Archive for Options

Volatility Index Uncovers Market Bottoms

Volatility Index Uncovers Market Bottoms

More and more investors are using options prices offered by the Chicago Board Options Exchange’s Volatility Index (VIX), to help determine market direction. The

26 Апрель, 2015 No Comment Read More

It’s importance when determining the price of options in the marketplace. Should It Influence your stock buying decisions? Volatility is the property of a

26 Апрель, 2015 No Comment Read More

VIX Looks Lifeless but It Still Works! The Striking Price Steven

VIX Looks Lifeless but It Still Works! The Striking Price Steven

A primer on the finer points of using the VIX volatility index to forecast stock market movement. LONG BEFORE OPTIONS TRADING entered the mainstream,

26 Апрель, 2015 No Comment Read More

VIX and More Implied Volatility and Magnitude v

VIX and More Implied Volatility and Magnitude v

Wednesday, July 30, 2008 Implied Volatility and Magnitude vs. Direction Awhile back, a reader posed what sounded like a basic question: Isn’t implied volatility

26 Апрель, 2015 No Comment Read More

The Volatility Index (VIX) Analyzing Market Sentiment Financial Web

The Volatility Index (VIX) Analyzing Market Sentiment Financial Web

The Volatility Index (VIX ) is a relatively new index that captures implied volatility for the S&P 500 index options. An implied volatility uses

26 Апрель, 2015 No Comment Read More

The CBOEs Volatility Index (VIX)

The CBOEs Volatility Index (VIX)

In my books and seminars I discuss determining market tone before making any investment decisions. One of the main factors I utilize in this evaluation

26 Апрель, 2015 No Comment Read More

Q Does VIX Follow Market Direction Options for Rookies

Q Does VIX Follow Market Direction Options for Rookies

Hi Mark, Hi have a question about the VIX. Why is it that VIX increases and decreases more or less with the market rather

26 Апрель, 2015 No Comment Read More

Playing The VIX As A Portfolio Strategy Tool

Playing The VIX As A Portfolio Strategy Tool

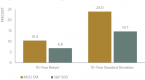

The market volatility index VIX is considered as the Fear Gauge of the market and is expected to tell us whether the market has

26 Апрель, 2015 No Comment Read More

by Dr. Kent Moors | published November 14th, 2011 As we brace for another bout of volatility in crude oil prices, I've got some

26 Апрель, 2015 No Comment Read More

Normalized Volatility Indicator

Normalized Volatility Indicator

by Rajesh Kayakkal Early bear phase signals can help you get out of the market before it turns down. This indicator tells you how.

26 Апрель, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...