Archive for Stocks

Diversification (finance) Wikipedia the free encyclopedia

Diversification (finance) Wikipedia the free encyclopedia

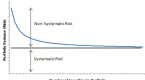

In finance, diversification means reducing non-systematic risk by investing in a variety of assets. If the asset values do not move up and down

23 Июнь, 2015 No Comment Read More

Common Stock Strategies Part 2 Quality Income Cost Averaging

Common Stock Strategies Part 2 Quality Income Cost Averaging

Warren Buffett and Quality Some investors prefer to consider themselves not value or growth but quality. This is a sort of hybrid approach in

23 Июнь, 2015 No Comment Read More

CBOE CBOE S&P 500 Implied Correlation Indexes

CBOE CBOE S&P 500 Implied Correlation Indexes

The CBOE S&P 500 Implied Correlation Indexes The CBOE S&P 500 Implied Correlation Indexes are the first widely disseminated, market-based estimate of the average

23 Июнь, 2015 No Comment Read More

Analysis and Development Of Correlation Arbitrage Strategies on

Analysis and Development Of Correlation Arbitrage Strategies on

Statistical arbitrage and Pairs Trading strategies CASL What is pairs trading? Developing a pairs trading system from scratch. Empirical study: statistical arbitrage between. Dow

23 Июнь, 2015 No Comment Read More

Why (and How) Diversified Investors Win

Why (and How) Diversified Investors Win

By Carl Richards September 6, 2011 11:35 am September 6, 2011 11:35 am Carl Richards Diversification remains one of the most fundamental investing principles,

23 Июнь, 2015 No Comment Read More

What Benchmark Should I Measure My Return Against

What Benchmark Should I Measure My Return Against

Disclamer: Both I and my clients invest in the funds mentioned in this article. Craig L. Israelsen has a nice article in Financial Planning

23 Июнь, 2015 No Comment Read More

A three-fund portfolio is a portfolio which does not slice and dice. but uses only basic asset classes usually a domestic stock total market

23 Июнь, 2015 No Comment Read More

Save for Us Creating a Diversified Portfolio

Save for Us Creating a Diversified Portfolio

Monday, November 24, 2014 Creating a Diversified Portfolio Let’s first define the goals of creating a diversified portfolio: It should be well diversified in

23 Июнь, 2015 No Comment Read More

Portfolio Recommendation Beats S&P 500 by 9 4% (Free Money Finance)

Portfolio Recommendation Beats S&P 500 by 9 4% (Free Money Finance)

Categories November 11, 2009 Portfolio Recommendation Beats S&P 500 by 9.4% The following is a guest post from Marotta Wealth Management . For those

23 Июнь, 2015 No Comment Read More

Market risk is measured by beta, which is another measure of investment risk that is based on the volatility of returns. In contrast to

23 Июнь, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...