Archive for Cash

Four Funds for NaturalResource Investing

Four Funds for NaturalResource Investing

The recent spike in the price of wheat was a reminder that commodities like foodstuffs offer profit potential for investors. Several top advisors outline

1 Июль, 2015 No Comment Read More

With Huge War Chests Activist Investors Tackle Big Companies

With Huge War Chests Activist Investors Tackle Big Companies

Shareholders, Supersized Shareholders, Supersized The so-called activist investors flocking to Wall Street are major shareholders with hedge fund money, and they are using their

1 Июль, 2015 No Comment Read More

Nasty Shareholder Activist Battles And Why They Happened

Nasty Shareholder Activist Battles And Why They Happened

Shareholder activists. as the phrase implies, are strategically and operationally involved in the companies in which they have a vested financial interest. The management

1 Июль, 2015 No Comment Read More

Newcomers jump into activist investing eying returns and capital Yahoo Finance Canada_1

Newcomers jump into activist investing eying returns and capital Yahoo Finance Canada_1

Focus: Retail By Svea Herbst-Bayliss BOSTON (Reuters) — The largest new field of activist investors in years is shaking up corporate America, seeking to

1 Июль, 2015 No Comment Read More

Investor Activism IR s New Rules of Engagement

Investor Activism IR s New Rules of Engagement

The shareholder activism landscape has changed dramatically over the last few years. Activist hedge funds today manage roughly $100 billion, almost three times as

1 Июль, 2015 No Comment Read More

Insurgencies by the numbers The Deal Pipeline (SAMPLE CONTENT NEED AN ID )

Insurgencies by the numbers The Deal Pipeline (SAMPLE CONTENT NEED AN ID )

by Ronald Orol And Paula Schaap | Published December 26, 2014 at 11:47 AM This year, activism reached new heights as an asset class:

1 Июль, 2015 No Comment Read More

Cliffs Natural Resources Proxy Battle Gets Nasty

Cliffs Natural Resources Proxy Battle Gets Nasty

In a bit of he said, she said. he said, iron ore mining giant Cliffs Natural Resources ( NYSE: CLF ) announced it was

1 Июль, 2015 No Comment Read More

Can JP Morgan Transparently Police Itself The Harvard Law School Forum on Corporate Governance and

Can JP Morgan Transparently Police Itself The Harvard Law School Forum on Corporate Governance and

Can JP Morgan Transparently Police Itself? Editor’s Note: Ben W. Heineman, Jr. is a former GE senior vice president for law and public affairs

1 Июль, 2015 No Comment Read More

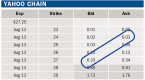

Like many investors, I started off my trading experience with shares, or stock trading, conventionally thought of as the safest and easiest form of

1 Июль, 2015 No Comment Read More

Structural Diversification for All Seasons

Structural Diversification for All Seasons

Structural Diversification for All Seasons Now that we are hip deep in our Dynamic Asset Allocation for Practitioners series (Parts I. II and III

1 Июль, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...