You Index Your Portfolio Performance Simplified

Post on: 28 Июнь, 2015 No Comment

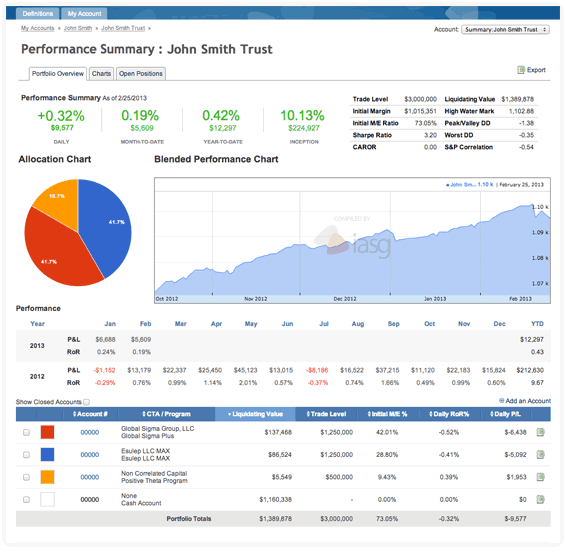

If you’re reading this post, chances are you’re a concerned investor with a healthy blend of investment assets. But is your portfolio returning as much as it could be? With Personal Capital’s You Index™, you can effectively measure the success of your investments and manage toward your long-term goals.

The first step to understanding your investment results is to track your portfolio performance. With a single stock or fund, it’s easy. For your entire portfolio, it’s easier said than done. You can use some of the math equations out there – but note that they may be overly simplified. And the more investments you have, the more time you’ll spend calculating your portfolio’s performance against the markets. That assumes you have the time, and few of us do.

That’s why we created the You Index™. We do the math for you, and extrapolate how all of your current stock, cash, ETF and mutual fund positions would have performed across all of your investment accounts. We understand that you need to be able to make informed investment decisions and that to do so, you need access to your portfolio information – ideally in a user-friendly way. Your You Index™ tracks your portfolio performance in one easy-to-read number: a percentage that illustrates the gross return of your entire current portfolio over custom periods of time. It’s completely personalized to you and your investments.

Using your You Index™ number, you’ll easily be able to see just how well your investment returns compare to those of the broader market. We use the Standard & Poor’s 500, the Dow Jones Industrial Average, as well as a foreign equity index and a U.S. bond index. And the You Index™ is always up-to-date. It reflects the stocks and ETFs as they trade throughout the day, and mutual fund prices are updated after market close.

Armed with this knowledge, you’ll be equipped with the tools necessary to informatively scrutinize and manage your portfolio. What do you do if the S&P 500 grew by 12% over the past quarter but your You Index™ number shows your portfolio would have grown by 10%? If you’re in a diversified portfolio, maybe nothing (perhaps youre giving up short-term returns in an up market with an eye toward better long-term performance over market cycles). But it enables you to track the success of your strategy. And maybe, it’ll help you to develop a strategy if you don’t have one yet.

Ultimately, the You Index™ helps take the guesswork out of investing. You now have a tangible way to ensure your portfolio is working as hard as it can. This way, you can hit your long-term investment goals. Investing does come with its risks, but tools like Personal Capital’s You Index™ can help provide you with the information you need to keep your portfolio on track and your mind at ease.