3 US Dollar Factors at the Forefront

Post on: 28 Март, 2015 No Comment

After an important week that saw the US dollar kick off a fresh rally, there are three items of particular importance for the dollar outlook in this holiday-shortened week to come.

The US dollar (USD ) performed extremely well this past week as investors and traders around the world continue to position for a change in monetary policy.

A little more than a week ago, Federal Reserve Chairman Ben Bernanke kicked off a fresh rally in the dollar by saying that asset purchases could be tapered in 2013. His views were reinforced this past week by other voting members of the Federal Open Market Committee (FOMC ), and their comments drove the dollar to fresh highs against all major currencies.

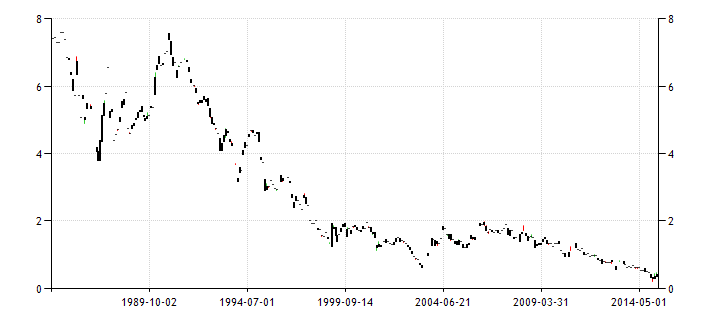

The greenback rose to its strongest level against the Australian dollar (AUD ) in two-and-a-half years and its strongest level against the Canadian dollar (CAD ) in more than a year. While we did not see the dollar reach highly significant milestones against the euro (EUR ), Japanese yen (JPY ), and British pound (GBP ), the greenback still rose to three-week highs (or more) against all three of those currencies.

Going into the new, shortened trading week (US markets will be closed Thursday for the July 4 holiday), there are three things forex traders should know about the dollar:

1) The Fed Will Most Likely Taper in September

Despite all of the attempts by FOMC voters this past week to downplay the significance of Bernanke’s comments by saying that the decision to taper will be based on data, Fed Governor Jeremy Stein was quite clear that September could be the month when changes are made.

Stein said the Fed should be clear that in making a decision in, say, September, it will give primary weight to the largest stock of news that has accumulated since the inception of the program and will not be unduly influenced by whatever data releases arrive in the few weeks before the meeting.

This specific comment about September sparked speculation that it will be only two more months before the Fed starts to taper, and we agree that this is likely because the central bank will not want to suddenly reduce stimulus right before the holidays.

While we have already seen the dollar trade higher on the back of liquidation of dollar-funded carry trades and re-pricing of FOMC expectations, there’s scope for further gains on this week’s economic reports.

2) Critical US Economic Reports Are Due This Week

The sustainability of the dollar rally will hinge on the outcome of number of US economic reports that are scheduled for release this week, including manufacturing and non-manufacturing ISM and the ever-important non-farm payrolls (NFP) report.

A minor slowdown in job growth is expected to be offset by a drop in the unemployment rate, and the closer the unemployment rate gets to the 7% mark mentioned by Bernanke and Stein, the greater the likelihood of a reduction in stimulus in September instead of December.

As long as there aren’t any major disappointments in US data, we expect the dollar to extend its gains in the coming week.

3) The Hunt for Bernankes Successor Is on

Lastly, talks regarding the appointment of Bernankes successor could gain momentum in the coming weeks. According to the Wall Street Journal. President Barack Obama already has a short list of candidates that most likely includes Janet Yellen. Tim Geithner. and Larry Summers.

The role of Fed Chairman is a very important one, as this person’s background, experience, and monetary policy bias will play a critical role in how he or she handles the recovery and future crises. If Obama ultimately settles on a less-familiar candidate, the resulting uncertainty could put added pressure on both equities and currencies.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.