Why You Should Avoid Avista s Dividend Avista Corporation (NYSE AVA)

Post on: 4 Апрель, 2015 No Comment

2012 has been exceptionally volatile for the stock market, and the European situation is further threatening investments. With the economic and political climates only becoming more tumultuous, I have been concentrating on high yield opportunities. Blue-chip dividend companies are well-known, but there are attractive equities with high yields going ex-dividend every week. This strategy can work in one of two ways: either you buy before the ex-date to receive the dividend or buy after if the stock declines far below the after-tax amount of the dividend. Regardless of your short-term strategies, these equities can be attractive longer-term investments depending on your individual circumstances.

Buying the stock to receive the dividend is intuitive but many have contacted me requesting further details on the second strategy. Investopedia has a great example of how this works. To explain this, I will use AT&T (T ) as an example. AT&T declared a $0.44 dividend to shareholders of record on July 10, 2012. On the ex-dividend date the stock price should decline by the after-tax dividend amount, with an assumed tax rate of approximately 15% because many dividends qualify for a preferential tax rate. It is true that you can personally avoid immediate taxation by owning the security in an account with beneficial tax treatment but this serves as a benchmark.

As a result, an investor would expect the stock price to decline by $0.37 = [$0.44 * (1-.15)]. If AT&T declined by more than $0.37 in the absence of negative news you might have an attractive opportunity. If you would like to be more conservative you can ignore the tax aspects and only trade if the stock price declines by the full dividend amount. Executing this strategy can generate returns over short periods of times, but should only be performed on companies that you would be comfortable owning.

To focus on these opportunities I ran a screen with a focus on relative safety for the investments as the objective is to concentrate on liquid companies that are affordably priced. I began with a specification of a dividend yield greater than four percent and an ex-dividend date within the next week. To provide some layer of safety I narrowed down the environment by looking at companies with market capitalizations greater than $1B, PEs between zero and 20, and institutional holding percentage in excess of fifteen percent (except ADRs).

While not a precise requirement, I prefer companies that have underperformed the S&P 500 year-to-date as it indicates reduced downside relative to peers. With the impending European crisis I now avoid companies with significant European exposure. This is summarized below:

- Dividend Yield 4.0%

- Ex-Dividend Date = Next Week

- Market Capitalization $1B

- PE Ratio: 0-20

- Institutional Ownership 15%

- Ideally Modest S&P 500 Underperformance

- Minimal European Exposure

After applying this screen I arrived at the equity discussed below. Although I envision these as short-term trading ideas, you still need to exercise caution. The information presented below should simply be a starting point for further research in consultation with your professional financial advisor before you make any investment decisions. My goal is to present new companies to you and provide a brief overview of their recent developments and this should not be considered a substitute for your own due diligence.

Avoid: Electrical Utilities

I wrote a detailed explanation of how I analyze utility companies in March and in brief I focus on the number of customers and geographic location. Larger companies enjoy scale benefits and are able to profit more from smaller rate increases. While geographical differences exist for regional utilities, the underlying business is essentially the same: A stable, cash-cow business that returns most profits to investors via dividends and share repurchases.

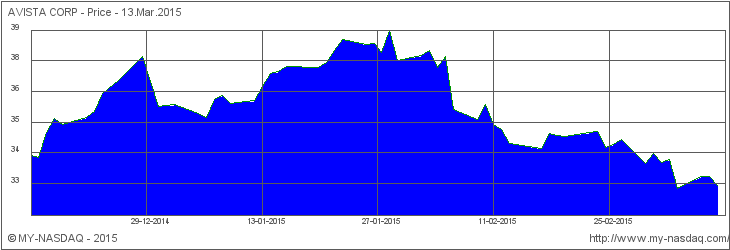

Avista is a utility company that produces energy for fewer than one million customers in the Western United States. Avista announced second quarter 2012 earnings that declined primarily due to weak topline revenue. Management was very bearish when describing the quarter and it should give potential investors cause for concern.

Avista’s earnings for the second quarter and first half of 2012 were below our expectations largely because retail loads were lower than we anticipated. The continued weak economy and operational challenges at certain industrial customers resulted in lower retail sales volumes [emphasis added]. Based on results for the first half of the year and a reduction in our forecasted loads for the remainder of 2012, we expect our consolidated and utility earnings to be at the lower end of our guidance range for the year. — Avista Chairman, President and Chief Executive Officer Scott L. Morris

Fortunately utility resources costs have declined but other operating costs, depreciation, and all other costs increased year-over-year. The company’s financial position is not in jeopardy but I do not foresee any catalyst that will reverse the company’s fortunes. I cannot recommend Avista, because it has a small customer base, unfavorable geographic region, and has faced economic pressure that has forced it to guide lower. The yield is merely average for the industry and there is no compelling reason to pick Avista given the risks assumed.

The information presented has been summarized below. Yellow and red represent avoid and consider classifications, respectively.