Archive for Options

How to read the market 4 indicators

How to read the market 4 indicators

N egative sentiment is sweeping through the bourses is a very common line that you hear in television channels. If anyone were to ask

21 Сентябрь, 2015 No Comment Read More

May 22, 2008 CBOE Volatility Index (VIX) The CBOE Market Volatility index (VIX) was introduced in 1993 by the Chicago Board Options Exchange (CBOE)

21 Сентябрь, 2015 No Comment Read More

A Simple Way I Use The $VIX To Assist Me With Market Timing

A Simple Way I Use The $VIX To Assist Me With Market Timing

Whenever the Bears start showing their claws, one of the first things mentioned in trading circles is the $VIX. The $VIX is the Chicago

21 Сентябрь, 2015 No Comment Read More

VIX Options — Introduction Find Out How My Students Make Over 87% Profit Monthly, Why Trade VIX Options? VIX options make the trading of

20 Сентябрь, 2015 No Comment Read More

VIX Wikipedia the free encyclopedia

VIX Wikipedia the free encyclopedia

CBOE Volatility Index (VIX) 1985–2012. VIX is a trademarked ticker symbol for the Chicago Board Options Exchange Market Volatility Index. a popular measure of

20 Сентябрь, 2015 No Comment Read More

Using Options to Hedge a Portfolio Cabot Investing

Using Options to Hedge a Portfolio Cabot Investing

Using Options to Hedge a Portfolio Covered Call Put Purchase Risk Reversal Using Options to Hedge a Portfolio A few Cabot Options Trader subscribers

20 Сентябрь, 2015 No Comment Read More

This VIX Trade Could Be A Big Deal

This VIX Trade Could Be A Big Deal

As an options trader, you can’t understate the importance of volatility. It’s one of the primary ingredients in the price of an options contract.

20 Сентябрь, 2015 No Comment Read More

The risks of VIXtied investing—Commentary

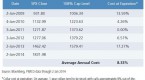

Source: Vanderbilt University Robert Whaley, Vanderbilt professor, father of the VIX Trading in these ETPs ostensibly gives investors an opportunity to profit when the

20 Сентябрь, 2015 No Comment Read More

The Hurdles to Replicating VIX

The Hurdles to Replicating VIX

LIMITED SPOTS AVAILABLE: On Monday, August 6, TheStreet invites you to a Meet and Greet with our CEO and many of the Premium Services

19 Сентябрь, 2015 No Comment Read More

PIMCO On Hedging It Pays To Be Countercyclical

PIMCO On Hedging It Pays To Be Countercyclical

Authored by Vineer Bhansali of PIMCO, Tail Risk Hedging: It Pays to Be Countercyclical It is a well-known phenomenon that quiet markets, low volatility

19 Сентябрь, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...