Withholding Tax Allowances Instructions

Post on: 16 Март, 2015 No Comment

Tax Allowances Are Key to More Income

Tax allowances are the key to more income throughout the year. Unfortunately very few people know how they work. Its that time of year when many people start to get giddy about getting that fat tax refund theyve been waiting for. According to the IRS. the average tax refund last year was a whopping $2,783. Surely, visions of HDTVs, laptops, and smartphones are dancing through the heads of many. What many of us, particularly younger professionals, dont realize or dont want to accept, is that getting that huge refund is really a poor financial strategy.

The reason why anyone would be able to receive a huge refund is mostly going to be due to the fact that they were paying the government too much withholding tax on their income throughout the year in the first place. A lot of people realize this, but dont seem to know how to take action. Personally speaking, I have fallen into that psychological trap as well, where you think by getting a large refund you are somehow better off financially for it. Getting that large check in the mail feels like a huge blessing. Quite the opposite is true.

The Drawbacks to getting a Large Refund

1. You are loaning your money for a negative return. Getting a large refund means you are paying more in taxes throughout the year. This money could easily be going into your bank account and earning interest throughout the year. Lets say that you invest the extra income in mutual funds and you earn the stock market historical average, in effect youre loaning the government your cash and in return for your kind offer you are giving them a good chunk of cash. Even if you just put the money into a high interest checking account that returned 4% a year, consider it a 4% loss on the amount of your refund.

2. You are binging and purging your cash. Getting more of your true income delivered to you on a consistent basis allows you to work it into your budget. If you direct deposit this income into your savings, you dont miss it at all. The urge for many, when they receive a big refund, is to go out and spend it because they feel that they deserve it. They do, after all, its their hard earned cash! If you set yourself up to not get that big refund, theres no urge to purge.

3. You are not able to distribute investment risk evenly over time. Part of any good investment strategy is to distribute risk of loss buy adding investment contributions over time. Even if you wisely invest your refund versus spending it all, you would most likely be making one large contribution versus spreading out risk over the year. This is a bad investment practice.

The Basics of Withholding Tax Allowance Exemptions

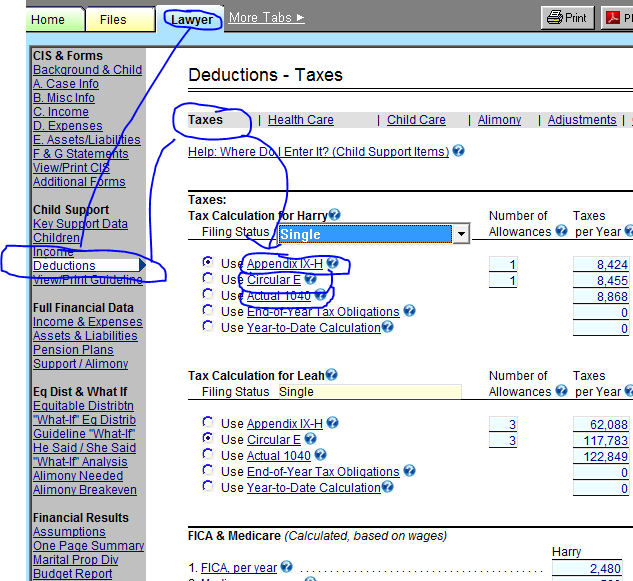

A withholding tax allowance is simply a number than you can claim on your W4 form that will change the amount of your income that your employer will withhold from you throughout the year. The number of allowances can vary, but is most likely 0, 1, or 2. The higher the allowance number, the less tax will be withheld from you with each paycheck. A W4 is filled out by an employee when they start employment.

Allowances on a W4 can be updated at any time by filling out a new one. Most employers will allow you to do this whenever you desire (and as often as you desire), and your withholding tax amounts should take effect in your next full pay period (this may differ by employer, so ask yours).

Dont Take Tax Allowances Too Far

On the other end of things, you dont want to end up owing the IRS significant money and possible penalties. Just be careful

Your End Goal with Withholding Taxes

Ideally, at the end of the year, you will benefit the most if you receive a very small refund (close to nothing) or end up paying a very slight amount that you will be able to easily pay. One caveat when changing allowances: the last thing you want to do is end up with too high of an allowance that results in you owing a high amount that you are unable to pay .

How can I Figure out what my Tax Allowance should be?

Fortunately, there are at least three free resources available to you, which are cited below. If you still are having trouble figuring out what your allowance should be, you may want to speak with your employers payroll department or a qualified tax professional.