XOM Common Size Analysis of Exxon Mobil Financial Statements

Post on: 18 Август, 2015 No Comment

For a book project we are working on we conducted a common size analysis of Exxon Mobils (XOM — Annual Report ) financial statements. We figured it would be something worth passing along here.

Below we provide common-size income statement and balance sheet s for ExxonMobil. Under U.S. GAAP, Exxon provides three years of income statement data and two years of balance sheet data.

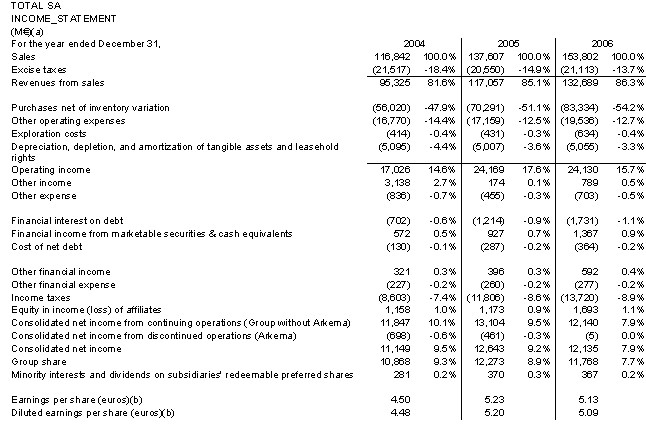

Exhibit 1: Horizontal Common Size Income Statement

Exhibit 3: Horizontal Common Size Balance Sheet

Exhibit 4: Vertical Common Size Balance Sheet

Initial Assessment

For the most recent year, 2006, Exxon Mobil’s revenues (sales) rose just 1.8% (Exhibit 1) while total assets rose a larger but still modest 5.1% (Exhibit 3). This indicates a modest deterioration in operating efficiency.

Income Statement

ExxonMobil’s horizontal common-size income statement is presented in Exhibit 1. The vertical common-size income statement is presented in Exhibit 2. Revenue grew 23.2% in 2005 but cumulatively grew just a little more. Surprisingly, management’s discussion and analysis (MD&A), makes no comments regarding the significant revenue growth in 2005. However, given the similarity to the growth rate experienced that year by Total SA. it seems likely to have had the same underlying cause: higher oil prices. This is supported by the increase in the cost of crude oil and product purchases (Exxon purchases some of the oil used in its upstream operations) which rose substantially in 2005 but declined slightly in 2006.

Nearly all of ExxonMobil’s other operating expenses rose at a slower rate than sales. Only crude oil and production and manufacturing expenses rose at a faster rate. Selling, general and administrative expense was virtually a fixed cost, as was exploration expense. Given the large increase in oil prices the lack of new exploration is somewhat surprising. Typically one would expect the higher profits to attract capital (which in turn would increase supply and help control the prices.) The largest oil company is spending little incremental capital to find additional supply, which could suggest that the high prices will persist.

Because the costs in aggregate rose at a slower rate than sales, the net profit margin for ExxonMobil increased steadily from 8.7% in 2004 to 10.1% in 2005 and 10.8% in 2006.

Balance Sheet

Exxon Mobil’s horizontal common-size balance sheet is presented in Exhibit 3. The vertical common-size income statement is presented in Exhibit 4. The financial statements present only two years of balance sheet data, which is the norm. Investors would have to search prior year documents to compare longer-term trends.

For 2006, total assets increased by 5.1%, which is somewhat more than the 1.8% growth in revenue. Overall the company made slightly less efficient use of its assets in 2006.

Cash and cash equivalents were reduced by 1.5% during the year. Although the company generated more than $49 billion in cash from operations. it used nearly $30 billion to repurchase shares, $7 billion for dividends and $15 billion to invest in equipment. Restricted cash was generally unchanged. As a percentage of total assets, the combined restricted and unrestricted cash fell from 16.0% to 15.0%.

Notes and accounts receivable increased 5.3%, in line with total assets but at a faster rate than the sales that resulted in the receivable. When receivables grow faster than sales it could indicate that the company is having trouble collecting from customers, is offering more lenient credit terms, or simply that more of the sales took place later in the accounting period. Each of those can sometimes be innocuous and can sometimes indicate deteriorating earnings quality. It is up to investors to smoke out the underlying cause and evaluate whether it is significant.

Inventories rose 14.4% for crude inventory and 18.1% for materials and supplies, both of which are considerably faster than either sales or assets. As is the case with accounts receivable. inventories are often tied to the level of sales. Large increases in inventory at a retailer would typically be cause for concern – namely that the company chose poor-selling merchandise. However, since Exxon’s inventory is primarily a commodity, there isn’t that issue to contend with. Even if sales slow down, the inventory will remain valuable. In fact, if oil prices rise the inventory will increase in value, and the larger dollar value of inventory likely consists at least in part of the same quantity of oil marked to a higher value.

Prepaid expenses were close to unchanged, and total current assets rose 3.3% almost exactly in the middle between the growth in sales and the growth in assets.

Investments and advances rose 12.8% and finished 2006 at 10.6% of assets, up from 9.9% in 2005. Property, plant and equipment rose at a slower rate, but still faster than either sales or assets. The lack of new exploration noted above has not prevented the company from investing more in existing fields or other operations. Other assets declined year/year.

Liabilities

Notes and loans payable declined 3.9% in 2006 as maturing long-term debt was repaid and replaced with debt of longer maturities.

Accounts payable increased 8.2%, which was faster than assets and sales but in line with the growth in inventories. If inventories were purchased late in the year it could result in higher accounts payable for any inventory purchased on credit. As a percentage of assets, accounts payable represent 17.8%, compared to 17.3% the preceding year.

Income taxes payable fell 4.6%, and in aggregate current liabilities grew at approximately the same rate as total assets.

Turning to long-term liabilities, long-term debt and the portion of earnings owed to minority investors grew a bit faster than total assets, while deferred tax liabilities declined. The most significant change related to postretirement benefit reserves, which increased 36.3% year/year and represented 6.4% of total assets in 2006 compared with just 4.9% in 2005.

The reason for the significant pension obligation increase in 2006 was primarily a change in accounting principles. As the company explains in its 10K:

Effective December 31, 2006, Exxon Mobil Corporation implemented FASB Statement No. 158, “Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans” (FAS 158), which requires an employer to recognize the overfunded or underfunded status of a defined benefit postretirement plan as an asset or liability in its statement of financial position and to recognize changes in that funded status in the year in which the changes occur through other nonowner changes in equity. In 2006, the amounts recorded in other nonowner changes in equity for net actuarial losses and prior service costs are required by FAS 158. For 2005, FASB Statement No. 87, “Employers’ Accounting for Pensions,” required an employer to recognize a liability in its statement of financial position that was at least equal to the unfunded accumulated benefit obligation for defined benefit pension plans.

The plans themselves did not change, merely the way they are recognized on the financial statements. In 2005, Exxon did not have to recognize its entire shortfall (the difference between the current value what it is expected to pay out in future benefits and the assets available to cover the expenses) on the balance sheet. In 2006 and future years it must.

Largely due to the difference in reported pension obligations, total liabilities grew as a percentage of total assets from 46.6% to 48.0%. In aggregate, all other liabilities declined relative to assets.

Stockholders Equity

In 2006 Exxon Mobil issued new stock, increasing its common equity by $309 million. This amount most likely reflected changes resulting from stock based compensation. The company repurchased $28 billion worth of stock for the treasury account.

The significant share buyback negated most of the other contributions to shareholder equity, resulting in a modest 2.4% increase for total shareholder equity. As a percentage of assets, shareholder equity declined to 52.0% from 53.4%. Still, it represents the largest source of capital for the firm.

Like this article? Why not try out: