ZeroCoupon Bonds

Post on: 9 Апрель, 2015 No Comment

Zero-coupon bonds are the most volatile among all the different types of bonds. Zero-coupon bond prices are very sensitive to changes in interest rates which go up and down as in a roller coaster. Zero-coupon bonds are more complex than conventional bonds and you need to know how they work.

What are zero-coupon bonds?

Zero-coupon bonds do not pay interests and is issued at a deep discount to its face value. The bond increases its value until maturity when equivalent to its face value.

Zero-coupon bonds are debt securities that are issued at deep discount from its face values. They do not pay periodical interests and are redeemed at its face value ($1,000) when they arrive to maturity. For example, a zero-coupon bond with 16 years to maturity (with a face value of $1000) that has a 5% yield would cost around $613.91 at its issuance. In other words, you would buy this zero-coupon at $613.91, would not receive intern payment of interests and by the end of the 10 years you would get $1000, the face value of the bond.

Due that zero-coupon bonds do not pay interests. They don?t have a current yield as those from conventional bonds.

The price of a zero-coupon bond is the current value of the face value of the bond at its date of maturity discounted at its internal rate of return. Better said, the investors fund grows from $613.91 to $1000 in 10 years. The initial price is composed at a return rate that after 10 years will be valued at $1000.

The return rate, or yield, in a zero-coupon can be solved mathematically or used in compound interest tables, a financial calculator or a personal computer.

The yield in a zero-coupon bond is determined using Microsoft Excel software:

- Click on the f key on the toolbar Highlight rate Fill in the information in the following box:

Nper = total number of payments Nper 10

Fmt = payment (interest) each period fmt 0

PV = present value of bond (needs a negative PV — 613.91

sign before the amount)

FV = future value (face value) of bond FV 1000

Type = 1 for payments at the end of each period Type 1

Formula result = rate Formula result (rate) = 0.05

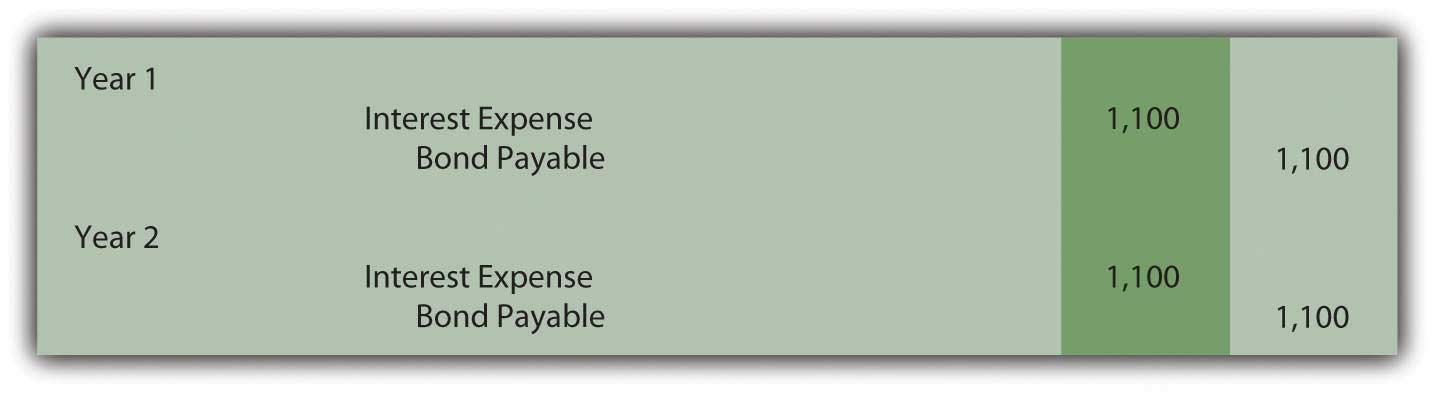

Knowing the yield of a bond not only helps for federal tax purposes but also to calculate the price of a bond. Although zero-coupon bondholders do not receive interest payments, they are obligated to pay federal taxes over the accrued interest as if they had been paid to them. In the example the accrued interest for the first year is $30.70.

Interest = $613.91 x 0.05 = $30.70

The zero-coupon bondholder pays taxes over the amount of $30.70 even though it hasn?t been received yet, creating a negative cash flow. The bondholder takes money from his own pocket to pay taxes without having received the $30.70. In exchange interest is added to the price of principal of the zero-coupon bond so that by the end of the first year the bonds price will increase to $644.61 ($613.91 / 30.70). The accrued interest for year number 2 is $32.23:

Interest = $644.61 x 0.05 = $32.23

Bond prices by the end of the second year is of $676.84 ($644.61 + 32.23). Theoretically, the prices increases with the accrued interest until the price reaches $1000 at maturity.

There are other factors besides the accrued interest that affects the price of zero-coupon bonds. For example, if the rates of interest increase, the price of the bond would drop below the theoretic price.

Because of negative cash flows, due to paying taxes over accrued (ghost) interests during the bonds active lifetime, zero-coupon bonds are better used in investment accounts which are not subject to taxes.

These investment accounts are pension funds, individual retirement accounts (IRAS), 401 (K) s, and SEP accounts. In these plans the accrued interest is subject to taxes when the funds are drawn.

Investing in municipal zero-coupon bonds can eliminate the tax problem over ghost interests.