Archive for Bonds

How Do Hedge Funds Get Away With It Eight Theories The New Yorker

How Do Hedge Funds Get Away With It Eight Theories The New Yorker

By John Cassidy The crux of the issue is the industrys two-tiered fee structure, which includes a hefty management fee (two per cent has

21 Июнь, 2015 No Comment Read More

Definition: According to Till, H. (2007), Amaranth Advisors, LLC was founded in 2000 by Nick Maounis and was a multi-strategy hedge fund headquartered in

21 Июнь, 2015 No Comment Read More

The big debate during the 20th century was about the relationship between the market and the state. Both those institutions are now tarnished. The

21 Июнь, 2015 No Comment Read More

Sharing Ideas December 1, 2008 Staff Report It is a tribute to the investment advisor industry that so many advisors could travel to Chicago

21 Июнь, 2015 No Comment Read More

Kumar Palghat is Kapstream managing director. Everyone is well aware by now that the sub-prime market in the US was one of the key

21 Июнь, 2015 No Comment Read More

MarktoMarket A MadeInWashington Disaster

MarktoMarket A MadeInWashington Disaster

Mark-to-Market: A Made-In-Washington Disaster Editor’s Note: We are reprinting Brian Wesbury and Robert Stein’s Mark to Market Means Mayhem from American Spectator in full

21 Июнь, 2015 No Comment Read More

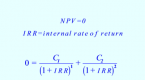

Internal rate of return (Business) Definition Online Encyclopedia

Internal rate of return (Business) Definition Online Encyclopedia

INTERNAL RATE OF RETURN — IRR The internal rate of return (IRR) is the interest rate such that the discounted sum of net cash

21 Июнь, 2015 No Comment Read More

How to cope with mark to market mayhem

How to cope with mark to market mayhem

Mark-to-market (M2M) is not a phrase that gets the pulse racing. However, it pervades almost every corner of investing. It can also cause normally

21 Июнь, 2015 No Comment Read More

A simple 50/50 Asset Allocation Model is based on a passive two-asset class portfolio. It was built to reduce volatility of returns, decrease risk,

21 Июнь, 2015 No Comment Read More

Safe SelfDirected IRAs For Retirement Investors

Safe SelfDirected IRAs For Retirement Investors

One of the interesting quirks of the investing world in the last few years has been the rise of self-directed IRAs. You often hear

21 Июнь, 2015 No Comment Read More

Follow Us

Sidebar Post

- Most Popular

- Recent Comments

-

Bollinger Bands Strategy With 20 Period ...

-

Pay Off Your Mortgage Prior To Retiremen...

-

You Say You Want A Dissolution An Overvi...

-

Pay Down the Mortgage Before Retirement ...

-

Volume indicator

-

Uncover Value Opportunities Using the Pr...

-

The Strategic Sourceror Top Tips for Rec...

-

How to pay off debt

-

Recessionproofing retirement

-

Frontier Markets The New Emerging Emergi...