1) Moving Averages

Post on: 2 Июль, 2015 No Comment

1) Moving Averages

MOVING AVERAGES

What are moving averages?

They are the most common technical analysis indicator. It smoothes out prices to help traders get a clearer picture of the overall trend as market noise is filtered out.

Moving averages are lagging indicators, which mean that they do not predict new trends, but confirm trends once they have been established. As you can see in Figure 1, a currency pair is deemed to be in an uptrend when the price is above a moving average and the average is sloping upward. Conversely, a trader will use a price below a downward sloping average to confirm a downtrend. Many traders will only consider holding a long position when the price is trading above a moving average. This basic rule can help increase the odds that the trend works in the traders’ favor.

How are they calculated?

Simple Moving Averages are calculated by adding up the last X periods closing prices and then dividing that number by X.

For example: calculate a 5 period moving average

Trading day 1 2 3 4 5

Closing Prices were 93.09 93.57 93.50 94.22 94.16

5 day Average = sum of the last 5 days closing prices

Closing prices 5

Therefore,

5-day Average=93.70 + 93.57 + 93.50 + 94.22 + 94.16= 93.71

What kinds of moving averages are there?

Simple

A simple moving average reacts twice when a new piece of data is added and the last price is a low price and it is dropped off, the simple moving average will rise. If the last price is a high price and it is dropped off the simple moving average will dip. These dips and rises have nothing to do with the direction of the market. Simple moving averages where the first in a long line of special moving averages. Exponential, Weighted, Triangular, Displaced and a whole family of moving averages have come out since. Banks are among the largest players in the FOREX market and tend to stick with tradition with a reluctance to adopt new changes.

The Simple Moving Average (SMA) is used mainly to identify trend direction, but is commonly used to generate buy and sell signals. The SMA is an average, or in statistical speak — the mean. An example of a Simple Moving Average is presented below:

The prices for the last 5 days were 25, 28, 26, 24, 25. The average would be (25+28+26+26+27)/5 = 25.6. Therefore, the SMA line below the last days price of 27 would be 26.4. In this case, since prices are generally moving higher, the SMA line of 26.4 would be acting as support

The chart below of the GBP/JPY shows a 20-day Simple Moving Average acting as support for prices.

(gbp/jpy chart)

Exponential

The Exponential Moving Average (EMA) weighs current prices more heavily than past prices. This gives the Exponential Moving Average the advantage of being quicker to respond to price fluctuations than a Simple Moving Average; however, that can also be viewed as a disadvantage because the EMA is more prone to whipsaws (i.e. false signals).

Some traders believe an exponential moving average (EMA) is better than a simple MA because it places more weight on the latest data point and it responds to changes faster.

The formula is as follows:

EMA= Todays Price X (2/n+1) + Yesterdays EMA X (1-(2/n+1))

It is a good thing that we have computers and charting programs to do these complex calculations. The exponential moving average is more sensitive to the price action.

The chart below of AUD/USD shows the difference between a 20-day Exponential Moving Average (EMA) and the 20-day regular Simple Moving Average (SMA):

(aud/usd chart)

Triangular

The Triangular Moving Average is a Simple Moving Average that has been averaged again (i.e. averaging the average); this creates an extra smooth Moving Average line.

The chart below of the EUR/USD shows the relation between a 20-day Simple Moving Average and a 20-day Triangular Moving Average:

(eur/usd chart)

Generally, simple moving averages are smooth, but the re-averaging makes the Triangular Moving Average even smoother and more wavelike.

Typical (Pivot)

The Typical Price Moving Average combines the Pivot Point concept and the Simple Moving Average. The Pivot Point calculation is shown below:

Pivot Point = (High + Low + Close) / 3

The calculated Pivot Point number is then inputted into the regular Simple Moving Average equation; rather than the input of the closing price, the Pivot Point calculation is used.

The chart below of EUR/JPY shows the slight difference between a 10-day Simple Moving Average and a 10-day Typical Price Moving Average:

(eur/jpy chart)

Weighted

The Weighted Moving Average places more importance on recent price moves; therefore, the Weighted Moving Average reacts more quickly to price changes than the regular Simple Moving Average. A basic example (3-period) of how the Weighted Moving Average is calculated is presented below:

Prices for the past 3 days have been $5, $4, and $8.

Since there are 3 periods, the most recent day ($8) gets a weight of 3, the second recent day ($4) receives a weight of 2, and the last day of the 3-periods ($5) receives a weight of just one.

The calculation is as follows: [(3 x $8) + (2 x $4) + (1 x $5)] / 6 = $6.17

The Weighted Moving Average value of 6.17 compares to the Simple Moving Average calculation of 5.67. Note how the large price increase of 8 that occured on the most recent day was better reflected in the Weighted Moving Average calculation.

The chart below of the GBP/JPY illustrates the visual difference between a 20-day Weighted Moving Average and a 20-day Simple Moving Average:

(gbp/usd charts)

How are moving averages used in trading?

Trend identification

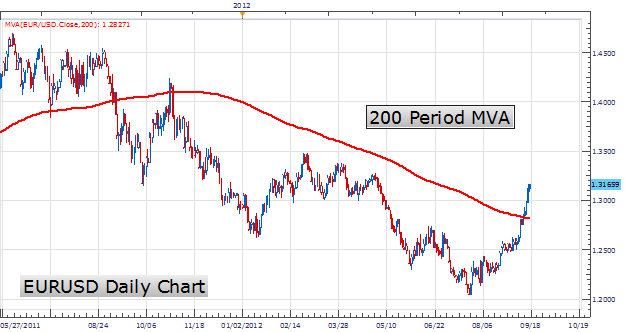

Identifying trends is one of the key functions of moving averages, which are used by most traders who seek to make the trend their friend. Moving averages are lagging indicators, which means that they do not predict new trends, but confirm trends once they have been established. As you can see in Figure 1, a currency is deemed to be in an uptrend when the price is above a moving average and the average is sloping upward. Conversely, a trader will use a price below a downward sloping average to confirm a downtrend. Many traders will only consider holding a long position in an asset when the price is trading above a moving average. This simple rule can help ensure that the trend works in the traders’ favor.

(nzd/usd chart)

Buy and Sell Signals

Crossovers

A crossover is the most basic type of signal and is favored among many traders because it removes all emotion. The most basic type of crossover is when the price of an asset moves from one side of a moving average and closes on the other. Price crossovers are used by traders to identify shifts in momentum and can be used as a basic entry or exit strategy. As you can see in Figure 1, a cross below a moving average can signal the beginning of a downtrend and would likely be used by traders as a signal to close out any existing long positions. Conversely, a close above a moving average from below may suggest the beginning of a new uptrend.

(nzd/usd chart)

Enter when a strong trend pulls back to a moving average line

On the NZD/USD chart below, we can see that the market pulled back to find support at the 34 period SMA. This is while the daily chart showed a strong uptrend. We could have bought there and placed our protective stop below the moving average.

(nzd/usd chart)

Double Crossover Method

The second type of crossover occurs when a short-term average crosses through a long-term average. This signal is used by traders to identify that momentum is shifting in one direction and that a strong move is likely approaching. A buy signal is generated when the short-term average crosses above the long-term average, while a sell signal is triggered by a short-term average crossing below a long-term average. As you can see from the chart below, this signal is very objective, which is why it’s so popular. The more space there is between the two moving averages, the better the signal. The divergence between the shorter term moving average from the longer term average of signals increasing market momentum — momentum to the upside, when the shorter term average is above the longer term average, momentum to the downside when the shorter term moving average is below the longer term average. In the USD/CHF the shorter green 5 period SMA acts the trigger line. When it crosses over the slower moving red 20 SMA, a buy signal is generated. When the 5 SMA crosses below the 20 SMA a sell signal is generated. A whipsaw on September 23rd would have stopped our trade out. However, the remainder of the signals would have been positive gainers. See the chart below:

(usd/chf chart)

Momentum

Many beginner traders ask how it is possible to measure momentum and how moving averages can be used to tackle such a feat. The simple answer is to pay close attention to the time periods used in creating the average, as each time period can provide valuable insight into different types of momentum. In general, short-term momentum can be gauged by looking at moving averages that focus on time periods of 20 days or less. Looking at moving averages that are created with a period of 20 to 100 days is generally regarded as a good measure of medium-term momentum. Finally, any moving average that uses 100 days or more in the calculation can be used as a measure of long-term momentum. Common sense should tell you that a 15-day moving average is a more appropriate measure of short-term momentum than a 200-day moving average.

One of the best methods to determine the strength and direction of an asset’s momentum is to place three moving averages onto a chart and then pay close attention to how they stack up in relation to one another. The three moving averages that are generally used have varying time frames in an attempt to represent short-term, medium-term and long-term price movements. In Figure 2, strong upward momentum is seen when shorter-term averages are located above longer-term averages and the two averages are diverging. Conversely, when the shorter-term averages are located below the longer-term averages, the momentum is in the downward direction.

(nzd/usd chart)

(usd/cad chart)

Support/Resistance

When price is in an uptrend and subsequently, the moving average is in an uptrend, and the moving average has been tested by price and price has bounced off the moving average a few times (i.e. the moving average is serving as a support line), then buy on the next pullbacks back to the Simple Moving Average.

(eur/gbp chart)

Moving Average Acting as Resistance Sell Signal

At times when price is in a downtrend and the moving average is in a downtrend as well, and price tests the SMA above and is rejected a few consecutive times (i.e. the moving average is serving as a resistance line), then buy on the next rally up to the Simple Moving Average.

(gbp/jpy chart)

Stop loss

The support and resistance characteristics of moving averages make them a great tool for managing risk. The ability of moving averages to identify strategic places to set stop-loss orders allows traders to cut off losing positions before they can grow any larger. As you can see in Figure 5, traders who hold a long position in a stock and set their stop-loss orders below influential averages can save themselves a lot of money. Using moving averages to set stop-loss orders is key to any successful trading strategy.

(aud/usd chart)

Parameters. The most commonly used time frames for moving averages are 10, 20, 50, 100 and 200 periods. As always, the longer the time frame, the more reliable the study. However shorter term moving averages will react more quickly to the market’s movements and will provide earlier trading signals.

Both of these examples are using the 100 period simple moving average. The use of 10, 20, 50 and 200 period simple and exponential moving averages are just as popular by traders. The preference is yours and depends on how many trading signals you want. The higher the number of periods used in the study, the fewer the number of signals, but they may be more accurate in providing good entries.

Moving averages display a smoothed out line of the overall trend. The longer the term of the moving average, the smoother the line will be. In order to gauge the strength of a trend in a market, plot the 10, 20, 50, 100 or 200 day SMAs. In an uptrend, the current price should be above the SMA while the SMA is also moving up and in a downtend, the current price should be below the SMA while the SMA is also moving down. This offers another way to gauge the direction of the trend, in order to find a good place to enter into a trade. Below is a daily chart of the EUR/USD. You can see where the 100-day SMA plotted on the chart not only shows the direction of the daily trend but also provides.

(eur/usd chart)

SPECIAL APPLICATIONS OF MOVING AVERAGES

Moving Average Envelopes

Percentage envelopes indicate when a market has become over extended, when they have deviated too far from the moving average line. Envelopes are placed at fixed percentages above and below the moving averages.

Short term traders commonly use a 3% envelope around a 20 day moving average. Longer term traders commonly use a 5% envelope around a 10 week average. When the price moves outside the envelope this is an indication that the market is overextended.

(usd/cad chart)

Finding an Appropriate Time Periods

Because most MAs represent the average of all the applicable daily prices, it should be noted that the time frame does not always need to be in days. Moving averages can also be calculated using minutes, hours, weeks, months, quarters, years etc. Why would a day trader care about how a 50-day moving average will affect the price over the upcoming weeks? On the other hand, a day trader would want to pay attention to a 50-minute average to get an idea of the relative cost of the security compared to the past hour. Some traders may even use the average price over the past three minutes to gauge an uptake in short-term momentum.

No Average is Foolproof

As you know, nothing in the financial markets is for certain — certainly not when it comes to using technical indicators. If a currency bounced off the support of a major average every time it came close, we would all be rich. One of the major disadvantages of using moving averages is that they are relatively useless when an asset is trending sideways, compared to the times when a strong trend is present. As you can see in Figure 1, the price of an asset can pass through a moving average many times when the trend is moving sideways, making it difficult to decide how to trade. This chart is a good example of how the support and resistance characteristics of moving averages are not always present.

Without a directional move that takes this pair beyond its average price, Moving Averages will twist around each other and offer no clear trading signal. See the chart of the EUR/GBP:

(eur/gbp chart)

Last edited by Thomas Long; 09-21-2009 at 10:52 AM.