators

Post on: 28 Март, 2015 No Comment

If you are new to forex trading, then you must learn technical analysis basics and master a few indicators. When it comes to indicators, you will come across hundreds upon hundreds of indicators.

What are the most important indicators that you need to be aware of when trading forex? In this article, I will give you a list of only 4 indicators that are the most important.

Price (Chart) Trend Lines

Trend Lines are one of simplest yet the most effective indicators. Many traders ignore them but to tell you the truth, trend lines are used effectively by pro traders daily in their trading decisions.

Trendlines can be used to define the support and resistance in any trend. though there is an element of subjectivity in drawing trend lines but with little practice, you can learn to draw trendlines accurately enough.

Trendline break is a very popular trading strategy; plus you can use these trend lines in placing the stop loss effectively.

Exponential, Weighted & Simple Moving Average

Moving averages (MAs) are just the average of the closing prices for a certain number of periods. Moving averages are also one of the most simple yet the most effective indicators .

There are basically three types of Moving Averages:

- Simple Moving Averages (SMA)

- Exponential Moving Averages (EMA)

- Weighted Moving Averages

Many trading systems use these MAs in one for or the other. Exponential Moving Averages (EMA) are just the exponential average of the past closing prices taken over a period.

EMAs place more weight on the recent prices as compared to the past prices unlike the SMA that places equal weight on all the closing prices.

For a basic forex system you can use the cross of two MAs (whether simple or exponential) to generate buy and sell signals. Some trading systems instead use the cross of three MAs. Either way, you need to master these MAs if you are really serious about learning forex trading.

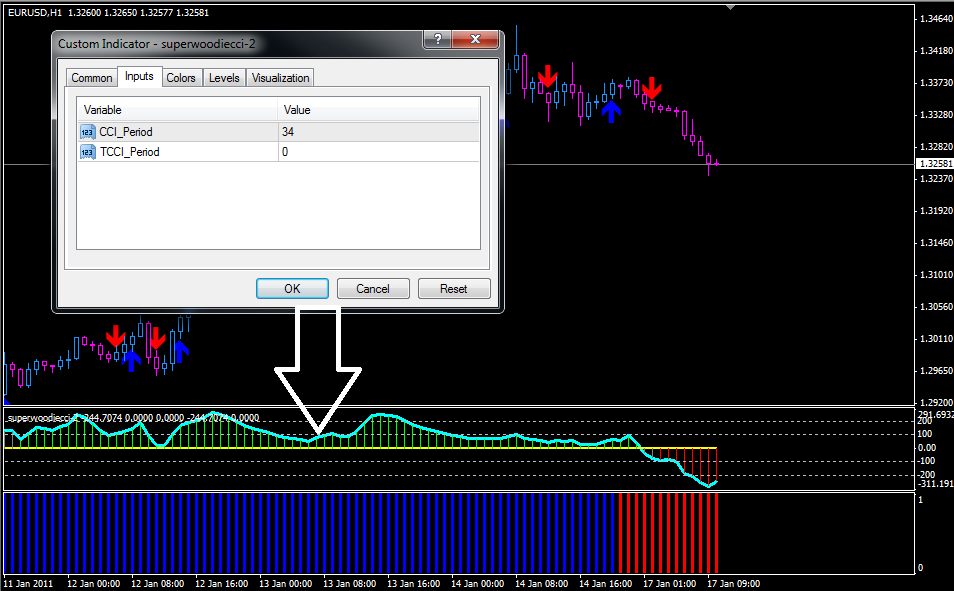

Moving Average Convergence Divergence (MACD)

Moving Average Convergence Divergence (MACD) is one of the most versatile indicators that applies very well to the forex market. It is basically the difference of two exponential moving averages, the 12 day EMA and the 26 day EMA.

It comprises of two lines as follow:

- One is the MACD line that is the difference of the 12 day EMA and the 26 day EMA

- Second is the Signal Line which is simply the 9 day EMA of the MACD line.

The MACD Histogram is simply the bar chart of the MACD Signal Line .

Stochastic Indicator

Stochastic is the fourth most important indicator that you need to master. It is a momentum oscillator and has two line %K and the %D.

%K is the fast moving line while %D is the slow moving line. The default settings is 14 days.

Always remember the K.I.S.S rule (Keep it Simple Stupid) while trading. Pro traders most often use only the above four indicators and with experience you will also learn how versatile and effective the above four indicators are.

%img src=http://media.avapartner.com/banners/p369485172.gif?tag=33247&tag2=