4 Currency ETFs On The Move

Post on: 20 Июнь, 2015 No Comment

With disappearing sensitivity given mid-2013, Sep was a branch indicate where sensitivity began to enhance in many currencies. Currencies, and their analogous banking exchange-traded funds (ETFs), have seen usually rising in daily ranges, that means bigger moves and some-more distinction intensity if youre on a right side of a trade. Volatility was serve stretched final week, as a Japanese yen saw a pointy dump following a warn proclamation by a Bank of Japan that it would continue to ease . This action typically devalues a currency. This put a yen into a spotlight, yet it isnt a usually banking ETF value profitable courtesy to right now.

CurrencyShares Japanese Yen ETF (FXY ) fell 2.74% on Oct. 31, that is a really vast pierce precipitated by a warn BOJ announcement. This is a latest dump in a downtrend that began in late 2011. The decrease to uninformed multi-year lows means theres tiny support underneath a cost until a Jun 2007 low during $80.61. If in a position, a trail of slightest insurgency is still down and offered is approaching to continue. Acquiring a new short position after such a dump is trickier. While it might meant blank some of a move, watchful for a consolidation and afterwards a renewed mangle reduce is some-more a advantageous play than jumping into a brief arbitrarily. Waiting for a pullback to $88.80 is another option, yet it might not start anytime soon, and might meant blank some-more downside in a meantime. (For more, see: How Can we Invest in a Foreign Exchange Market? )

CurrencyShares Euro ETF (FXE ) continues a decline, that commenced in May. Strong offered in Jul by Sep saw a postponement in October, as a cost bounced, yet by Oct. 31 a cost was right behind nearby a progressing lows. A dump behind subsequent a Oct. 31 low during $123.08 signals a downtrend has re-emerged and a serve dump is likely. The nearest price target is a vital support area between $120 and $119 — a closeness of vital lows in 2012 and 2010. If a cost continues to reason above $123.08 and rises, a cost is still in a bearish consolidation. Other shorting opportunities arise nearby short-term resistance between $126 and $127. (For more, see: Finding an Alternative with Currency ETFs .)

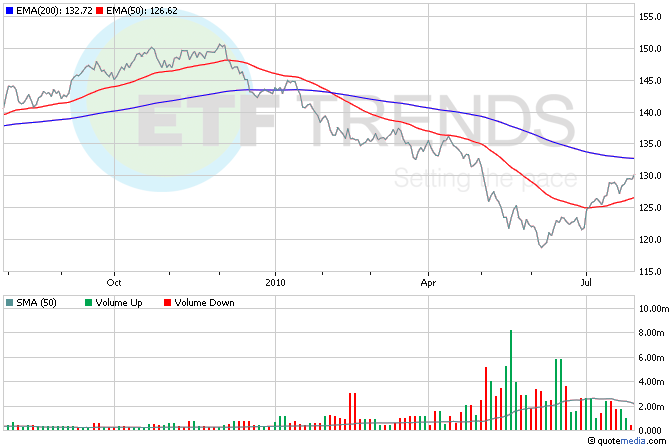

CurrencyShares Canadian Dollar ETF (FXC ) pennyless subsequent a $88.20 Mar low in October, yet has so distant unsuccessful to continue falling. Instead, a ETF is consolidating nearby support during $88. Momentum is still down, yet another dump subsequent a new lows during $87.70 is indispensable to endorse it. If that occurs, a subsequent downside aim is $85.50, a turn not seen given 2009. If a cost continues to teeter within a Oct cost range, shorting opportunities start between $89 and $90 formed on a longer-term expectancy of a cost stability to fall. A convene above $90 breaks a converging and indicates during slightest short-term bullishness. The aim in that box is $90.75 to $91. (For associated reading, see: Major Moves Underway in Currency ETFs .)

CurrencyShares Australian Dollar ETF (FXA ) fell neatly in Sep after violation subsequent a triangle pattern. The cost rallied in October, yet within a rising channel that is demonstrative of a pullback, not a reversal. A dump subsequent $87.75 breaks a channel and indicates a downtrend is approaching continuing. The Oct rebound did come in a closeness of a Jan low, signaling there is support between $87 and $86.48. A dump behind subsequent $86.48 is a clever vigilance that a Australian dollar will continue to fall. There is tiny support until $81.25the segment of a 2010 low. If a cost continues to pull higher, a vital shorting event occurs between $92.75 and $92. (For more, see: ETF Plays for a Surging Greenback .)

The Bottom Line

The banking markets are seeing strong trends that is reflected in banking ETFs. Trade in a instruction of a trend, entering during consolidations or when a cost starts relocating in a trending instruction following a converging or pullback. Use stop detriment orders to control risk. Precisely determining risk in a banking ETF can be difficult, though. The foreign sell market (FOREX) trades 24-hours a day during a week, yet a ETFs do not. This leaves them disposed to cost gaps, like a one that occurred on Oct. 31 in FXY (although thats an impassioned example). Price gaps meant a stop detriment or entrance sequence might not fill during a cost expected, ensuing in some-more risk/loss than expected. Only risk a tiny apportionment of a account on any singular trade. (For associated reading, see: 4 Currency ETFs to Watch Right Now .)

Cory Mitchell doesnt possess or have interests in any of ETFs mentioned in this article.