Your Guide to Gold Ira Rollovers

Post on: 21 Май, 2015 No Comment

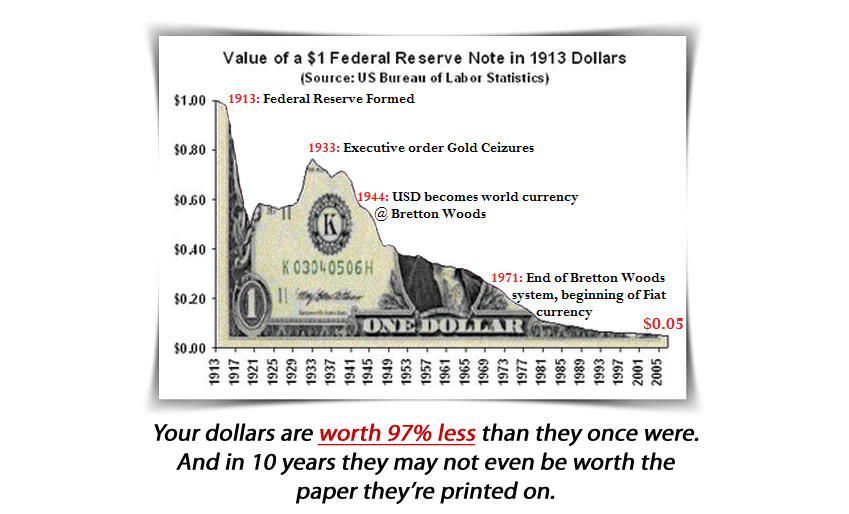

Precious Metals Vs Paper Investments

There are 2 major benefits that precious metals can provide you that a paper-based investment cannot:

- There are no restrictions to gold and other metals

- Precious metals are evergreen

In other words, you can buy as much gold as you want, and the government cannot do anything about it. Gold, Silver, and other metals have and always will hold value. You dont have to worry about stocks going up and down, and losing thousands of dollars in the process. Just think about some of the major corporations that held a massive position in the market, and then all of a sudden, it crashed for one reason or another. Your retired life cannot afford for that to happen even once, let alone worrying about it every day until you actually retire and cash out.

Metals such as gold are not found on every corner, which means that your investment choice will always have little supply, high demand, and in turn, will always be high in value.

Take a look at the gold price chart for yourself. There is no time like the present to make that investment in your future:

Gold, Silver, and Platinum are not just for retirement planning. Just think of all of the products that contain these precious metals. From computer systems to car parts, and even dental procedures, this information alone proves that there will always be high demand. And dont forget that our own money (coins) is made from these metals.

Transferring From Paper IRA to Gold IRA

If you have an IRA set up by your company, then you likely have a paper-based one. These are the default IRAs that financial firms create for staff members, yet it isnt that hard to transform your IRA from paper to gold. Its typically less complicated to transfer your IRA upon retirement, but nothing says that you cannot change it today!

Get in touch with your HR Representative or Manager and find out what company oversees your IRA. Give them a call and discuss with them your desire for a Gold IRA rollover. They will provide you with all of the necessary documents in order to make this change.

If you have a 401k, you could also move that investment into a gold IRA.

What Metals Can I Use?

Many IRAs restrict the kind of gold and silvers you can hold in your IRA considering that these are one of the most stable metals, and due to the fact that they are one of the most valuable. The most common is gold, silver and platinum to hold in your IRA, but there are specific requirements for each:

- Gold needs to be 24 karat, and the gold should have an authorized refiner trademark. However, the one exemption to this is United States Gold Eagle coins, which are 22 karat.

- Silver coins and bars are allowable if they are 99 % fine or greater.

- Platinum, which is the most useful metal in regards to per-ounce rate, must be 90.9 % fine or greater.

Gold and silver are only rising in value, so the time is now to invest in a gold IRA.

Most individuals begin counting down the days to retirement, but at the same time, they feel anxious about their financial stability. If you want to live the life you deserve, then plan for it today instead of tomorrow. Precious metals are much more valuable than a paper IRA, and will continue to be for many many years.

Dont let a 401(k) plan or company IRA representative decide your future. Take control of it today.