Archive for Stocks

What is the best Portfolio diversification strategy

What is the best Portfolio diversification strategy

This is the fourth blog post that I have written in response to several questions asked by an accountancy student from the University of

15 Июнь, 2015 No Comment Read More

Saving and Investing An Introduction to Diversification

Saving and Investing An Introduction to Diversification

Published on April 7th, 2008 April is Financial Literacy Month. during which Get Rich Slowly will explore the fundamentals of personal finance. Today well

15 Июнь, 2015 No Comment Read More

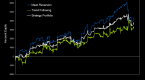

The key of reducing the risk is to avoid a portfolio where all the securities are strictly correlated with each other. If the correlation

15 Июнь, 2015 No Comment Read More

Investment Diversification Basics

Investment Diversification Basics

Diversification is one crucial aspect of a solid investment strategy. To diversify means to spread your portfolio over many types of investments and over

15 Июнь, 2015 No Comment Read More

Investment Diversification A Look at the Basics

Investment Diversification A Look at the Basics

Investment Diversification is one of the basic tools of building a sound investment portfolio. Diversification is the fancy name for the advice your mother might

15 Июнь, 2015 No Comment Read More

Introduction to BDCs (last updated 12/2002 ) History/Background: • Business development company (BDC) regulation was created in 1980 by Congress • Goal of BDC

15 Июнь, 2015 No Comment Read More

Strategic Asset Allocation and International CAPM

Strategic Asset Allocation and International CAPM

Contents 1 Introduction 1.1 Goal of the paper and problem setting 1.2 Methodology 2 International Capital Asset Pricing Model 2.1 The model and assumptions

15 Июнь, 2015 No Comment Read More

Chapter VII: Where Do Betas Come From? I. Beta Risk In the previous chapter, we focussed on the Arbitrage Pricing Theory as an alternative

15 Июнь, 2015 No Comment Read More

How to Measure Your Portfolio s Risk For Dummies

How to Measure Your Portfolio s Risk For Dummies

Exactly how risk is measured is a complicated issue. Before you can begin managing a portfolio you have to look at individual investments. Originally,

15 Июнь, 2015 No Comment Read More

Estimation of expected return CAPM v and French

Estimation of expected return CAPM v and French

Page 1 ________________________________________________________________________________________________________________________________________ email: ppe@asb.dk Abstract Most practitioners favour a one factor model (CAPM) when estimating expected return for an individual stock. For estimation

15 Июнь, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...