Yet another update on the iron (m)ore market ROGER MONTGOMERY

Post on: 19 Июнь, 2015 No Comment

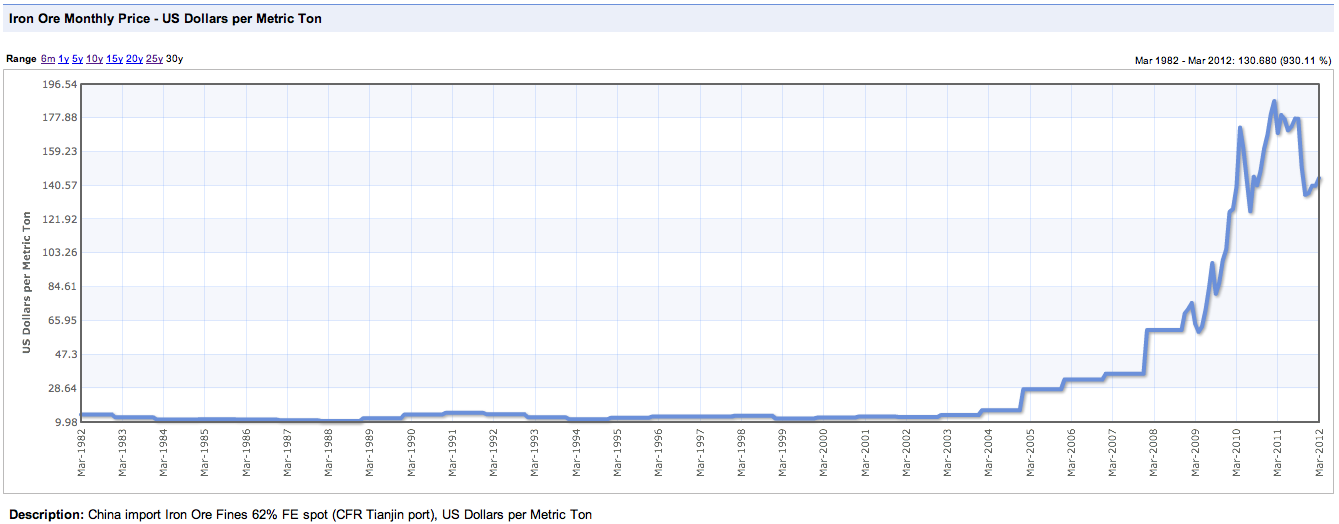

Earlier this week, it was announced that Australian junior iron ore miner Western Desert Resources (ASX: WDR) had called in administrators after failing to negotiate a funding deal with its bankers. This comes as the iron ore spot price has fallen by over 40 per cent in less than a year; and by over 12 per cent in the last month alone.

There is a really important point to note about the recent decline in the iron ore price. But first, some historical context: if we wind back the clock a few years, the “bear case” against the iron ore producers primarily related to the unsustainable nature of China’s demand growth driven by its fixed asset investment binge. With so much of China’s steel-intensive construction generating insufficient cash flow to service the debts with which it was financed, it was hardly a sustainable source of demand growth for the long-term. (Your author feels somewhat credible commenting on the bear case; given he spent many of these years cutting his teeth at arguably the most famous short-selling-dedicated hedge fund in the world).

Fast-forward back to today, and we see the iron ore price has come off substantially, and we are starting to see some of the smaller high-cost producers literally go out of business. Yet here is the important point: the substantial decline in the iron ore price has occurred notwithstanding a reasonably steady level of demand growth out of China. That is, the decline has been primarily supply-side-driven, not demand-side-driven.

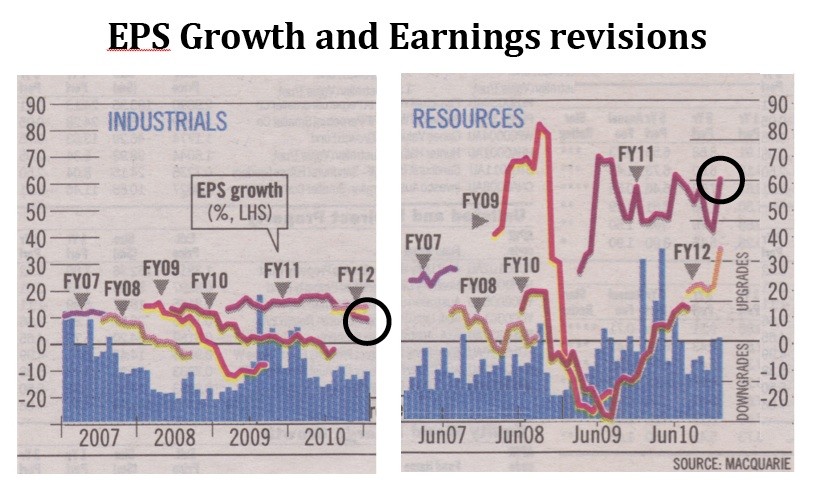

This week, Macquarie’s elite commodity team cut their iron ore price forecasts by up to 20 per cent, versus their forecasts from just four months ago. In their note to clients, Macquarie said: “We still feel comfortable with the demand side of iron ore However, we heavily underestimated supply growth – this is the major delta driving our change of view.” (Interestingly, Macquarie was the bank that rejected Western Desert Resources’ funding proposal, sending it into the hands of administrators – we now probably understand why).

So for those who believe the iron ore price could not possibly fall any further, just remember that the main pillar of the iron ore bear case is actually yet to play out. To believe a sustained rebound in the iron ore price is to believe a gigantic reacceleration in Chinese construction like we have never seen before. This seems like a very big call to make.