Will China s Bubble Pop Japan Offers Clues

Post on: 23 Июнь, 2015 No Comment

About

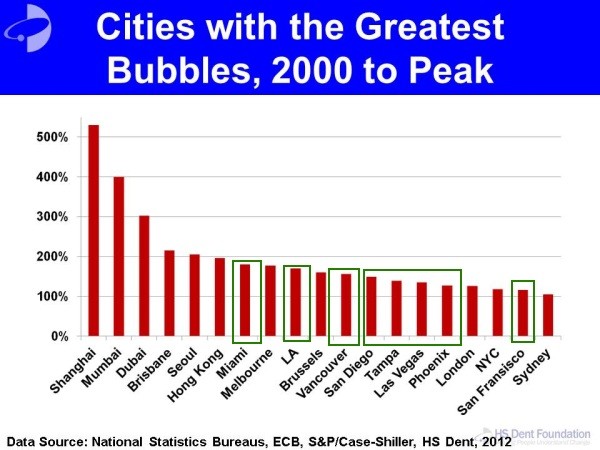

As China takes measures to curb bank lending. fears about whether the country’s economy is in a bubble are escalating. Investors, meanwhile, are looking to other nations that have traveled down the same road for lessons about how things might unfold.For example, as Chinese real estate prices soar. investors are asking if the country learned nothing from the implosion just suffered by the American economy. Or will the consequence this time be Dubai times 1,000 like famed short-seller Jim Chanos is betting on?

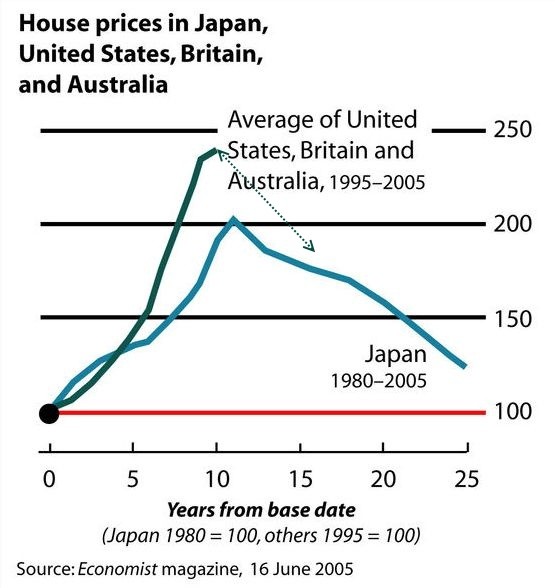

While the economic turmoil in the U.S. and Dubai are instructive, a more valuable lesson may be learned from Japan right next door. Like its Asian neighbor, China’s biggest priority is to keep employment high amid a weak global economy. The massive stimulus being coursed through the country by an iron triangle of influential government bureaucrats, dominating banks and high-powered captains of industry is also straight out of Japan’s playbook.

The Japan analogy is very much on everyone’s mind right now, says Matthew Gertken, a China analyst at global intelligence firm Stratfor. The real estate bubble that gets so much attention, meanwhile, is a symptom of deeper crises that requires blistering growth — and huge doses of stimulus spending when export markets get soft — to maintain the paramount goal of high-employment.

Dangers Down the Road

Rather than a speculative real estate bubble based on exotic financial instruments that spin out of control and catch the broader economy by surprise as it did in the United States, China is taking a more deliberate approach to prop up employment. And while that approach is less likely to result in a spectacular speculative crash, it will create big dangers farther down the road.

The fundamental trade-off though — preserving capital by cutting costs and reducing potentially bad loans or preserving employment — has far-reaching consequences and is a point of distinction in economies often lumped together.

As the downturn hit, American companies chose to maximize profit by firing wholesale. While U.S. GDP declined by 6.2% during the crises, unemployment ballooned to north of 10%. But companies delivered surprisingly strong earnings amid limp revenue and cash has piled onto corporate balance sheets nonetheless.

In Japan, the downturn slammed GDP by a staggering 14.2% into what is sometimes considered a depression. But unemployment remains at just around 5% — what is usually considered full-employment.

Of course, the Japanese have paid a heavy price for their longstanding practice of maintaining high employment. In the 1990s, for example, the country had a banking crises after piles of loans made more for political rather then economic considerations (what China is witnessing now) went bad.

But China currently has little choice but to keep growth at a breakneck pace. The country has a massive, growing population that is rapidly moving from rural to urban areas. The government, meanwhile, has linked its legitimacy with economic growth, Gertken says.

And that blistering growth serves to mask over many social tensions. Unlike the exceptional social cohesion that has allowed Japan to function in the direst of economic circumstances, China is filled with internal rivalries. There is a history of tension ranging from the coastal regions versus the interior to the urban and the rural regions, Gertken says.

Chinese officials seem well aware of the tightrope they are walking and seem to be doing a good job of managing risks so far. But investors should note that any misstep could result in a harsh political, as well economic, upheaval for the emerging giant that would tank the fragile global economic recovery unfolding.